Private credit predicted to grow amid yield and shelter

The Australian Financial Review (AFR) is reporting the Reserve Bank of Australia (RBA) has estimated that the Australian private credit market has grown to around $40 billion, or around 2.5 per cent of total business lending1, and my friends at Tanarra Capital have predicted Australia’s market will continue to expand with attractive yields helping the asset class win share from more volatile equity markets2.

For more than two years, we have predicted that private credit would become an asset class in its own right and would be found in nearly all portfolios. Lower correlation to equity markets than publicly traded fixed income is just one of the reasons investors are now insisting their financial planners add private credit to approved lists and model portfolios.

At Montgomery, our investors are attracted by the strong yields and resilience amid global uncertainty.

For more mature investors who cannot stomach the volatility common to stock markets, Private Credit has, to date, provided attractive returns on par with share markets but without any of the volatility associated with public markets.

Additionally, as interest rates have risen in recent years, so have the yields on floating-rate loans, making private credit an attractive investment proposition offering “a degree of insulation from the volatility experienced in larger markets like the U.S.”.

There is little doubt stability, coupled with the attractive yields offered by private credit, makes it a compelling investment proposition in the current environment.

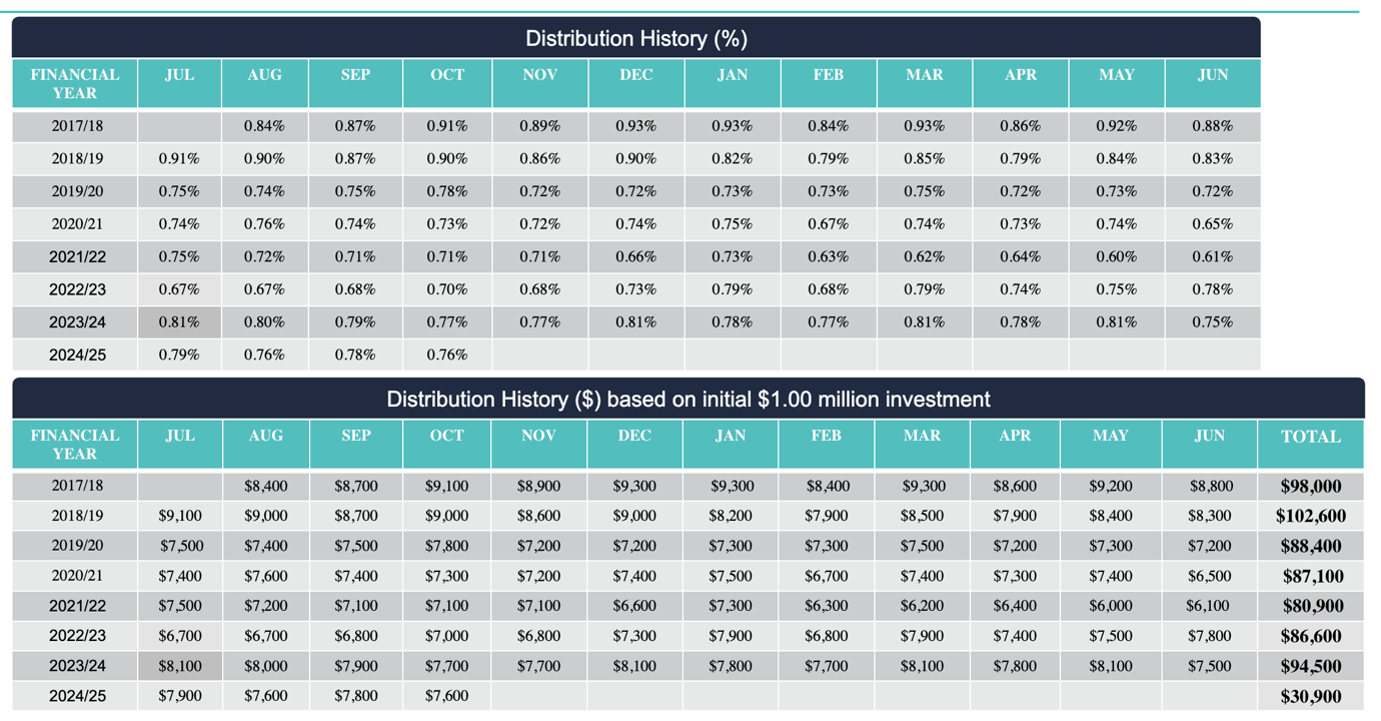

As Table 1 reveals, wholesale investors in the Aura Private Credit Income Fund have enjoyed more than seven years of monthly income, no negative months, and an average return of 9.64 per cent per annum if they had reinvested their monthly distributions to 31 October 2024.

Table 1. Aura Private Credit Income Fund (wholesale investors only)

Past performance is not a reliable indicator of future performance. Returns and distributions are not guaranteed.

Past performance is not a reliable indicator of future performance. Returns and distributions are not guaranteed.

And the growth will continue given the tighter controls on bank lending since the GFC has encouraged small and medium-sized corporates to prefer non-bank sources of finance.

Offering attractive yields, reliable monthly income, robust loan portfolio credit ratings, and a track record of zero capital losses, certain funds are also elevating portfolio diversification. By introducing exposure to a distinct risk and return profile beyond traditional and publicly listed asset classes, private credit provides a compelling opportunity for investors seeking to optimise performance and stability.

Importantly, seeking a manager with a track record of successfully navigating a variety of business sectors is essential. The policies of the new U.S. president could, for example, create some volatility for business and fund managers in private credit will need to concentrate on industries with inherent resilience and domestic support. A recent AFR article predicted financial services, education, childcare, healthcare and infrastructure as resilient sectors, with some benefitting “from government investment and long-term contracts”.

Meanwhile, in a welcome move for reputable operators, ASIC is ramping up its work to improve compliance and transparency in the private credit market, which would help ensure industry growth is stable and continues to put clients and investor outcomes first.

And we believe there is plenty of growth to come. In the U.S. and Europe private lending makes up the majority of business lending. Australia’s private credit market is still small, but the offer of stability and insulation from international volatility will ensure the Australian market grows.

To help navigate private credit and answer your questions about investing in this important asset class or the Aura Private Credit Income Fund call David Buckland, CEO or Rhodri Taylor, Account Manager on (02) 8046 5000, or email us at invest@montinvest.com .

1Australian Financial Review: Private credit continues rapid expansion

2The Australian: Private credit market to grow as investors seek yield and shelter from equity risk

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652) (Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.