New data show slowing loan growth for the big banks

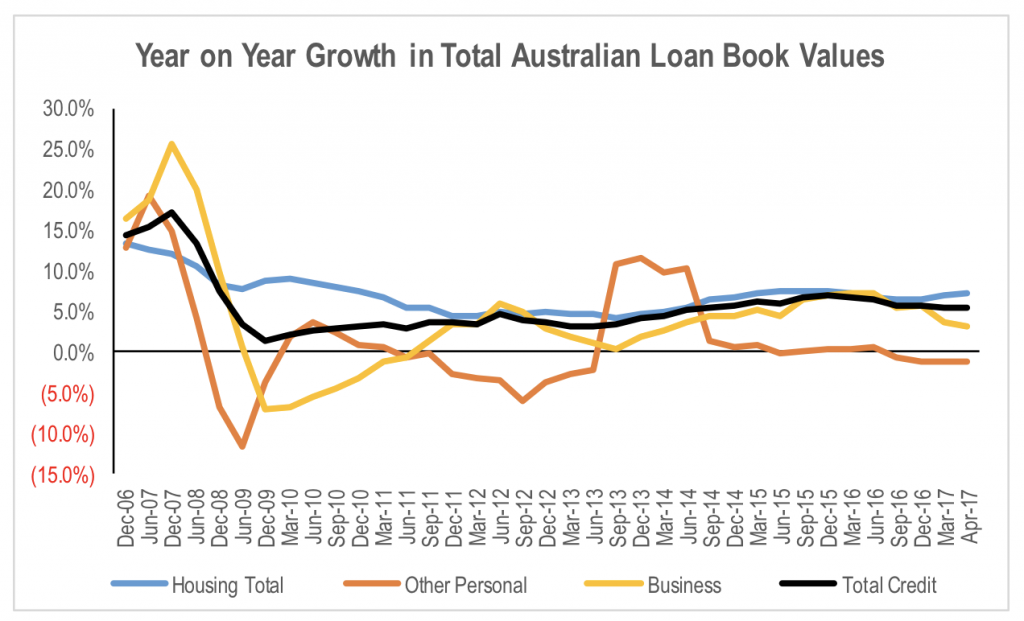

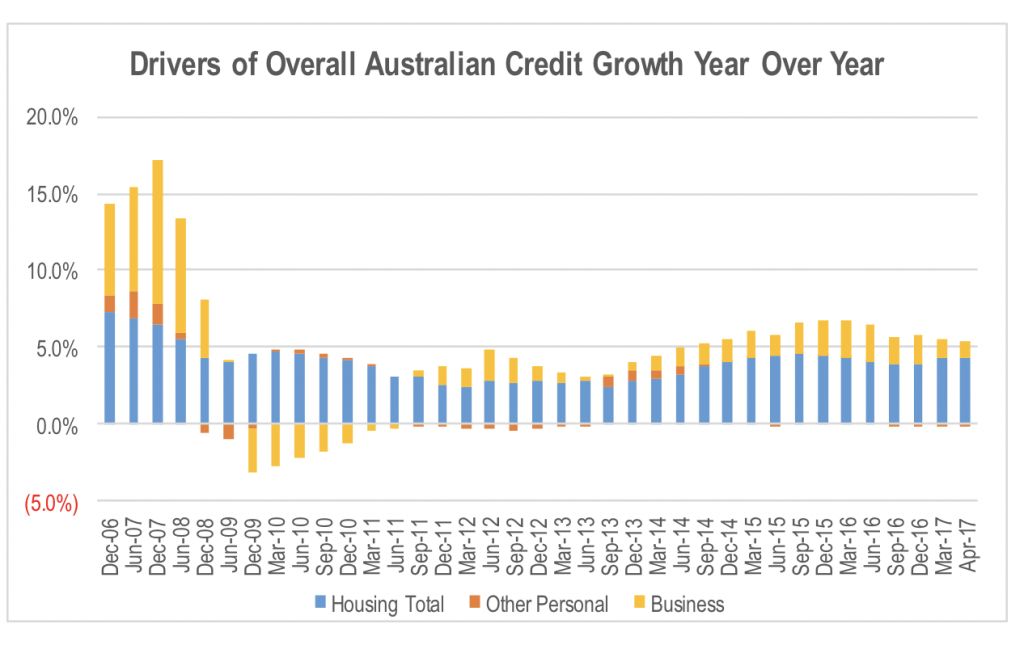

The Reserve Bank and APRA have just released their credit statistics for April. The numbers show a slowing in loan growth rates that was consistent with the recent major bank results to March 2017. The source of slowing is primarily from weakening growth in loans to the corporate sector, while mortgage book growth remains reasonably stable at around 7% year on year.

The findings will be a concern for the RBA, but its desire to boost business lending and investment through further cuts to the official rate will be tempered by the concern that it will further fuel imbalances in the residential property market.

As a result of the slowing growth in business lending, the driver of bank loan book growth continues to shift toward mortgages, increasing bank exposure to residential property markets.

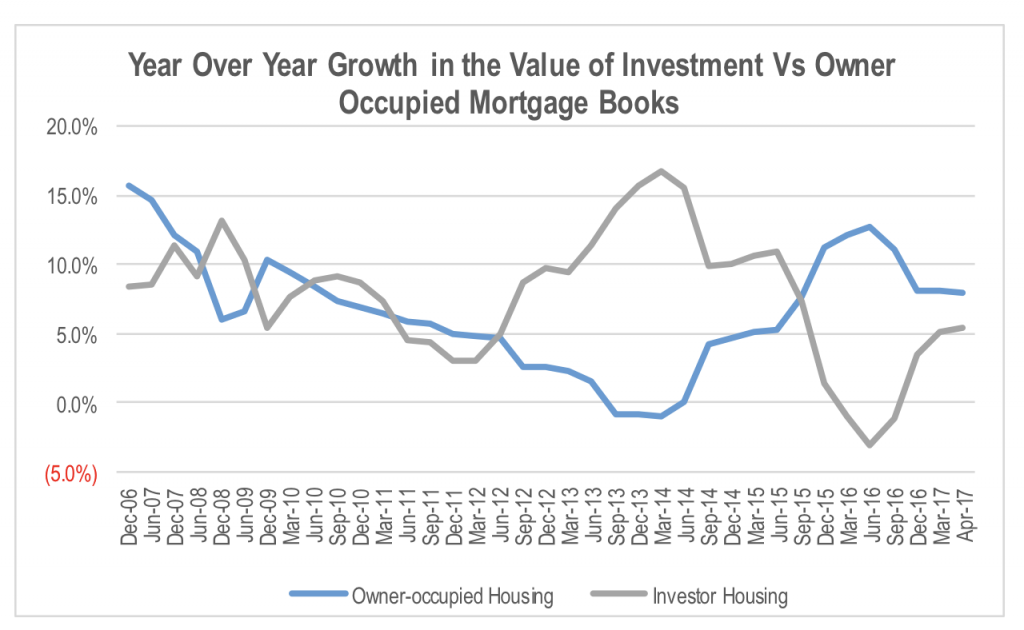

Investment property mortgage book growth continued to recover from the lows of June 2016, but remains slightly below that of owner occupied loan book growth.

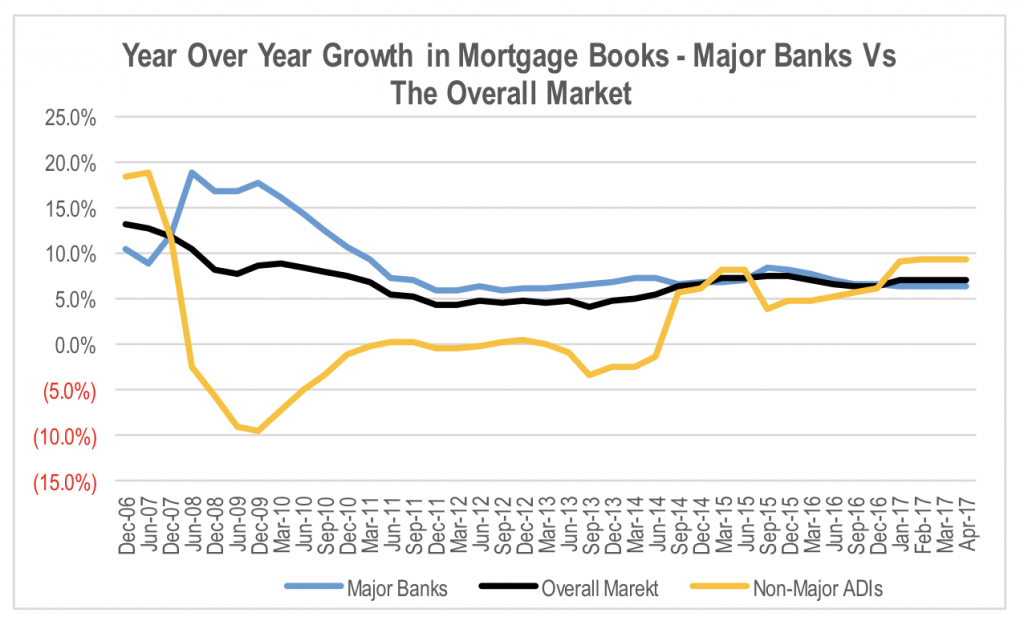

One point of interest is that mortgage book growth is moderating for the major banks, while growth has remained more stable for the broader market. For the first time in a number of years, mortgage book growth for the major banks has fallen below that of the overall market. This implies that the major banks have lost a small amount of share. This could signal that the constraints being placed on the majors and/or their own sense of the rising risks in the residential property market have made the smaller banks and other ADI’s more competitive. The pick-up in mortgage growth outside the majors appears to have occurred around the time the majors were lifting their standard variable rates in December and February.

Among the major banks, CBA’s mortgage book is growing slightly faster than that of the other majors, followed by WBC. NAB’s mortgage book growth has accelerated slightly over the last 6 months, while ANZ has remained conservative in its expansion in line with management’s more cautious rhetoric about the risk in the residential property market.

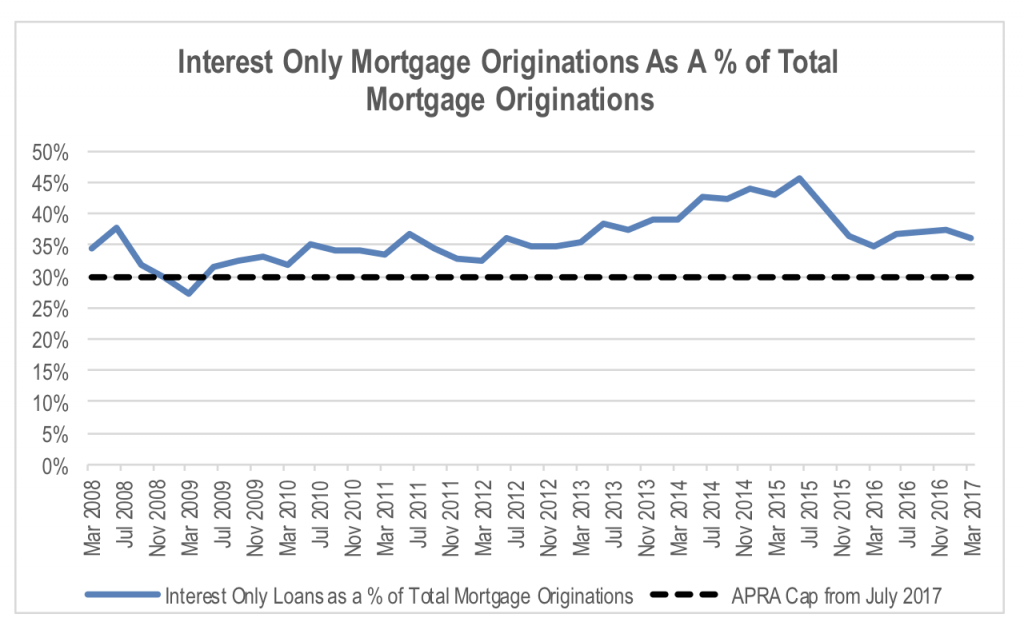

APRA data also shows that the flow of new mortgage originations associated with interest only loans slowed in April to 36% of all mortgage originations. This is down on the peak levels of around 46% from mid 2015, but it remains well above APRA’s recently announced cap of 30%.

What is yet to be determined is whether the restriction on the supply of the interest-only features will reduce the rate of growth in the overall mortgage market, or will it merely see consumers substitute into products with principal and interest features?

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY