Performance to 31 August 2015

The Montgomery funds recorded solid results in the twelve months to 31 August 2015.

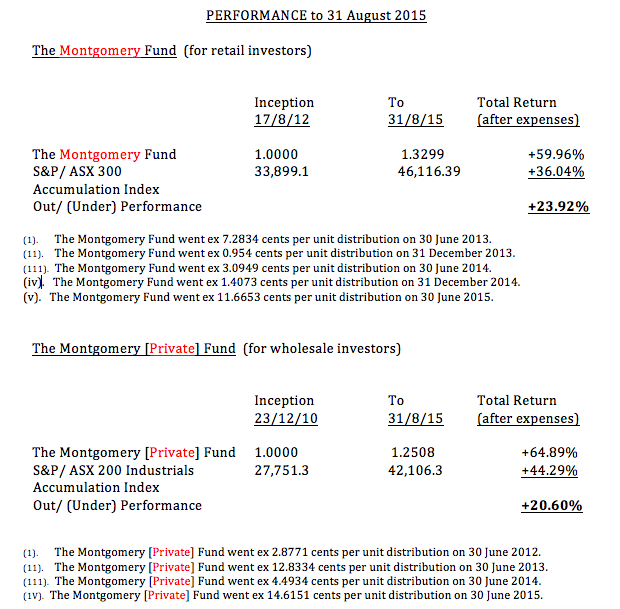

The Montgomery Fund was up by 5.71 per cent, outperforming its benchmark by 8.94 per cent. Over the period under review, the S&P/ ASX 300 Accumulation Index, which assumes reinvestment of dividends, was down 3.23 per cent.

The Montgomery [Private] Fund was up by 6.4 per cent, out-performing the broader market by 9.63 per cent.

In the period between inception (17 August 2012) and 31 August 2015, The Montgomery Fund has out-performed its benchmark by 5.96 per cent per annum, after expenses.

In the period between inception (23 December 2010) and 31 August 2015, The Montgomery [Private] Fund has out-performed its benchmark by 3.13 per cent per annum, after expenses.

Over the two months to 31 August 2015 the Montaka Global Fund delivered a positive return of 8.00 per cent while the Montgomery Global Fund recorded a positive return of 1.86 per cent, slightly under-performing its benchmark the MSCI World Net Total Return Index in Australian dollars, which increased by 2.10 per cent. All Montgomery funds have generally maintained a significant cash weighting over the periods under review.

For those readers who may be having trouble understanding the difference between the total return and the unit price, can I please encourage you to read the following post, How Do We Calculate Returns?

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

not sure why the Montaka fund is not available to us mere mortals with less than 500K to spend.

I think you’d find it would be very popular…

Funny you say that Carlos.

We are quite advanced in designing the Montaka Global Access Fund, and hope to be able to make announcement on its timing in a few weeks. Regards, David

Good news! I too look forward to hearing about this.

Great to hear David. Unfortunately my platform provider has not approved the Global Fund, so hopefully the new fund might be available on more platforms – are you thinking of a listed or unlisted structure? Or is this information not yet publicly available?

Hi patrick,

Eventually it will be there. In the meantime, more flexible investors who are looking to benefit from the offer are allowing their portfolio to have some items off-platform. Profit before convenience?

I’m looking forward to the Montaka Fund being opened to retail investors. Great result to date!