Polen Capital – Beyond Returns

Our recent launch of the Polen Capital Global Growth Fund marks the formal commencement of our partnership with Polen Capital. After due diligence of several established global managers with long term track records we are delighted to have found in Polen, a team with integrity, a desire to offer their expertise to Australians, and a deep attachment to a quality-based investment philosophy.

One of the reasons we were so attracted to Polen’s capability was their impressive track record. Australian investors now have access to Polen’s capabilities through the Polen Capital Global Growth Fund (the Fund). To better understand the historic performance of the strategy we recently converted its six-and-a-quarter year track record to Australian dollars.

Aside from absolute performance, there are some other compelling findings, which you may not be aware of.

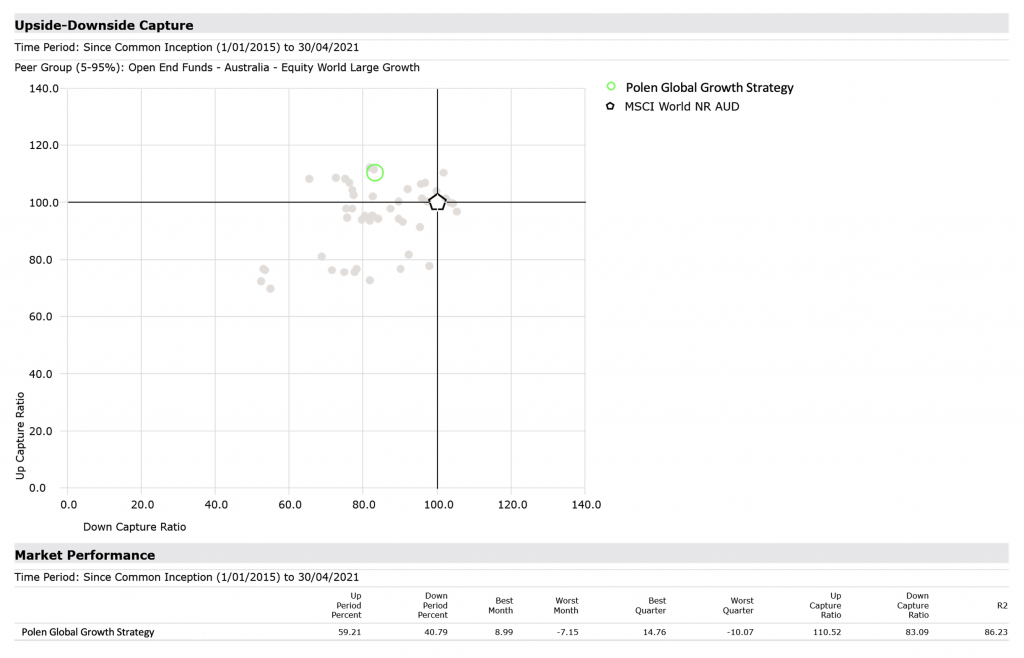

Upside/Downside Capture

The returns of the broader strategy have been impressive, generating an annual average 16.81 per cent per annum to 30 April 2021 in Aussie dollars. This represents outperformance of 5.21 per cent p.a. above its benchmark the MSCI ACWI Net Total Return Index in AUD since inception[1]. And like Montgomery, Polen’s “don’t lose mentality” approach to capital preservation is an important feature.

So, how have they faired on the capital preservation gauge? Using available data, Morningstar are able to measure how much of the upside movement a fund captures during a positive month in the market. Similarly, Morningstar can measure how much of the downside a fund captures during a down month for the market.

Figure 1. reveals that since its inception, and in Australian dollars, the strategy (represented by the lime colour green circle) has captured 110 per cent of the upside on average in months when the MSCI World[2] rose. During months where the benchmark fell, the strategy has captured almost 20 per cent less of the downside on average. This is an impressive result over 76 months and not least because it remained fully invested. The grey circles in the chart represent other funds in the same Morningstar, global equity, large growth universe as Polen Capital.

[1] Source: Montgomery/Archer. Returns prior to Polen Capital Global Growth Fund Class A Units inception 15-03-2021 have been derived from Polen Global Growth – Separately Managed Account (SMA) inception 31 December 2014, converted from USD to AUD and then applied to the Class A Units fee structure.

[2] The Polen Global Growth strategy is benchmarked against the MSCI ACWI Net Total Return Index (AUD). Due to data restrictions, this analysis has been done with the MSCI World Net Total Return Index (AUD), which is the closet AUD world market proxy available via Morningstar.

Figure 1. Upside Downside Capture. The Polen Global Growth Strategy

Source: Montgomery/Morningstar

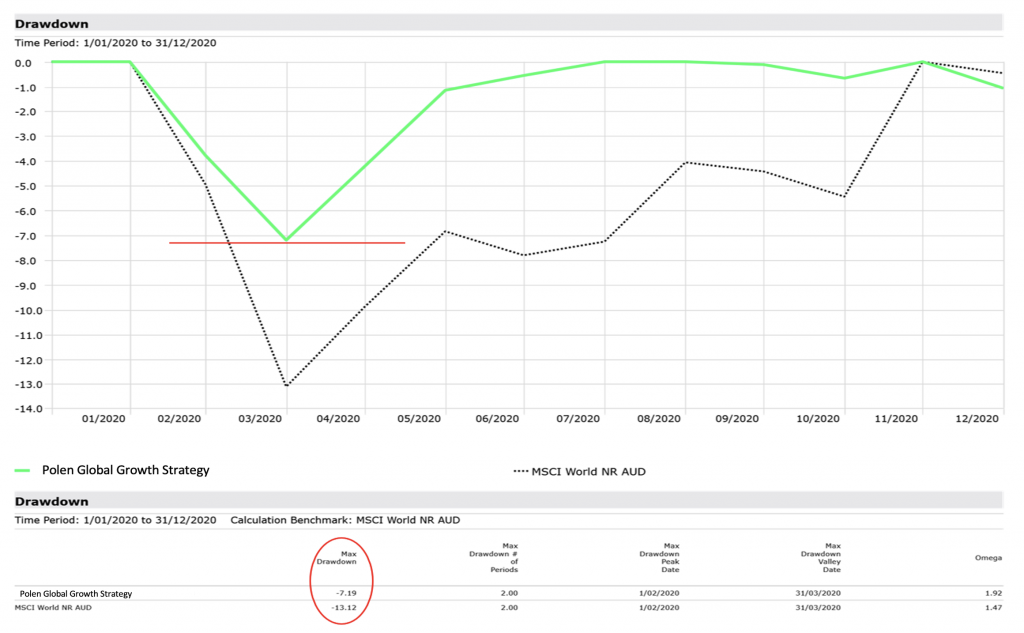

COVID Drawdown

Another aid to understanding the strategies past ability to preserve capital, is to examine its performance during market dislocations (Figure 2.). Fortunately we have a very recent experience to examine, the COVID-19 sell off in March 2020. During this period the MSCI World fell approximately 13 per cent while the strategy, in Australian dollars, fell just over half as much, by slightly more than seven per cent.

We can also go back in time to find the strategies worst ever drawdown. Since the inception of the strategy , the largest drawdown in Australian dollar terms has been negative 10.23 per cent in December 2018.

While many investors focus on the ultimate return, we believe the journey taken to reach that return is equally important. Polen Capital’s strict adherence to their quality-focused investment process – investing exclusively in what they believe to be the world’s highest quality businesses has assisted during periods of tremendous volatility. Polen’s focus on investments candidates displaying very strong balance sheets, abundant free cashflow, strong return on equity (ROE), solid margins and moreover real, organic revenue growth should sound very familiar to Montgomery investors.

Figure 2. Polen Global Strategy experience during Covid 2020

Source: Montgomery/Morningstar

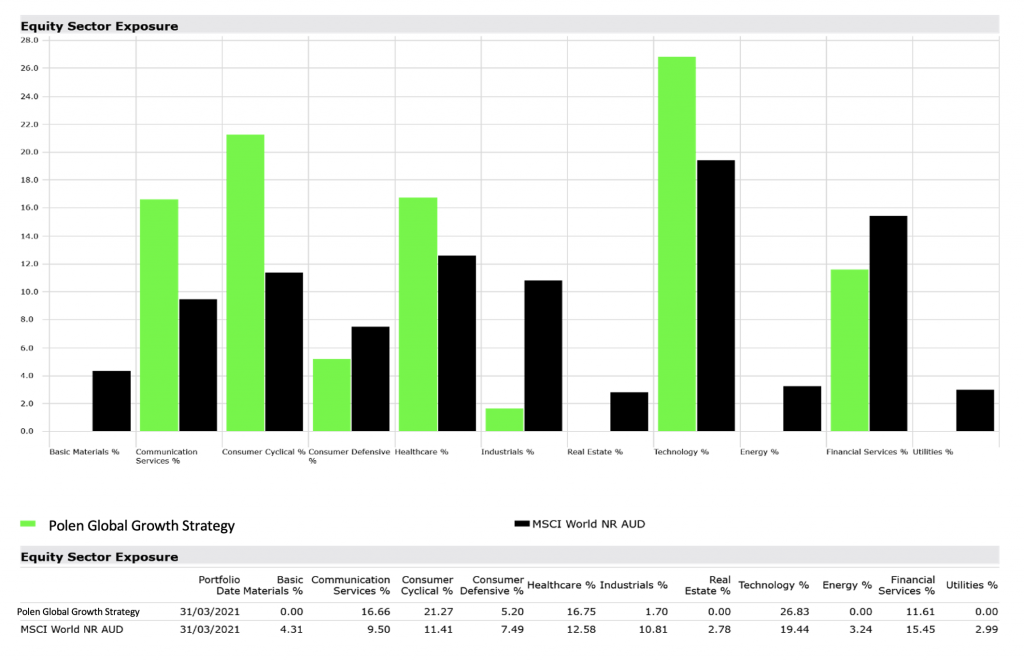

Complementarity

A final observation I’d like to bring to bring to your attention is just how different, to the index, The Fund’s portfolio is (Figure 3.). A common way of assessing this is to look at the “active share” of a fund at both the sector and individual stock level. Active share measures the percentage difference a strategy exhibits versus the market. At 31 March 2021, the Polen Capital Global Growth Fund had an active share of 85 per cent versus the MSCI World. In other words only 15 per cent of the portfolio was common to the Index. When advisers construct portfolios for their clients, they take special note of the active share, making sure not to incur fees for duplication. The Fund’s low level of common holdings with the benchmark is consistent with the fact that Polen Capital generally invest in just 20 to 30 of what they believe to be the highest quality businesses. The Fund’s sector level exposures and active weights can also be measured. The Fund’s largest sector active overweights are; Consumer Cyclicals, Technology and Communication Services. The largest active underweights relative to the MSCI World are Industrials, Materials and Financial Services.

Figure 3. Polen Global Strategy Active Sector Weights

Source: Montgomery/Morningstar

With such impressive results, I hope you can appreciate why, after a long and detailed search for a global partner, we are delighted Polen have partnered with Montgomery and Australian investors are now able to invest in The Polen Capital Global Growth Fund.

You should read the Product Disclosure Statement (PDS) before deciding to acquire the product.

The Polen Capital Global Growth Fund invests using an identical strategy to the Polen Capital Global Growth strategy. Past performance is not a reliable indicator of future performance.

Units in the Polen Capital Global Growth Fund (ARSN: 647 518 723) (Fund) are issued by the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Fund’s investment manager is Montgomery Investment Management Pty Ltd (ABN 73 139 161 701, AFSL 354 564). The fund’s sub-investment manager is Polen Capital Management, LLC.

The PDS contains all of the details of the offer. Copies of the PDS are available from Montgomery Investment Management on (02) 8046 5000 or at www.montinvest.com. Before making any decision to make or hold any investment in the Fund you should consider the PDS in full. An investment in the Fund must be through a valid application form attached to the PDS or via the online application form. You should not base an investment decision simply on past performance. Past performance is not a reliable indicator of future performance. The investment returns of the Fund are not guaranteed, and so the value of an investment may rise or fall.

The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon this information and consider seeking advice from a licensed financial advisor if necessary.