New research shows why it pays for investors to keep informed

A recent article by academics from the London Business School shows why it’s so important to stay informed of trends and movements in the business landscape. Keeping in touch means you can identify industries that are emerging, and those that are under threat – and shape your portfolio accordingly.

The article, by Elroy Dimson, Paul Marsh and Mike Staunton, is published in the 2017 edition of the Credit Suisse Yearbook. In it, the authors analyse investment returns and inflation rates from various asset classes and countries over the very long term. One of the focuses is on the great transformation of industries listed on the US stock exchange since 1900.

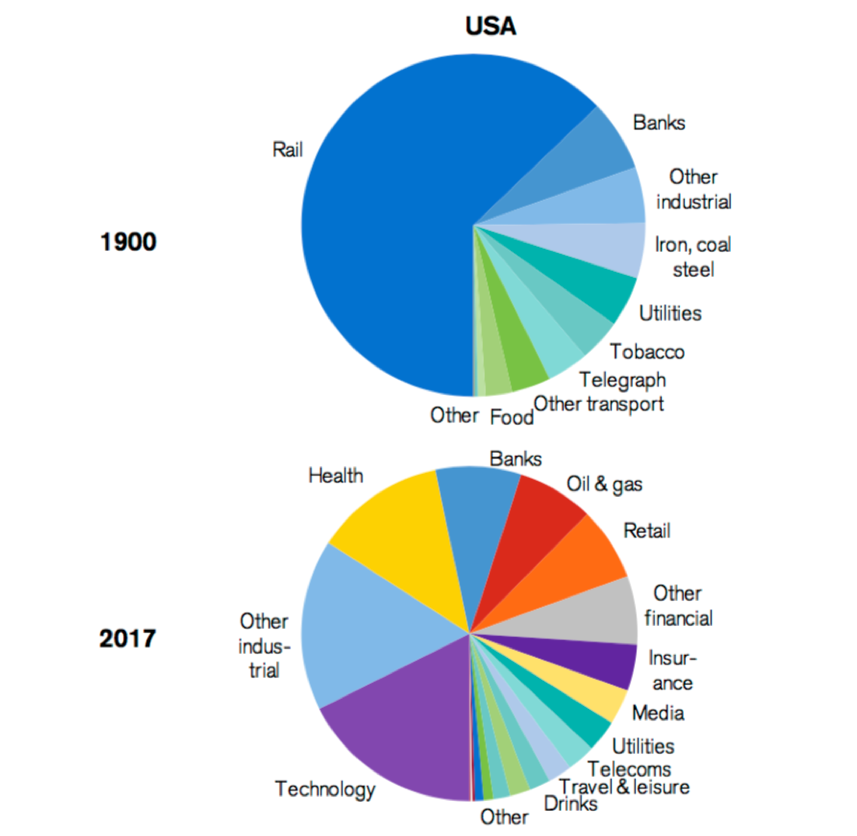

The article highlights how the configuration of the US stock market has changed immensely with the rise of entire new industries including electricity, power generation, cars, aerospace, airlines, telecommunications, oil and gas, pharmaceuticals, biotechnology, computing, information technology, media and entertainment.

Of the US firms listed in 1900, more than 80 per cent of their value was in industries that are today small or extinct. Railways are now a tiny part of the market, while textiles, clothing, footwear, iron, coal and steel have generally moved to lower cost locations in emerging countries.

Chart 1: Industry weightings in the US stock market, 1900 compared to 2017.

The largest listed industries in 2017 include technology, banks and insurance, healthcare, oil and gas and retail. Old and new industries can reward as well as disappoint investors, and this greatly depends on whether the underlying stock price correctly embeds expectations (or are they too optimistic?).

And risk management is crucial when we consider the year 2000 for example, when the crash of the telecommunications, media and technology (TMT) sector was attributable to investors placing too high a value on the new technologies. Do you remember the enterprise value to eye-balls investment methodology being dragged out by the broking community at the time?

Mr McGuire to Ben: “I want to say one word to you. Just one word. Plastics.”