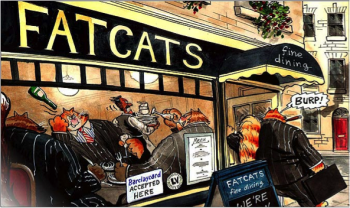

Never too big to fail…

Last week we spent some time reporting on our thoughts regarding the Financial System Inquiry and our interpretation of the submissions we’d read, as well as the possible impact on the competitive landscape for the big banks and their smaller, regional, would-be rivals…

You can watch one of the brief videos here.

Yesterday, our friend Christopher Joye wrote in The Australian Financial Review that the probability of the outcomes we thought likely, had increased.

Here’s a brief summary of the points from Chris’s article noting the changes would not be expected to be implemented for five years:

- Recommendations are yet to be finalised, but interviews with sources close to the inquiry revealed it will recommend the four major banks substantially increase their “common equity tier-one capital” buffer to compensate for the lower funding costs they receive because investors perceive them as “too big to fail”.

- The Financial System Inquiry is also preparing to impose a minimum “floor” on the “risk-weightings” the major banks apply to their home loans, which will create a more level playing field for competitors.

- The Financial Reviewunderstands the Murray Inquiry’s final report may call for an increase in the common equity tier-one capital buffer for the large banks from 1 per cent to 2 or 3 per cent. It is also likely to recommend a minimum risk-weighting floor on home loans of 20 per cent.

- Non-major banks now have minimum 35 per cent risk weightings applied to home loans, but the majors have no minimum, which has left them with much lower average risk-weightings of 18 per cent, according to APRA. This means the majors hold less than half the capital, more than twice the leverage and can, in theory, generate double the returns of competitors.

- Analysis published by Morgan Stanley and UBS suggests an increase in the majors’ too-big-to-fail equity buffer from 1 per cent to 2 per cent, combined with a new 20 per cent risk-weighting floor, would result in about a $24 billion deficiency in equity capital. The banks would, however, have until 2019 to implement the changes.

You can read the full article here.