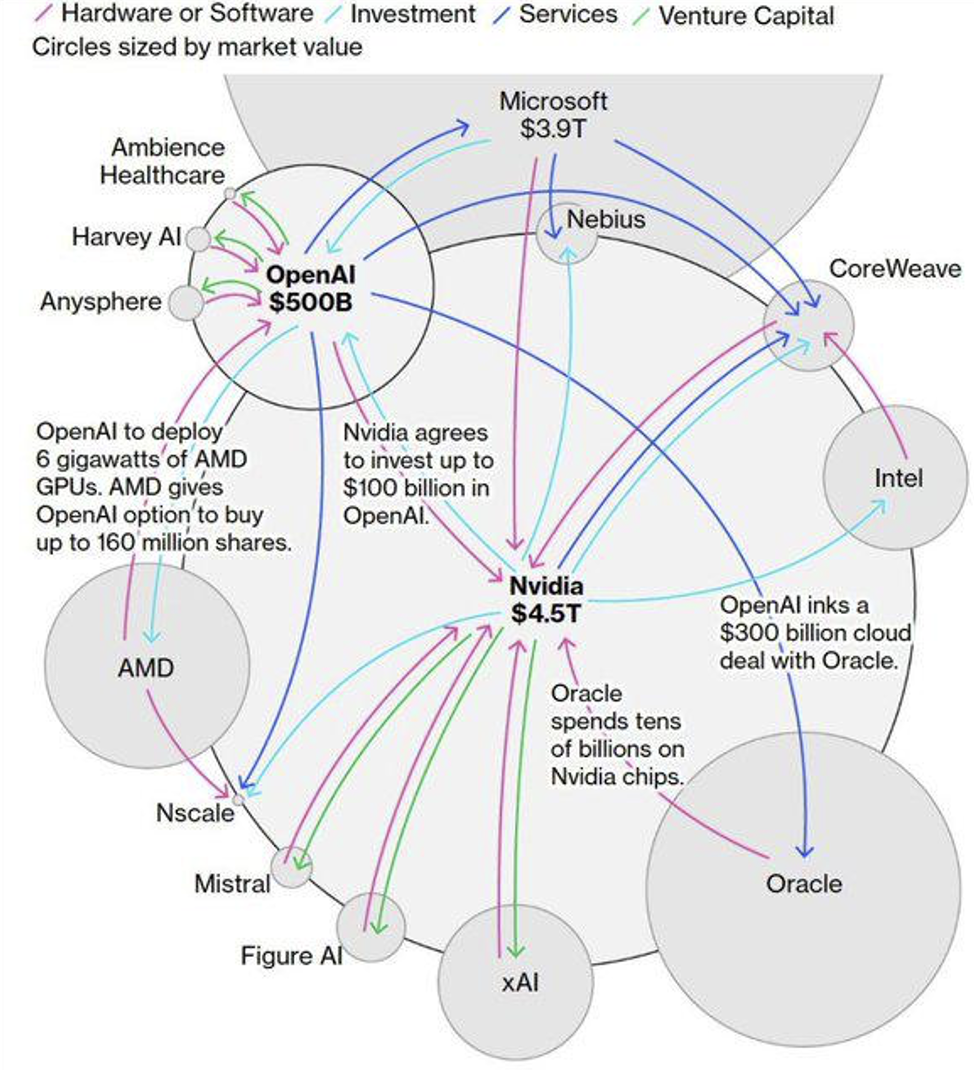

NVIDIA’s artificial intelligence web

Nvidia is increasingly finding itself at the centre of a growing list of round-robin style transactions between artificial intelligence (AI) players that are collectively raising the eyebrows of a variety of reputable investors and industry stalwarts, from Microsoft co-founder Bill Gates to famed short seller Michael Burry.

Figure 1. Sharing is caring

Source: Bloomberg

The diagram in Figure 1 was first published in a recent Bloomberg article and has since gone ‘viral’. I include it here for information purposes only and for the benefit of those who may have missed it.

It’s a map of everyone funding everyone. The cash, the compute, and the equity are all flowing in a loop with multiple players reporting the same wad of cash as their own revenue. That’s, of course, not particularly troublesome. When I buy something from you for $50, you will report that as revenue, and then when you use that $50 to buy something else, the recipient will also report the same $50 as revenue. The difference is whether genuine value is being delivered for the dollars spent.

And that raises the question of whether the extent of the cross-pollination is evidence of an artificial intelligence (AI) bubble inflating in real time? Given the chart was first published by Bloomberg a month ago, and remembering its illustrating transactions that have already occurred (and the stock market hasn’t crashed), it might be reasonable to conclude it’s not a revelation that will pop the boom/bubble. As the investing aphorism goes, ‘if it’s obvious, it’s obviously wrong’.

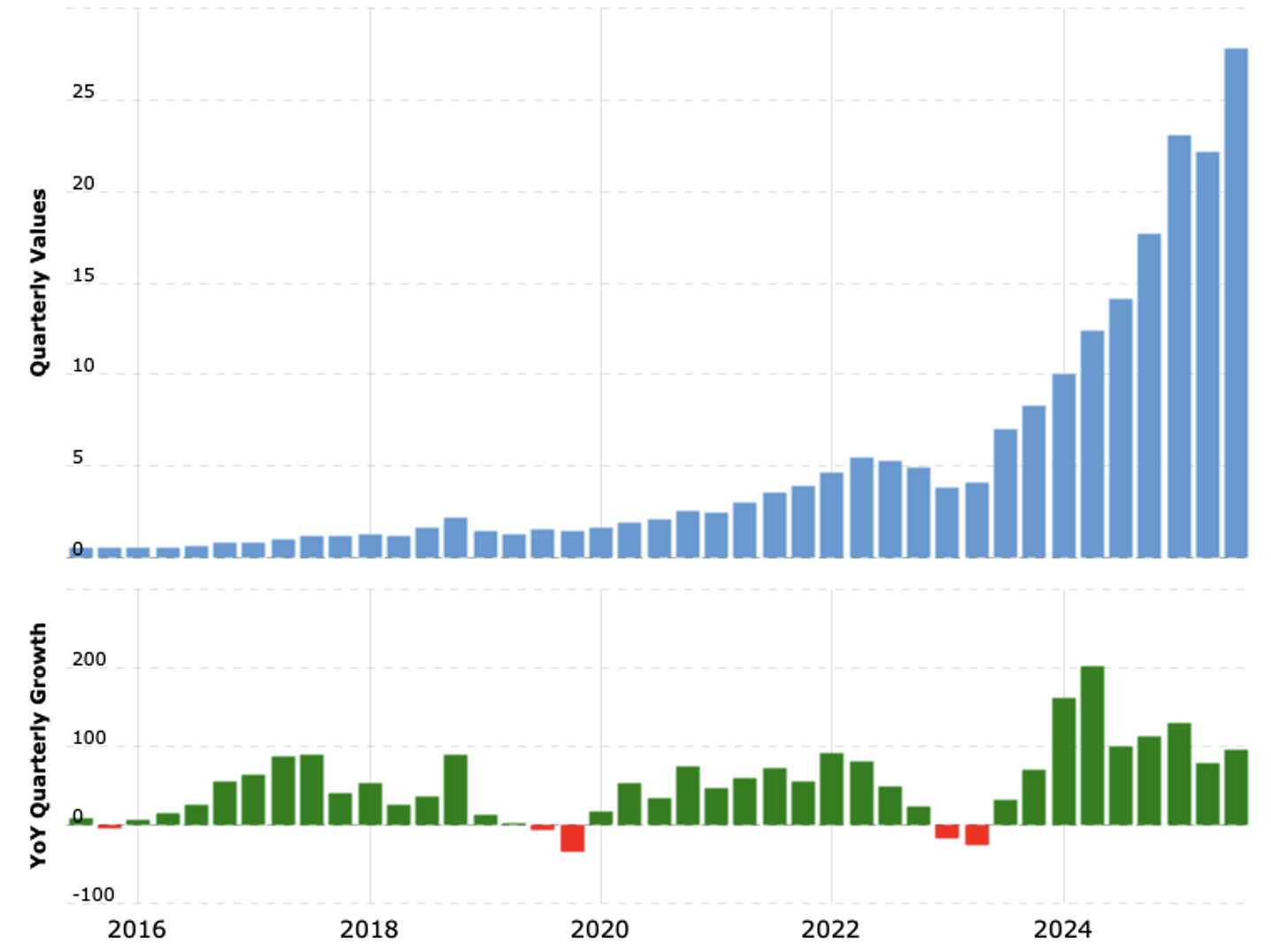

Perhaps more insightful is the jump in receivables for the company at the centre of the diagram, Nvidia.

Figure 2. Nvidia Accounts Receivables, $US billion

Source: MacroTrends

It’s not unusual for receivables to rise at the pace of revenue. Some proportion of customers will inevitably be sold goods on credit. What should raise questions is a rise in receivables that far exceeds the pace of revenue growth.

According to London-based MacroStrategy’s Julien Garran, Andrew Lees and James Ferguson, “…over the past 30 months, Nvidia’s receivables have risen from 56 per cent of quarterly revenues up to 85 per cent. [Our] understanding is that the increase is largely deals whereby Nvidia sells chipsets to datacentres for ‘future compute’. Jensen Huang has said the compute will be for Nvidia’s service for robot and driverless car developers training on synthetic data, but it is unclear how much revenue Nvidia is receiving from this source, as they don’t split it out, despite the fact that it is a multi-billion-dollar investment.”

Many are asking why Nvidia is doing deals so furiously. The latest was Nvidia investing US$100 billion in OpenAI, over time, in what some suspect is a non-binding agreement to provide compute for equity, just like Microsoft was doing before it decided to stop (also, it is a statement of intent, but when push comes to shove, it does not need to be honoured).

One idea worrying investors is that the Nvidia deals allow OpenAI to fund its non-binding commitment to renting US$300 billion of compute from Oracle, which means Oracle buys more chips from Nvidia. The worry is evident in Oracle’s share price performance since the 30 per cent bounce last month on the back of the announcement. The entire 30 per cent jump has been retraced.

Figure 3. Nvidia and Oracle, Year To Date (YTD)

Source: Finviz

Other ideas gaining traction to explain the purpose of Nvidia’s dealings is that

- It could tempt others to ‘believe’ in the AI Hype cycle, and invest in Open AI, which

- Would allow OpenAI to buy more chips from Nvidia. And

- It allows OpenAI to purchase more Nvidia chips despite the calamitous economics (a US$74 billion loss is forecast by OpenAI in 2028), and

- The revenue gains can be marked-to-market for future higher funding rounds.

But there’s a whiff of rats jumping ship.

Figure 4. Jumping ship, Nvidia insider sales, 1-Year

Source: Bloomberg, Montgomery

While Nvidia’s deals potentially point to an artifice propping up the entire AI boom, it looks like insiders are having none of it. Figure 4., offers a clear picture of what some insiders are doing. There’s precious little buying going on, but a ‘whole lotta selling’.

If I left you with Figure 4, which shows only the last 12 months of insider transactions recorded by Bloomberg, it would be an incomplete picture and perhaps an unfair painting of the situation. Figure 5., goes back considerably further and reveals insider selling has been a constant feature of Nvidia’s life as a public company. So, the recent selling is nothing new.

Figure 5. Nvidia insider transactions, 5-Years

Source: Bloomberg, Montgomery

What has changed over the last five years, however, is the frequency of insider buying. Between late 2020 and late 2023, insider buying was regular. In the latest leg of Nvidia’s share price surge, there has been zero insider buying. And that could be very important information. What Figures 4., and 5., don’t tell you is the quantum of selling. For that, you will need to look up the company’s Form 4s, which the Securities and Exchange Commission (SEC) requires insiders to submit when selling stock, within two days of the transaction.

Thoughts

Graphic Processing Unit (GPU) sales are increasing, but they are increasingly on credit. The round-robin financing might mean Nvidia’s customers aren’t good for it, and the lack of cash flow is prompting Nvidia insiders to reduce their exposure. It might not be the right picture, but it’s a non-zero possibility. What you do with that information is entirely up to you, and remember, some investors can provide equally compelling reasons that Nvidia is only in the early stages of a multi-year bull run.

As always, time will tell.

Disclaimer

The Polen Capital Global Growth Fund own shares in Nvidia and Microsoft. This article was prepared 12 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.