Plenty to like in Spark NZ’s FY21 result

Funds in the Montgomery stable are long-time holders of Spark, New Zealand’s leading telco. Spark is a steady performer, and a consistent dividend payer. And its recently reported full year results paint a picture of a telco in good financial health with potential for value creation by capital recycling.

Spark (ASX:SPK) is one of the two parts from when the state owned Telecom NZ was broken up and privatised. Spark ended up with all the customer facing aspects of Telecom NZ while Chorus owns most of New Zealand’s telecom backbone infrastructure including their version of NBN (which being 100 per cent fibre to the premises based is a much superior product to NBN).

Spark today consists of four main parts:

- A mobile business which is the leading player with a 41.5 per cent share of the NZ mobile market. The NZ mobile market is a rather cosy place from a competitive standpoint with only three players owning infrastructure and with all the players seemingly quite focused on internal improvement measures rather than external market share grab, the margins are high. New Zealanders have historically been quite low users of mobile data (probably an effect of their very good fibre broadband network) but are rapidly increasing their usage which has enabled the industry to keep average revenue per user (ARPU) up as the operators have been competing with larger data plans rather than on price.

- A traditional fixed line voice telephone business that has been in decline for a long time as people are disconnecting their fixed lines and instead rely solely on their mobiles.

- A Broadband business traditionally focused on ADSL or fibre connections. This is a very competitive and low margin business as there are a large number of players basically selling Chorus capacity and trying to charge a margin on top. Over the last couple of years, with the emergence of 4.5G and very recently 5G mobile networks that offer speeds and latency that are almost comparable with a fibre broadband connection, Spark in particular has started to offer fixed wireless broadband connections. This is basically a cellular connected router that you replace your existing router with and that connects directly to the closest mobile tower and then distributes internet to your devices. As the data never touches the Chorus network, there is no access fee payable to Chorus and Spark can capture a lot higher margin as the marginal cost to deliver this service is minuscule as they have already built the cellular network to service mobile handsets. Vodafone has recently also started to offer fixed wireless broadband and the third player in the market 3Degrees is also about to, which could be bad news for Chorus.

- Finally, we have a Cloud, Security and Service Management division which offers companies outsourced IT services. Spark is the largest cloud provider in NZ and offers both private and public cloud (Amazon Web Services, Microsoft Azure etc.) including helping companies transfer to the cloud as well as traditional outsourced IT support. This is a fast growing area of IT and given that only about 30 per cent of NZ companies have this far taken the step to move their IT infrastructure into the cloud, the growth runway should be substantial.

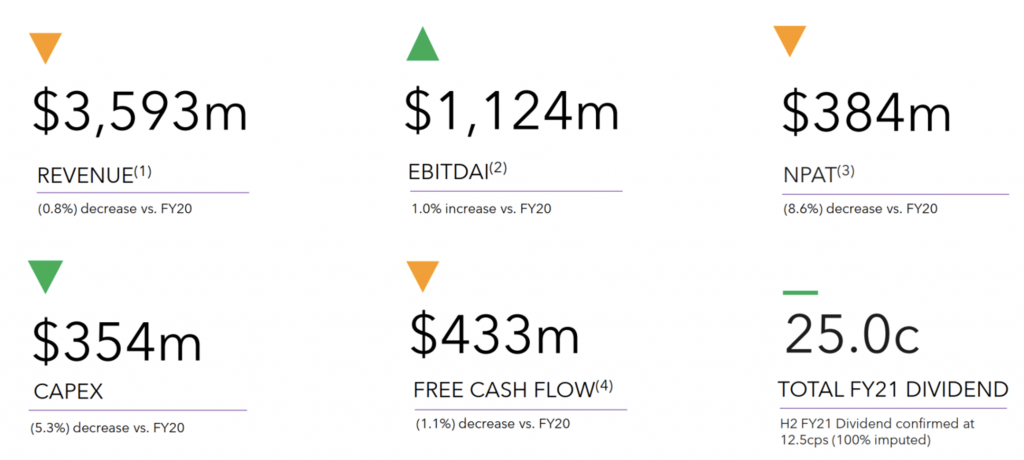

On 18 August, Spark reported their FY21 results and I thought it would be interesting to point out some of the highlights:

- Impressively, despite a slight fall in revenues in the year of 0.8 per cent, Spark managed to grow its EBITDA by 1.0 per cent showing very strong cost control. This is a result of the significant transformation they have undertaken over the last couple of years. In this video from a few years back, I discussed Spark’s transformation to an “agile” organisation and the significant simplification of product plans. The effects of this transformation is still playing out as we can see in the results with continuous falling costs. It is actually even more impressive when we consider the reason revenue fell was primarily that mobile roaming revenues has gone from around $40 million per year to almost zero as NZ with closed boarders have had hardly any foreign visitors during the year. Roaming revenues are extremely high margins (80 per cent +) so this almost pure profit falling away. The EBITDA of $1,124 million was higher than consensus forecasts and towards the top end of what Spark guided to previously.

- The second interesting update from results was Spark announced the initial results of their review of their infrastructure. In that, they identified their mobile towers (the physical towers, not including the bolted-on antennas) as a candidate for full or partial disposal. There is currently a huge appetite amongst investors with longer investment horizons for stable income generating assets and readers might be familiar with Telstra’s recent sale of a 49 per cent stake in their mobile towers for an implied valuation of AUD$5.9 billion representing a 28x EV/EBITDA multiple. Telstra’s tower business consists of 8,200 towers while Spark has about 1,500 towers so if we directly apply the same value per tower, this would imply a value of approximately NZD$1.1 billion which is approximately 13 per cent of the current market cap of Spark of around NZD$8.8 billion.

- This is of course a very rough way of estimating the value as it will all depend on what kind of contracts are put in place between Spark and the sold business as the value depends on this revenue stream. If we assume a similar 28x multiple as for Telstra’s deal and divide the NZD$1.1 billion by 28, we get approximately NZD$40 million in EBITDA per year or approximately 3.6 per cent of the just reported group EBITDA.

- In other words, if Spark sells 100 per cent of their towers for similar $/tower as Telstra and put in place a contracted revenue stream that works out to the same EV/EBITDA multiple as the Telstra deal, they could release 13 per cent of the current market cap to shareholders for a 3.6 per cent hit to EBITDA.

- Now, this is very rough maths but shows that there could be potential value accretion to be had if they do go down the path of selling parts of their infrastructure to take advantage of the arbitrage between the cost of equity that the market is currently applying to Spark overall and what an infrastructure investor hungry for stable income would apply for a secure revenue stream.

- Also, Spark is unlikely to sell 100 per cent of their towers as they would most likely, just as Telstra, want to retain control of the assets so that they do not lose control of their critically important antennas.

The above might sound very positive for Spark but we should also remember that parts of the business is still in terminal decline and we also have the potential that Vodafone and 2Degrees step up the competition in the mobile space and that AWS and/or Microsoft decide to be more aggressive in the cloud business in NZ which could have a negative impact on Spark.

Reporting Season Webinar

If you are interested in hearing our views on other company results, you can join Roger Montgomery as he hosts a panel discussion with our Portfolio Management teams on 20 September 2021 for the Montgomery Reporting Season Review, click to register.

The Montgomery Funds own shares in Spark New Zealand and Telstra. This article was prepared 19 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY