Oh Dear! (Part II)

In a follow up to Roger’s blog last week entitled “Oh Dear!” I was surprised the question of “Whether we should have an inquiry into the iron-ore industry or not?” has received so much air-time.

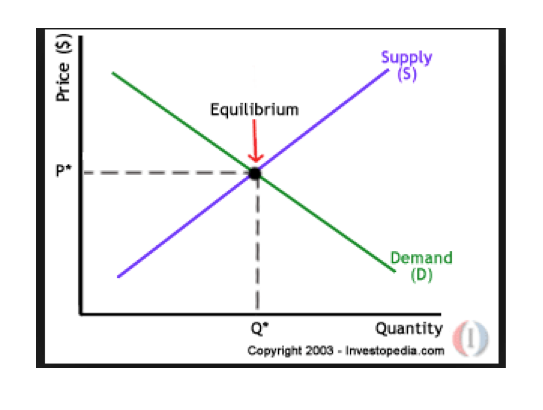

While Treasurer Hockey seems to have back-flipped on this question I wonder if some of our federal politicians should duck over to the Australian National University and attend the first lecture in Economics 101: Supply v Demand.

When the biggest buyer of iron-ore (read China) actively assists one of the biggest suppliers of iron-ore (read Vale) increase their production the purple Supply line above moves to the right, and voilà more quantity generally means a lower price.

When the biggest buyer of iron-ore (read China) actively assists one of the biggest suppliers of iron-ore (read Vale) increase their production the purple Supply line above moves to the right, and voilà more quantity generally means a lower price.

The “Big four” iron-ore producers (Rio Tinto, Vale, BHP Billiton and Fortescue Metals) currently supply around 1,075 million tonnes per annum. By 2018, this is expected to increase by 18.6 per cent to 1,275 million tonnes. Despite the bluster coming out of Canberra, the majority of the additional 200 million tonnes is expected to come from the Brazilian iron-ore giant, Vale.

China have just announced a $4 billion loan to assist Vale fund a $16.5 billion expansion of their low cost high quality S11D project. This mine – which contains 4.2 billion tonnes of ore at 66.7 per cent grade, well above the industry’s 62 per cent benchmark grade – will quickly ramp up to 90 million tonnes of annual production.

In addition China will invest in eight super-sized Valemax iron-ore vessels, which are 360 metres long, 65 metres wide and 30.4 metres deep with a deadweight tonnage of 400,000 which we have previously taken a look at.

Previously China had made life difficult for Vale over these vessels – first banning them and then imposing restrictions on them docking at Chinese ports. In China’s urge to diversify iron-ore supply – Australia accounts for 59 per cent of China’s imports – it seems Vale’s US$4/tonne of freight cost disadvantage relative to the Big Australians will now narrow.

At the time of writing iron-ore was US$57.60/tonne well up from the recent low of US$46.70/tonne.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Been some really great articles on the site as of late.

Keep up the good work.