Private Credit: Where collateral is king

Private credit, in your author’s opinion, will feature in the top ten most used investment phrases for 2023. My BBQ conversations on weekends this year have gone from penny stock recommendations to weird and wonderful ways to get exposure to private markets, notably through credit.

You would only have to drive across the harbour bridge here in Sydney of late to notice one of the most recognisable names in this space in a prominent location in North Sydney. Rightfully, this emerging asset class has turned heads, boasting U.S.$1.4 trillion in assets globally at the beginning of the year and forecast to grow as large as U.S.$2.3 trillion by 2027.[1]

Yet the most common misconception is that private credit represents the financing of sub-investment grade borrowers. I mean if the banks don’t lend to them, they must be very high risk, right? The team at Foresight Analytics produced a whitepaper earlier in the year looking at the key opportunities and risks for investors in private credit.

I would highly recommend the paper to anyone interested in this space and have summarised my top three insights from it for our blog subscribers below.

Insight #1: There is a long runway for growth in Australian non-bank lending

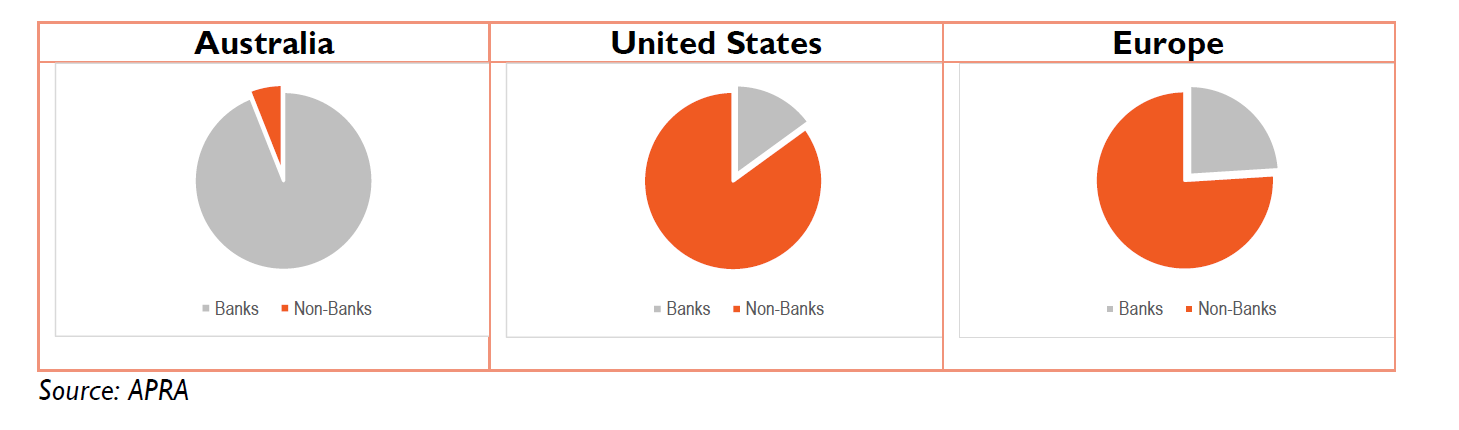

In a 2022 report, the Australian Prudential Regulation Authority (APRA) defined a non-bank lender as “a business that offers individuals and businesses credit but does not hold a banking license.”[2] The consequence of these lenders not holding a banking license is that they cannot rely on cash deposits as a source of finance for lending activities, and instead must rely on funds from external investors. These include institutional, wholesale, private and more recently, even retail investors. In Australia, there are over 600 providers of non-bank lending that account for only approximately five per cent of total debt financing issued. This contrasts to both the U.S. and Europe, where non-bank lending accounts for over 75 percent of total debt finance issued as captured in Figure 1. Of the U.S.$1.4 trillion in private credit assets globally, Australia would amount to less than $200 billion as at the end of 2021, albeit growing at double digits.[3] As such, there is a sizeable addressable market for non-bank lenders domestically, notwithstanding the asset class’ projected growth globally going forward.

Figure 1: Bank versus non-bank lending by geography

Insight #2: The opportunity set in Australian private credit isn’t limited to real estate or distressed debt. There are many other investment opportunities.

It is a common misconception that non-bank borrowers can’t access bank financing because they are of inferior quality. In fact, the introduction of stricter international regulations, known as the Basel III reforms, designed to increase the resilience of the global banking sector in response to the global financial crisis (GFC), have resulted in a reduction of traditional banks’ lending volumes so to abide by their increased liquidity and capital requirements. This explains why non-bank lending growth has outpaced that of the traditional banking sector in Australia since 2020.[4]

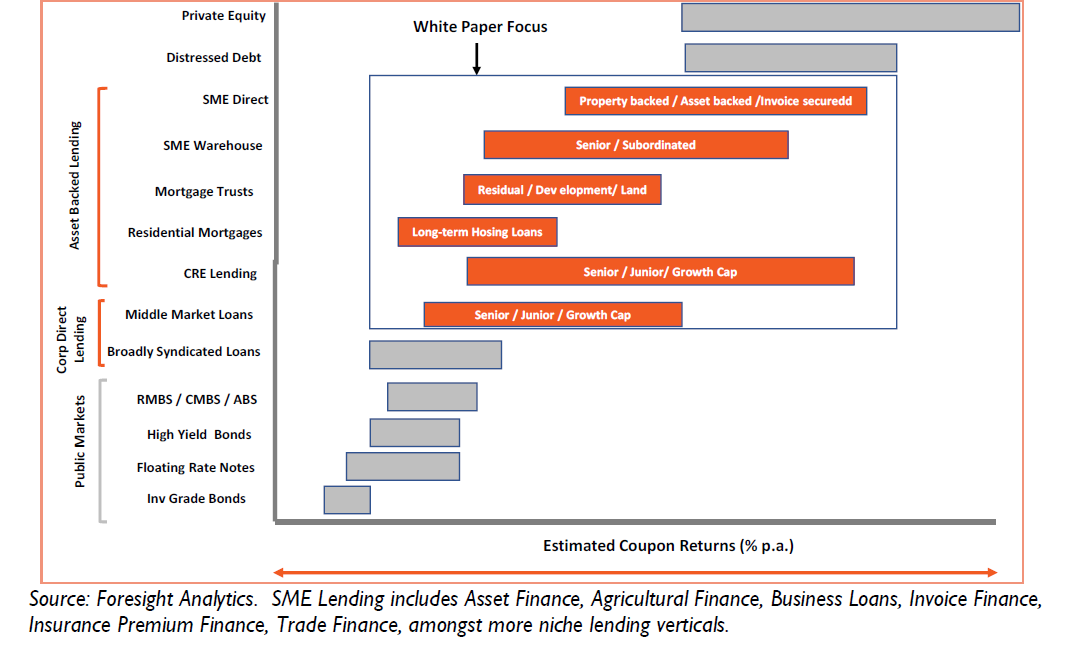

According to Foresight Analytics, the private credit market can be summarised by seven broad categories as illustrated in Figure 2, five of which are characterised as asset-backed lending. Residential and commercial property lending would be well known to many, if not all, our readers.

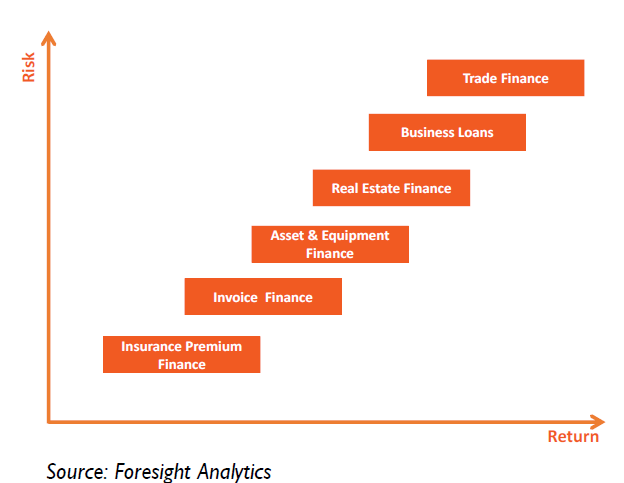

However, non-bank lenders have further been looking to provide specialised, technology-led financing solutions in other lending segments where the traditional banking sector has historically been weak. If we look to the types of SME loans in Figure 3, this specifically would be debt financing for short duration working capital finance rather than strictly financing residential or commercial real estate projects.

Additionally, non-bank lenders have the advantage, unlike traditional banks, of being able to accept non-property forms of collateral to underpin the loan. Examples of these acceptable forms of security range from property, plant, or equipment (including livestock), an insured invoice, a director’s guarantee, whereby the director of the borrowing entity is personally liable for the repayment of the loan, or a general security agreement (GSA) which represents a fixed and floating charge over a business’s assets.

As a result of this broader range of acceptable forms of collateral, non-bank lenders can finance a greater pool of SME borrowers.

Figure 2: Private credit opportunity set

Figure 3: Types of SME lending

Insight #3: The eleventh wonder of private credit – warehousing

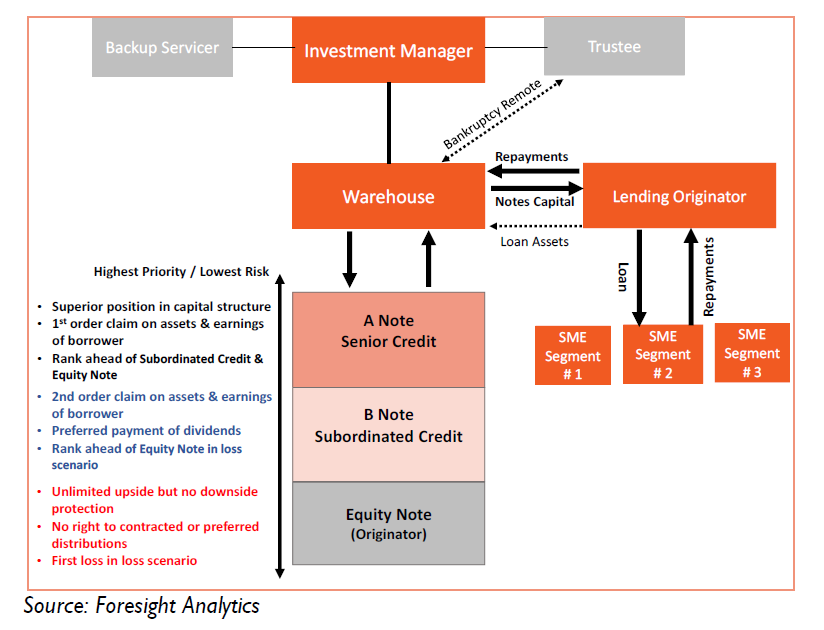

According to Foresight Analytics, warehousing financing “is asset-backed financing and is structured on a securitised note basis” through a trust.[5] This form of financing is most common in non-bank lenders whereas, outlined prior, they do not have the deposit base traditional banks do to call upon to provide and scale their debt financing. Importantly these warehouse structures are bankruptcy remote, meaning they sit as their own separate entity, ensuring the warehouse will continue to receive its contracted loan repayments even if the non-bank lender were to fall into liquidation.

An illustration of a warehouse is as per Figure 4 below, whereby there is firstly subordination of debt note holders (typically two or more), such as a private credit fund. The debt note holders sit senior to that of the equity note holder (typically the non-bank lender), meaning they receive a priority claim to all income and additional protection in a loss scenario.

Explicitly, this equity note represents an amount of committed capital from the non-bank lender to cover the first of any realised losses which occur only when the underlying security on a defaulted loan is exhausted or unrecoverable. As such, this is a key and very important credit enhancement available in SME lending that is often overlooked when assessing the multiple forms of protection available to external investors. Consequently, it is a key incentive for the lenders as equity note holders, and thereby first at risk, to ensure they are sourcing borrowers in accordance with their lending mandate.

Finance providers in this space are often specialists in debt structuring and origination in order to negotiate these credit enhancements, like our partner manager Aura who currently fund six non-bank SME lenders all through warehousing structures.

Figure 4: Warehouse finance structure and risk stack

If you would like to access Foresight Analytics whitepaper, please visit their website here: ‘Australian Private Debt Market Review – Opportunities and Risks for Investors’.

[1] Bloomberg via Morgan Stanley, 2023

[5] Foresight Analytics, 2023