Polen Capital – a nice start

Effective March 2021, Montgomery Investment Management became the distribution partner for Polen Capital in Australia and New Zealand. Polen Capital commenced operations in 1979, and the US$70 billion business is 71 per cent owned by its employees, who in turn have 100 per cent of the company’s voting rights.

Polen Capital has three distinct teams operating from three locations, and all have a few common characteristics – investing in a concentrated strategy of outstanding global businesses with very low portfolio turnover.

- The 11-person large company growth team is based in Boca Raton, Florida, Polen Capital’s global headquarters. Many readers may have come across Damon Ficklin, Head of the Polen Capital Global Growth Strategy and Jeff Mueller, Co-Portfolio Manager, and we re-introduce both gentlemen here.

- The 8-person small and mid-cap global growth team is based in Boston, and Rob Forker is Head of the Polen Capital Global Small and Mid-Cap Growth Strategy.

Interestingly, the small and mid-cap global growth strategy currently comprises 30 companies listed across ten currencies, with a market capitalisation range of US$1.2 billion to US$24.8 billion, and an average of US$8.4 billion. It is important to note, this median market capitalisation is only 1.3 per cent of the average market capitalisation of the Polen Capital Global Growth Strategy (US$646 billion).

We will discuss this investment opportunity and some of the “speedboat” type stocks which comprise the Polen Capital Small and Mid-Cap Strategy in a later blog.

- The Polen Capital Global Emerging Markets Growth Strategy is headed up by Damian Bird, and his 5-person team are based in London.

Today’s blog will take a deep dive into the current Polen Capital Global Growth portfolio. Over the four months from the launch of the Polen Capital Global Growth Fund, initial investors have received a 15.3 per cent return to 15 July 2021, out-performance against the MSCI ACWI Net Total Return Index in A$ of 3.5 per cent, after expenses. And in the six and a half years to June 2021, the Polen Capital Global Growth strategy has delivered investors a compound annual return of 17.36 per cent (in A$), out-performance against the MSCI ACWI Net Total Return Index of 5.01 per cent per annum.

While the current 26 stock portfolio has a forward 12-month PE of 32X compared with the MSCI ACWI of 19X, its long-term EPS growth rate is forecast at 17.3 per cent per annum, around triple the MSCI ACWI’s 6.0 per cent. Further, the Net Debt/Free Cashflow (ex-lease) ratio of the Polen Capital Global Growth portfolio is nil, whilst the benchmark’s is 2.9X; and the Return in Total Capital is 18.6 per cent versus the benchmark’s 12.3 per cent.

The Polen Capital Global Growth Strategy invests across the growth spectrum, ranging from safety all the way to growth.

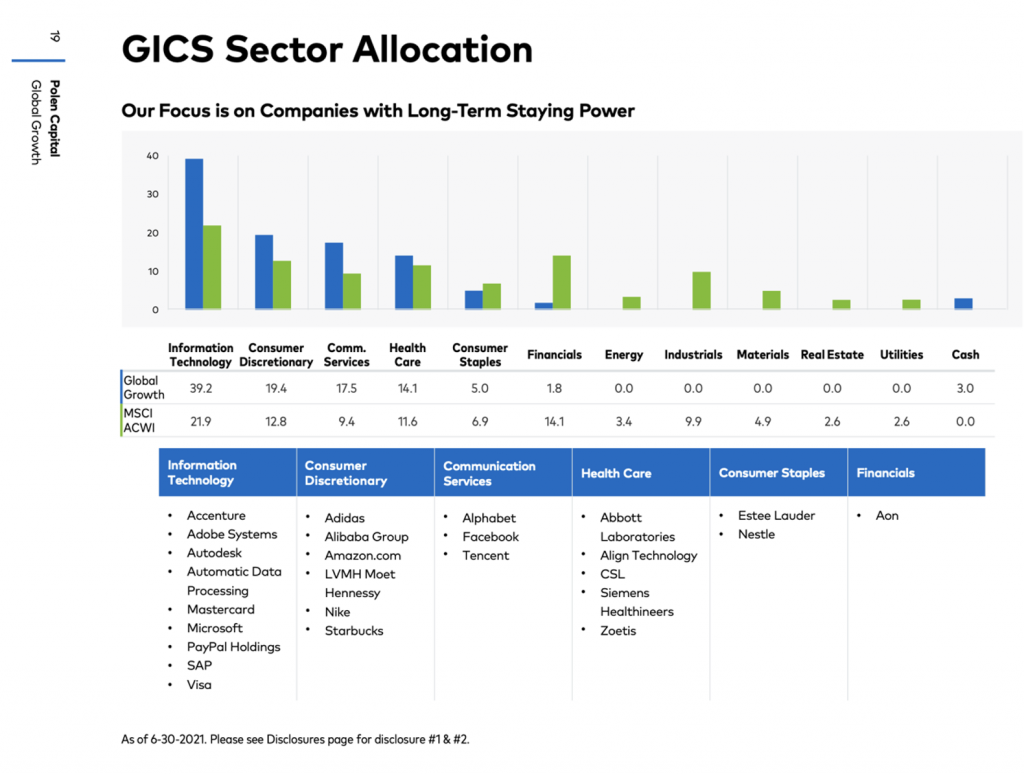

Relative to the MSCI ACWI benchmark, the Polen Capital Global Growth Fund is overweight Information Technology (39.2 per cent vs 21.9 per cent); Consumer Discretionary (19.4 per cent vs 12.8 per cent); Communication services (17.5 per cent vs 9.4 per cent) and Healthcare (14.6 per cent vs 11.6 per cent).

Significant underweight positions include Financials (1.9 per cent vs 14.1 per cent); Industrials (nil vs 9.9 per cent); Materials (nil vs 4.9 per cent); and Energy (nil versus 3.4 per cent).

Source: Polen Capital

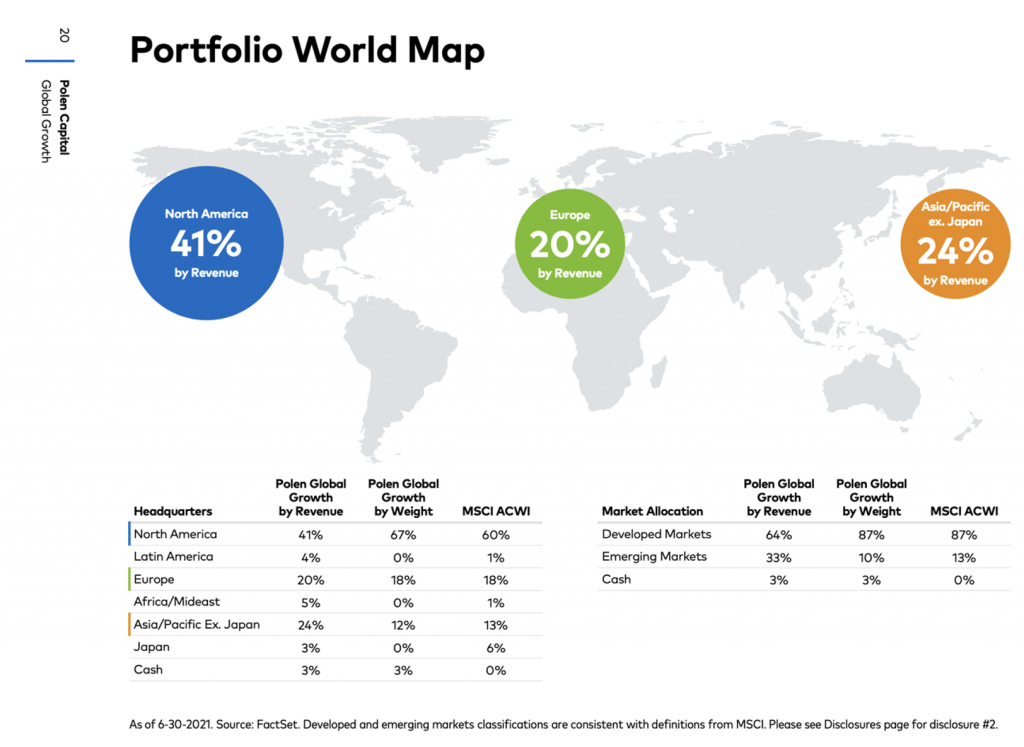

In terms of the revenue of the Polen Capital Global Growth Fund, 41 per cent is attributable to North America, 24 per cent to Asia Pacific ex-Japan, 20 per cent to Europe, 5 per cent to Africa, 4 per cent to Latin America and 3 per cent to Japan.

Source: Polen Capital

And from an Environmental, Social and Governance (ESG) perspective, the Polen Capital Global Growth strategy has attained a “High” Morningstar Sustainability Rating and is ranked in the top ten per cent in the Morningstar Global Equity Large Cap Category. Finally, the Polen Capital Global Growth Fund is 89 per cent less carbon intensive than its MSCI ACWI benchmark.

If you would like to learn more about the Polen Capital Global Growth Fund, visit the fund’s web page:

POLEN CAPITAL GLOBAL GROWTH FUND