Polen Capital identifies what makes a quality digital marketplace

As e-commerce growth accelerates it is important that online marketplaces constantly improve their services to stay relevant. Polen Capital identify the characteristics that companies should exhibit which will best position them to reap the long-term benefits of the secular shift to online shopping.

Marketplaces go mainstream

With in-person shopping restricted and customers staying indoors for most of last year, digital marketplaces quickly turned from a convenience to a necessity. The shift to e-commerce has been a boon for established leaders (such as Amazon and Alibaba) but has also given rise to new innovative marketplaces. These businesses have been able to compete with larger players by targeting local and niche markets and offering differentiated products, services, and customer experiences.

Given that the number of marketplaces is projected to continue growing, the Polen Capital investment team has closely looked at some attributes they believe set the best businesses apart from their competitors. Below, Polen Capital share some of their observations, including characteristics of leading platforms, lessons learned, and essential questions that they pose to management teams when considering new investment opportunities for the Polen Capital portfolios.

Features of successful marketplaces

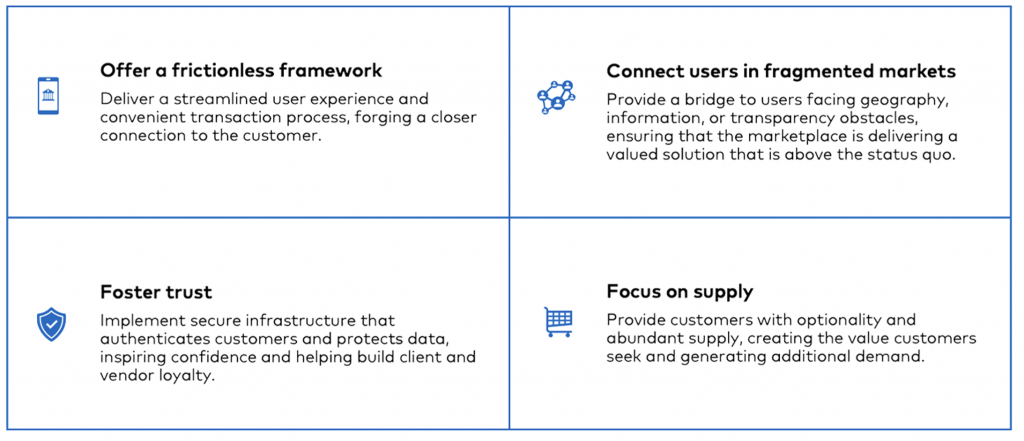

Although different marketplace models have been successful, Polen Capital believe the best demonstrate four key actions that allow them to fully deliver on their purpose:

Online marketplaces must constantly improve their service to stay relevant, and any price increases should bring a commensurate value-add to the customer. Therefore, Polen Capital believe that a disciplined pricing strategy is critical for marketplaces seeking long-term growth and profitability. Marketplaces should also align their brand, mission, and purpose across the entire business. Where there is a mismatch this can limit a company’s full potential.

For example, Etsy, an online marketplace for handmade and vintage items, focuses its community-centric model around its vision of empowering individuals to turn their creative talents into opportunities. It brings together a largely fragmented group of artists and artisans who believe in keeping the “human connection” at the heart of the business. This emphasis reveals the uniqueness of the products offered on Etsy’s platform. As the pandemic evolved, Etsy has grown in popularity, becoming the go-to place for custom items such as handmade facial masks.

Lessons from the accelerated shift to digital

The acceleration of digitisation has wide-ranging implications for marketplace businesses. Polen Capital has discussed why they believe companies that fail to embrace a “digital-first” approach to improving their value proposition are at risk of being left behind and losing competitiveness. The pandemic emphasised a vital lesson: all businesses must be digital. This is particularly true for marketplaces, where innovators often rely on technology to tap into new consumer markets. Digitalisation is raising the stakes, so companies have a growing incentive to find new ways to differentiate their customer experience.

The pandemic emphasised a vital lesson: all businesses must be digital

Online commerce has also disrupted the “winner-takes-all” business model, historically a mainstay of investing. Years ago, technology was only accessible and affordable to the largest industry players. However, the digital transformation has eroded traditional barriers to entry, democratised the business landscape, and levelled the playing field for smaller businesses. Consequently, Polen Capital believe it has become increasingly difficult for a “winner-takes-all” model to succeed, given that competition is often “just one click away.”

Investing in online marketplaces

The following are some key questions that Polen Capital find are important to ask management teams when assessing marketplaces. These considerations have allowed Polen Capital to identify some of what they regard as the best marketplaces in the U.S. and around the world. Together, these insights help fuel the Polen Capital investment process and pursuit of positive outcomes for clients.

- What specific actions are you taking to drive value for both sellers and buyers? Does this distribute more power to the edges?

- Is the leverage within the marketplace symmetrical?

- How do you mitigate multi-homing from both customers and suppliers?

- What friction points can still be removed or improved within your marketplace?

- Can this same value proposition be generated more directly today?

- Are both sides of your marketplace aligned in the core value proposition they are seeking?

Polen Capital seeks to invest in marketplaces that, among other things, focus on customer-centricity for both parties. They believe that the best management teams establish feedback loops to understand the needs of their stakeholders on a deep level and make decisions through the lens of the customer. Companies that exhibit these characteristics are best positioned to reap the long-term benefits of the secular shift to online shopping.

The Polen Capital Global Small and Mid Cap Fund owns shares in Etsy and the Polen Capital Global Growth Fund owns shares in Amazon. This article was prepared 17 September 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

To learn more about the Polen Capital funds, please visit the fund web pages: