My…Err?

Investors don’t have to have astronomic IQ’s and be able to dissect the entrails of a million microcap startups to do well. You only need to be able to avoid the disasters.

In an oft-quoted statistic, after you lose 50% of your funds, you have to make 100% return on the remaining capital just to get back to break even. This is the simple reasoning behind Buffett’s two rules of investing. Rule number 1 don’t lose money (a reference to permanent capital impairment) and Rule Number 2) Don’t forget rule number 1! Its also the premise behind the reason why built Skaffold.

Avoiding those companies that will permanently impair your wealth either by a) sticking to high quality, b) avoiding low quality or c) getting out when the facts change, can help ensure your portfolio is protected. Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.

Think about it; How many businesses owners would speak about their business in those terms? “Hi my name is Dave. I own an online condiments aggregator – ‘its a high yielding business that pays a fully franked yield’. You will NEVER hear that from a business owner. That only comes from the stock market and from those who have never owned or run a business.

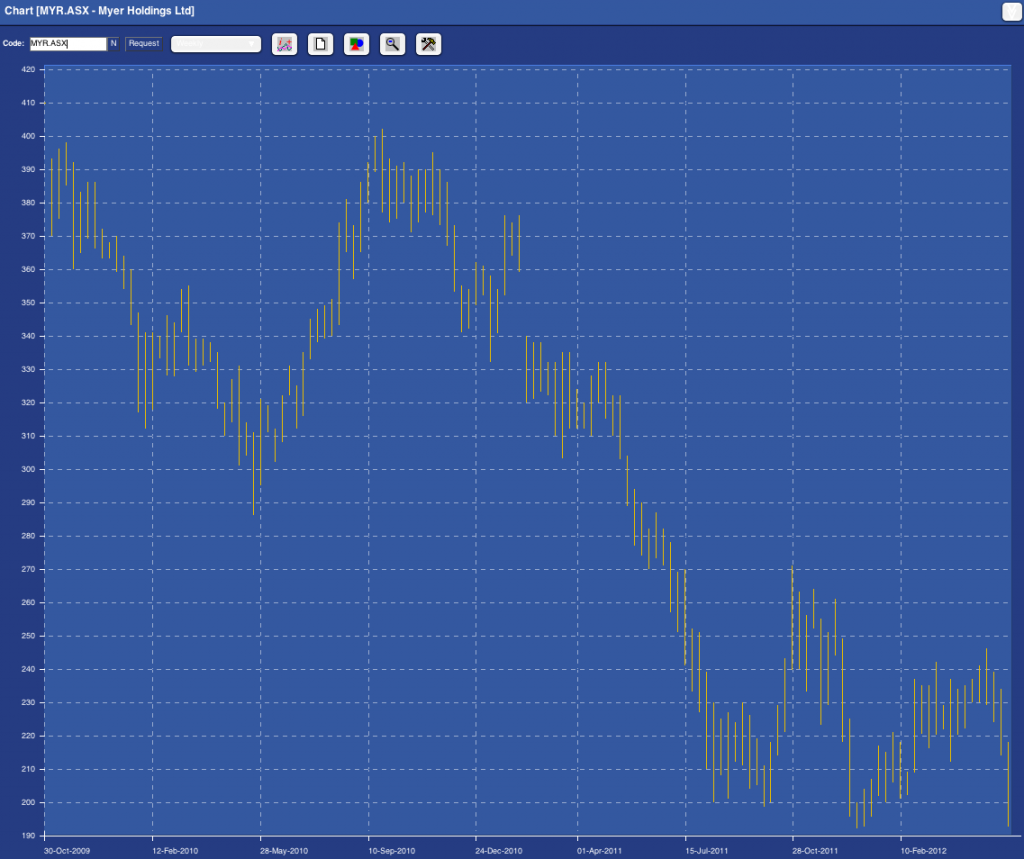

They key is not to think about stocks or talk stock jargon. Just focus on the business. Thats what we did when Myer floated in 2009. And with the market value of Myer now 50% lower than the heady days of its float, it might be instructive to revisit the column I wrote back on 30 September 2009, when I reviewed the Myer Float.

And sure, you can say that the slump in retail is the reason for the slump in the share price of Myer (I am certainy one who believes that the dearth of really high quality companies means multi billion dollar fund managers are bereft of choice meaning that a recovery in the market will make all stocks rise – not because they are worth more but because fund managers have nothing else to buy). But the whole point of value investing is to make the purchase price so cheap that even if the worst case scenario transpires, you are left with an attractive return.

It would be equally instructive to review the reason why we didn’t buy the things that subsequently went well (QRN comes to mind) so we’ll leave that for a later date.

Here’s the column from September 2009:

“PORTFOLIO POINT: The enthusiasm surrounding the Myer float is good reason for a value investor to stay clear. So is the expected price.

With more than 140,000 investors registering for the IPO prospectus, everyone wants to know whether the float of the Myer department store group will be attractive. This week I want to focus exclusively on this historic offer.

At present it is suggested the stock will begin trading somewhere between $3.90 and $4.90.

The prospect of a stag profit draws a self-fulfilling crowd. But if chasing stag profits is your game, I would rather be your broker than your business partner, for history is littered with the remains of the enthusiasm surrounding popular large floats.

Popularity, you see, is not the investment bedfellow of a bargain and being interested in stocks when everyone else is does not lead to great returns. You cannot expect to buy what is popular, travel in the same direction as lemmings and generate extraordinary results. Conversely thumb-sucking produces equally unattractive returns.

Faced with these truisms, I lever my Myer One card, obtain a prospectus and open it for you.

The Myer float is one of the hottest of the year and I am not referring to the cover adorned by Jennifer Hawkins! If those 146,000 people who have apparently registered for a Myer prospectus were to invest just $20,000 at the requested price, the vendors will have their $2.8 billion plus the $100 million in float fees in the bag.

A word about the analysis: It is the same analysis I have used to buy The Reject Shop at $2.40 (today’s close $13.35), JB Hi-Fi at $8 ($19.86), Fleetwood at $3.50 ($8.75), to sell my Platinum Asset Management shares at more than $8 on the morning they listed (at $5), and to warn investors to get out of ABC Learning at $8 (they were 54¢ when ABC delisted in August 2008) and Eureka Report subscribers to get out of Wesfarmers as it acquired Coles.

I don’t list these to boast but merely to demonstrate the efficacy of the analysis; analysis that is equally applicable to existing issues and new ones.

By way of background, TPG/Newbridge and the Myer Family acquired Myer for $1.4 billion three years ago. They copped flack for paying too much, but “only” used $400 million of their own capital; the remainder was debt. Before the first anniversary, the Bourke Street, Melbourne, store was sold for $600 million and a clearance sale reduced inventory and netted $160 million. The excess cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. Within a year the owners had recouped their capital and obtained a free ride on a business with $3 billion of revenue. Good work and smart.

But I am not being invited to pay $1.4 billion, which was 8.5 times EBIT. I am being asked to pay up to $2.9 billion, or more than 11 times forecast EBIT. And given the free “carry”, the bulk of the money raised will go to the vendors while I replace them as owners. Ownership is a very good incentive to drive the performance of individuals.

And driven they have been. In three years, $400 million has been spent on supply chain and IT improvements, eight distribution centres have been reduced to four and supply-chain costs have fallen 45%. Amid relatively stable gross profit margins, EBIT margins improvement to 7.2% and a forecast 7.8% reflect disciplined cost identification and management. Fifteen more stores are planned for the next five years and the prospectus notes that trading performance improved significantly in the second half of 2009 and into the first half of 2010. The key individuals have indeed performed impressively, but with less skin in the game they may not be incentivised as owners in future years as they have been in the past.

And what value have all these improvements created? The vendors would like to believe about $1.4 billion, and if the market is willing to pay them that price, they will have been vindicated, but price is not value and I am interested simply in buying things for less than what they are worth.

In estimating an intrinsic value for Myer, I will leave aside the fact that the balance sheet contains $350 million of purchased goodwill and $128 million of capitalised software costs. This latter item is allowed by accounting standards but results in accounts that don’t reflect economic reality. Historical pre-tax profits have thus been inflated.

I will also leave aside the fact that the 2009 numbers and 2010 forecasts have also been impacted by a number of adjustments, including the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”; the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business; costs associated with the gifting of shares to employees; and, most interestingly, the reversal of a write-off of $21 million in capitalised interest costs – all regarded as non-recurring.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75% fully franked payout, we arrive at an owners’ return on equity of about 28% on the stated equity of $738 million, equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13% required return, I get a valuation of $2.90.

Looking at it another, albeit simplistic way, I am buying $738 million of equity that is generating 28%. If I pay the requested $2.9 billion for that equity or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on “my” equity of 7.2%. For my money, it’s just not high enough for the risk of being in business.

Importantly, the return on equity – based on the simple assumptions that three stores, each generating $40 million in sales will be opened annually over the next five years and that borrowings will decline by $60 million in each of those years – should be maintained. But the end result is that the valuation only rises by 6% per year over the next five years and delivers a value in 2015 of $3.90: the price being asked today.

My piece of Myer seems a bit hot for My money.”

That was 2009. Has anything really changed? Has the following chart reveals. Myer is now trading at close to Skaffold’s current estimate of its intrinsic value. Before you get too excited (although the shortage of large listed high quality retailers means even this company’s shares may go up in a market or economy recovery) take a look at the pattern of intrinsic values in the past and the currently anticipated path of forecast intrinsic values; Past intrinsic values have been declining (generally undesirable unless forecasts for a recovery are correct) and forecast intrinsic values are flat.

Fig.1. Skaffold Myer Intrinsic Value Line

And as the Capital History chart reveals, 2014 profits are not expected to be better than 2010. That 4 years without profit growth. Question: Would you buy an unlisted business (as a going concern) that was not forecasting profit growth for four years?

Fig. 2. Skaffold Myer Capital History Chart

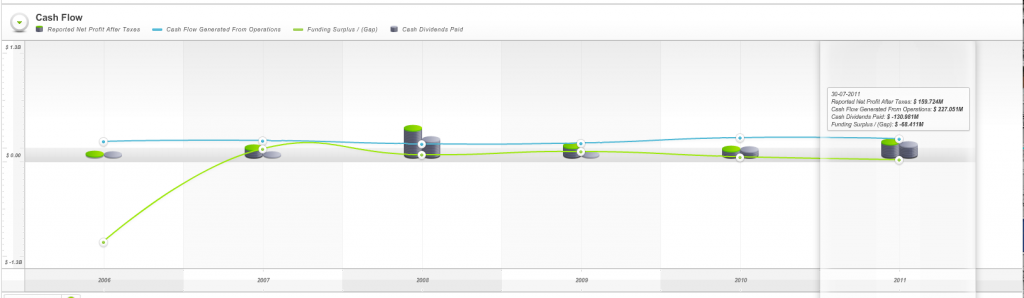

Finally the cash flow chart reveals the company has produced what Skaffold refers to as a Funding Gap. Its cash from operations have not been enough to cover the investments it has made in others or itself plus the dividends it has paid. In other words for 2010 and 2011, the two financial years it has registered as a listed company, it appears from Skaffold’s data that the company has had to dip into either 1) its own bank account, or 2) borrow more money or 3) raise capital (the three sources of funds available if a funding gap is produced) to cover this “gap”.

Fig. 3. Skaffold Myer Cash Flow Chart

I’d be interested to know if you are a loyal Myer shopper or not and why? If you don’t shop at Myer, why not? If you do shop at Myer, what do you like about the company, its stores and the experience? And I am particularly interested to hear from anyone who DOES NOT shop there but DOES own the stock!

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

Hi Roger,

You say…

“Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.”

No argument from me.

Then what may happen is, despite not being able to afford to, the company may maintain or increase it’s dividend through the use of borrowings. And if the stock price has also since halved, it may then get spruiked as some type of “mega yielding” stock that is too good to pass up.

One or two examples quickly come to mind.

Regards,

Craig.

Yes they do Craig. Good point!

Hasties problems came about by a severe rush of blood to the head.

They set their sights too high and too fast, wanting to take on the world and covering many bases then bad management of finances.

WIthout nominating any particular company, I would not be surprised to discover that some founders may believe that an IPO is a ticket to rapid expansion and then set about implementing strategies on the back of that belief. Capital allocation is a very important but widely under appreciated skill.

As pertinent, important and relevant as any article has ever been to the ill-informed investor, the only disappointment with this article is that it will never make the front page of a newspaper to inform the masses – way too logical to make any ‘funny’ money.

Appreciate the compliment Mark.

I bought a hybrid at $30 per security ($100 issue price) which is now priced at $90. It is paying a fully franked dividend of $6 per security. Ignoring the franking I am receiving either a 20% yield on my original investment or a 6.7% yield on the current price.

Which is the appropriate way to measure the return?

If I don’t think the price will increase i.e. the security has reached the estimate of intrinsic value should I sell my holdings and invest the $90 less tax in something else that is undervalued or take the 20% yield.

I believe its relevant to compare your market value post tax (and the return that would produce) to the market return you are receiving now (on the current market value).

David,

No advice but when I find a 3 bagger and it gets to it’s value I sell,

Particularly, If their are better options elsewhere. Which may be cash as Hybrids will get smashed if Euro explodes.

Worry about the ATO later,

Cheers

It is funny that the myer announcement which has caused people to look at the float again came at the same time as the Facebook float as i think there ar some similarities. Well publicised and hyped float priced as high as they can to allow the sellers to get the best return possible and the people who bought into it not getting what they hoped for when it started trading.

Out of the two major fashion retailers my money has always been on David Jones rather than Myer due to their more clear cut brand position rather than Myers. Although lately as i have increased my education i have to say i am a bit dissapointed in DJ’s and someone needs to ask the management what they have been doing for the last 5 years? Why are they only moving seriously into online now? But thats a discussion for another day.

I have never been a fan of Myer as a stock and not surprised at the performance so far.

I like to refer to them as “stuck in the middle”. They can’t offer a serious challenge to DJ’s as the “luxury” department store and they are too expensive for the middle end. This leads to no real competitive advantage in my opinion as there is no differentiating factor that would make them come into your mind as the first place to look for something.

The fashion brands that they stock just do not have the pulling power of the brands at DJ’s and Myer seems to know this as they decided to pay around $48 million for a slice of ownership in Sass and Bide. Have to say i thought this was an absolute crazy amount but was a desperate attempt to buy some credibility.

When products do match what is available at competitors Myer usually comes out behind (especially at the electronics section) and in other situations they offer things at the same price as the competitorsd but the problem being that people will likely go to the competitors first.

The in store experience also i believe fails. Niether Dj’s or Myer are particularly good at the service level but finding people in Myer seems to be harder than DJ’s. I have to say that their stores always seem to be a bit more sterile than DJ’s which is usually a bit more vibrant.

I noted with interest at some visits to the local shopping mall with my wife in January/February (and there for sale time). Myer was a ghost town, in this very big store the staff appeared to outnumber the shoppers which is saying something for Myer. Also having half the lights on also made it seem even more like finding a lost city. David Jones was still pretty active. I also see that everytime since i have been to Myer that they have had some type of sale.

It does appear to be wall-to-wall year round sales for Myer which means price discounting which means a backlog of inventory or sales with a drop in margins and i believe it to be the latter option. I read a quote from the CEO saying that the average basket size has remained the same at around $80 but there are less people buying stuff so reduced volume.

As the above shows, i can’t seem to find any real element where Myer comes out ahead from a business perspective.

None of the above to me makes a compelling investment case to me.

This is not about Myer, but look at Hastie, which collapsed. From Skaffold you can see that you’d avoid that like the plague.

i agree, they do not paint a pretty picture. I usually will have a look at the annual reports from these companies to learn more about what to look for to avoid. As mentioned in this article, your aim should be to simply stay away from bad businesses so therefore I like to know all the ways bad businesses may look.

In the annual report i found the following clause:

“INDEMNIFICATION OF OFFICERS AND AUDITORS

During the financial period ended 30 June 2011, the company paid a premium in respect of a contract insuring the directors of the company (as named above), the company secretary, and all executive officers of the company and of any related body corporate against a liability incurred as such a director, secretary or executive officer to the extent permitted by the Corporations Act 2001(Cth). The contract of insurance prohibits disclosure of the nature of the liability and the amount of the premium. The company has not otherwise, during or since the financial period, indemnified or agreed to indemnify an officer or auditor of the company or of any related body corporate against a liability incurred as such an officer or auditor”

I couldn’t see a similar clause in the Woolworths Annual Report. Considering the circumstances this stood out to me as a big potential red flag. Am i right to have seen this as a potential red flag to investors or is this just normal business practice?

Hi Andrew,

D&O insurance is standard.

Thanks Roger, i thought that might be the case. If it wasn’t for the circumstances around Hastie i would have probably glossed over it. Thanks for the clarification.