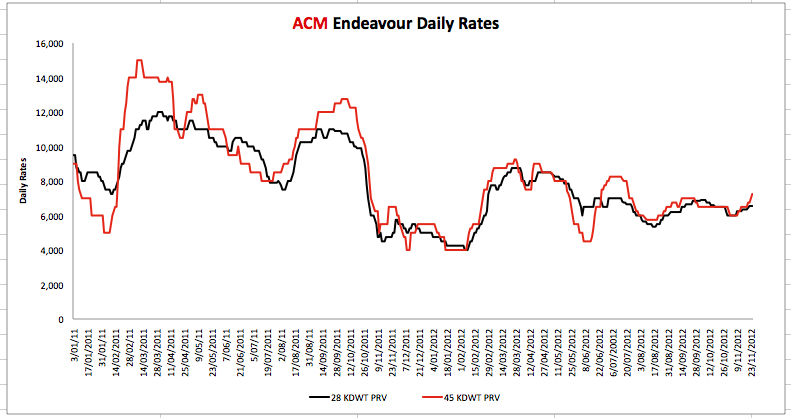

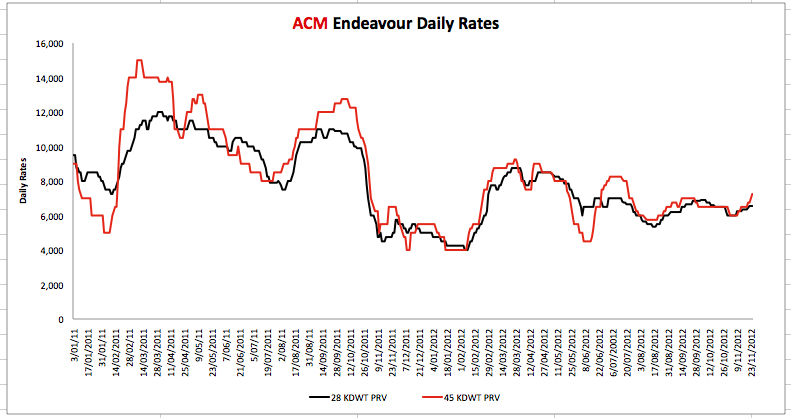

Pacific round voyage (PRV) lease rates – off the canvas?

The daily lease rates for bulk carriers have risen by 20% to 25% in the past three months. The graph below details those daily rates for two categories of bulk carriers over the past two years; 28,000 dry weight tonnes which are around 170 metres long and 45,000 dry weight tonnes which are around 230 metres long.

The daily rates are currently US$6,550 and US$7,250, respectively, and reflect the perception China’s imports have recently recovered. For example, after three months of decline, China’s total coal imports hit 16.8 million tonnes in October 2012, up 13% from 14.9 million tonnes in September, and up 7% year on year.

In the case of coal, the buyers (typically Chinese steel or electricity producers) pay the freight from the port of loading, known as FOB or Free on Board. In the case of iron-ore, the miners (typically BHP, RIO and Fortescue Minerals) pay the freight to the named port of destination, known as C&F or Cost and Freight.

Meanwhile, the Shanghai Composite Index hit 1,990 points, the lowest level since January 2009. Down 10% this year, and down 42% from the mid-2009 high, the Shanghai Composite Index is trading at 9.5 times estimated 2012 net profit and this compares to its long-term average of 17.7X.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.