NAB – Australian Business Conditions at a 4 Year Low

National Australia Bank’s monthly survey for July 2013 is pointing to business conditions being at their lowest level since May 2009.

Conditions are particularly bad in Manufacturing, and again we question which Sectors will pick up the slack from the slowdown in the Energy and Resources area.

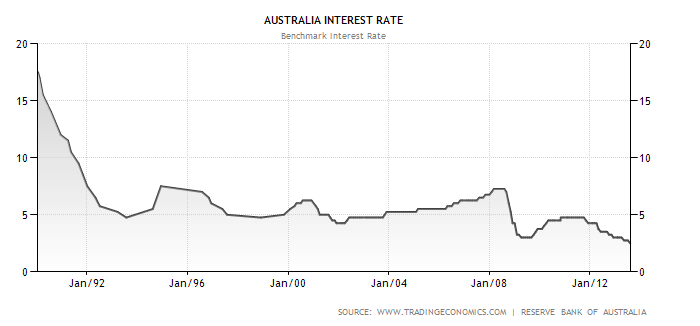

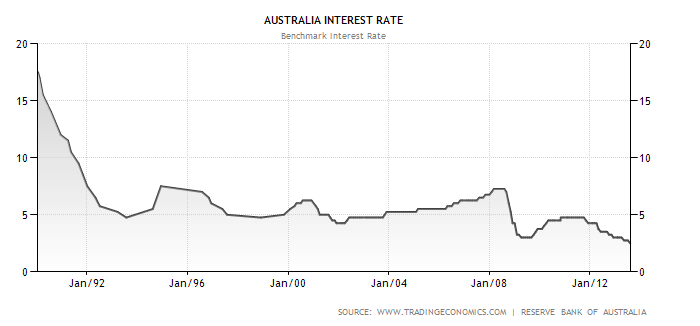

NAB’s Alan Oster believes GDP growth is softening to 2.2 per cent for 2013 and said, “when combined with still low rates of inflation, we expect another RBA cut (from the current multi-decade low of 2.5 per cent), probably in November”.

Meanwhile, the Pre-Election Economic and Fiscal Outlook (PEFO) confirmed a budget deficit forecast of $30b for F’14 and $24b for F’15.

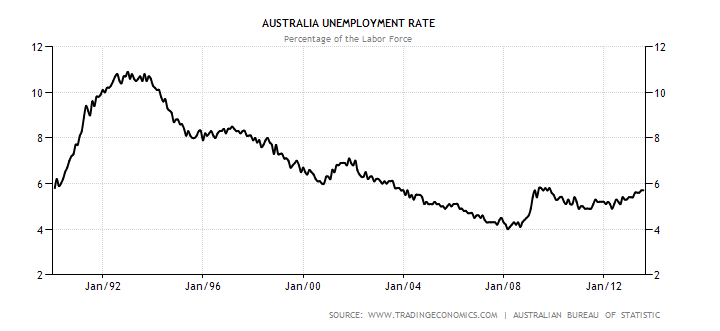

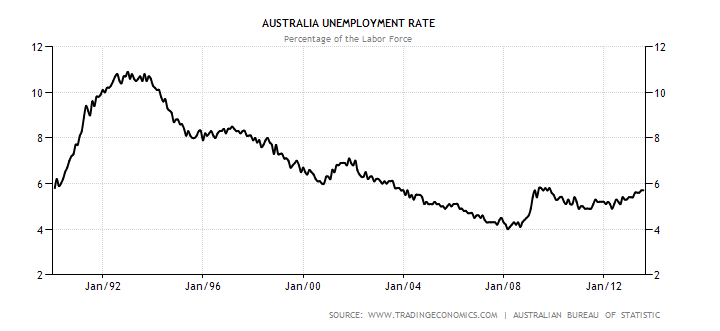

Unemployment is expected to hit 6.25 per cent in each of these two financial years, up from 4.0 per cent in early 2008.

As you know Montgomery is focused very much on individual businesses. If it isn’t going to affect the number of $2 buckets sold at The Reject Shop it really doesn’t get much headway at the office. Economic conditions in Australia however do affect some businesses more than others so it’s vital that we consider which businesses will be affected and when.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.