Polen Capital Global Small and Mid Cap Fund has left the starting block

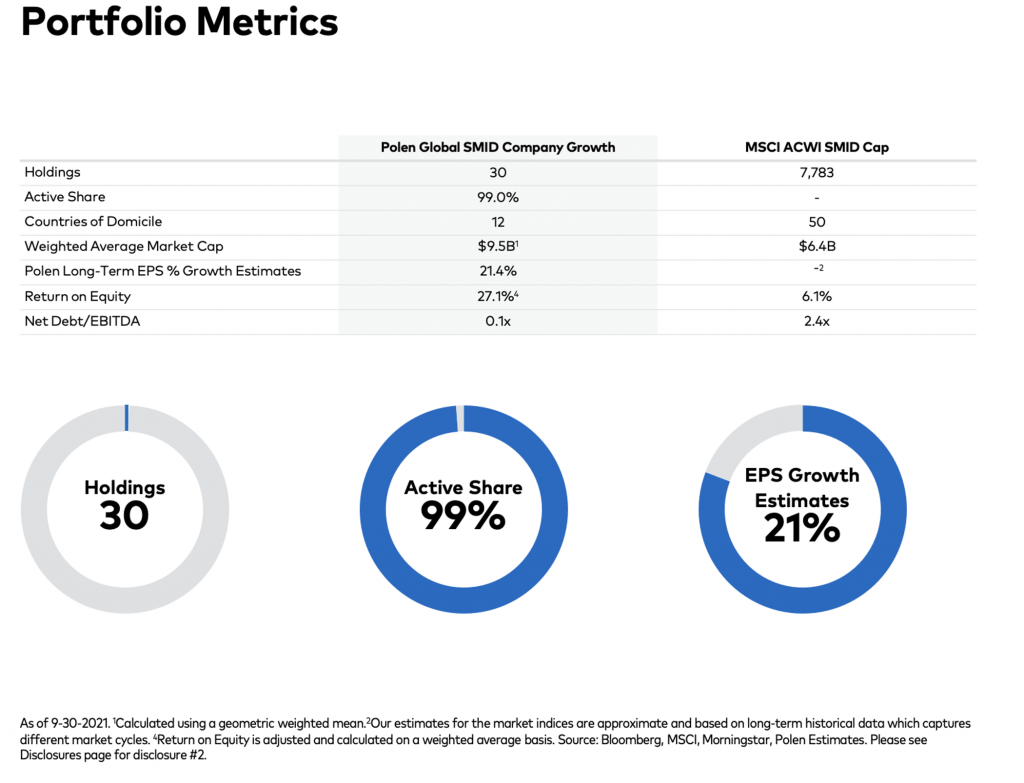

The Polen Capital Global Small and Mid Cap Fund was launched on Thursday 21 October 2021, and at the time of writing, it has invested in 30 companies with a weighted average market capitalisation exceeding US$9 billion, across 12 countries. For context, this is a fraction of the big global names like Apple (US$2.25 trillion), Microsoft (US$2.0t), Amazon (US$1.7t), Alphabet (US$1.5t) and Facebook ($0.87t).

Half the investee companies in The Fund hold net cash on their balance sheet, and the weighted average Net Debt to EBITDA ratio is only 0.1 times. The weighted average Return on Equity is 27 per cent, while medium to long-term Earnings Per Share (EPS) growth is expected to average 21 per cent per annum.

Interestingly the benchmark for The Fund, the MSCI ACWI SMID Cap in A$ (translated to the MSCI All Country World Index Small and Mid Cap in A$), which comprises 7,783 companies across 50 countries of domicile, has a weighted average Net Debt/ EBITDA ratio of 2.4 times and a Return on Equity of 6.1 per cent.

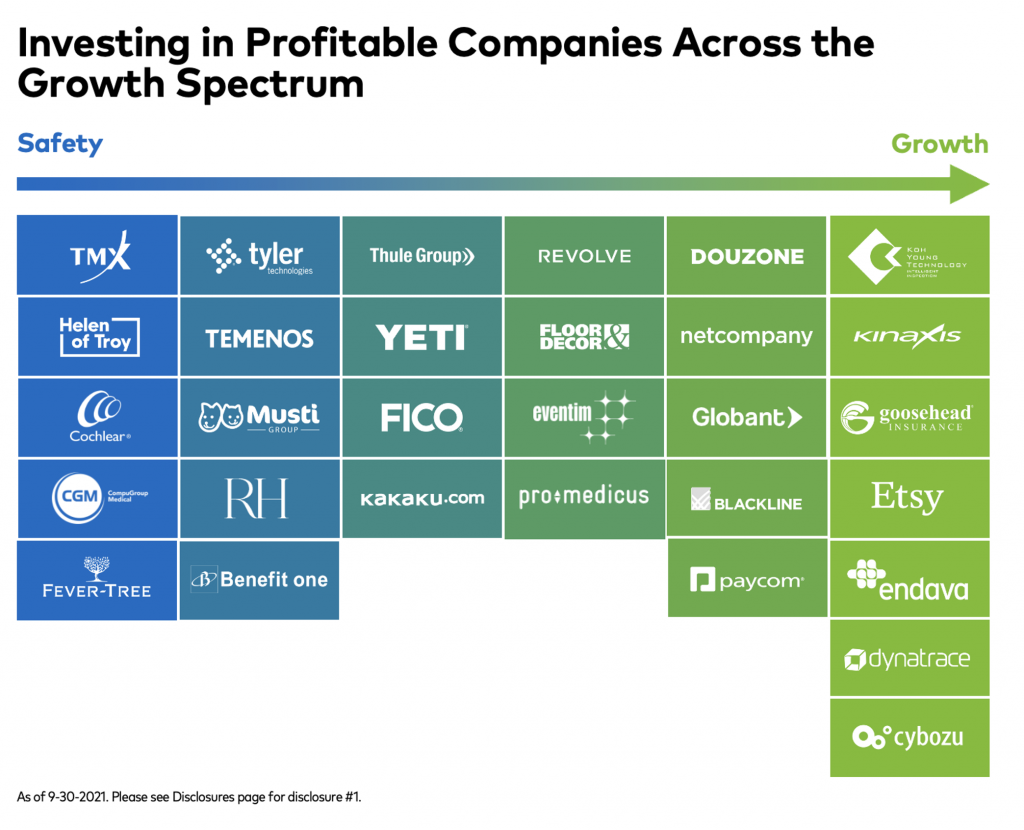

Polen Capital invest in profitable companies across the growth spectrum and The Fund is always fully invested. When markets become exuberant, there is a greater relative weighting to the Safety end of the spectrum and when markets become pessimistic, there is a greater relative weighting to the Growth end of the spectrum.

The current categorisation of investing across the growth spectrum is illustrated below:

When we analyse the seven companies on the right-hand side of the growth spectrum (Koh Young Technology, Kinaxis, Goosehead Insurance, Etsy, Endava, Dynatrace and Cybozu) and compare their fundamentals to the five companies on the left-hand side of the growth spectrum (TMX, Helen of Troy, Cochlear, Compu Group Medical and Fever-Tree) we observe that whilst the first sample of companies has more than double the average forward 12 month PE than the second sample of companies (75X v 35X), their average medium to long term annual EPS growth is also more than double (30 per cent v 14 per cent).

The Growth stocks on the right-hand side and the Safety stocks on the left-hand side will, if the assumptions hold firm, have a similar PE of 18-20X five years out. In addition, many of the companies in the Polen Capital Global Small and Mid Cap Fund will likely develop value-accretive growth options over time, helping to turn them into much bigger businesses.

If you would like to learn more about the Polen Capital Global Small and Mid Cap Fund, visit the fund’s web page: POLEN CAPITAL GLOBAL SMALL AND MID CAP FUND

The Polen Capital Global Growth Fund owns shares in Microsoft, Amazon, Alphabet and Facebook. The Polen Capital Global Small and Mid Cap Fund owns shares in the companies listed in the above image “Investing in profitable companies across the growth spectrum”. This article was prepared 03 November 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.