HOW MUCH PERSONAL CREDIT IS OUT THERE?

Recent data shows a continuing decline in new and outstanding personal credit. This is a concern for our retailers, as it means Australians are taking on less debt for spending on discretionary items.

Now, with housing credit being tight on the back of the APRA’s tightening and the Royal Commission’s findings of lax lending standards on behalf of lenders, we are likely to see a negative wealth effect as house prices fall.

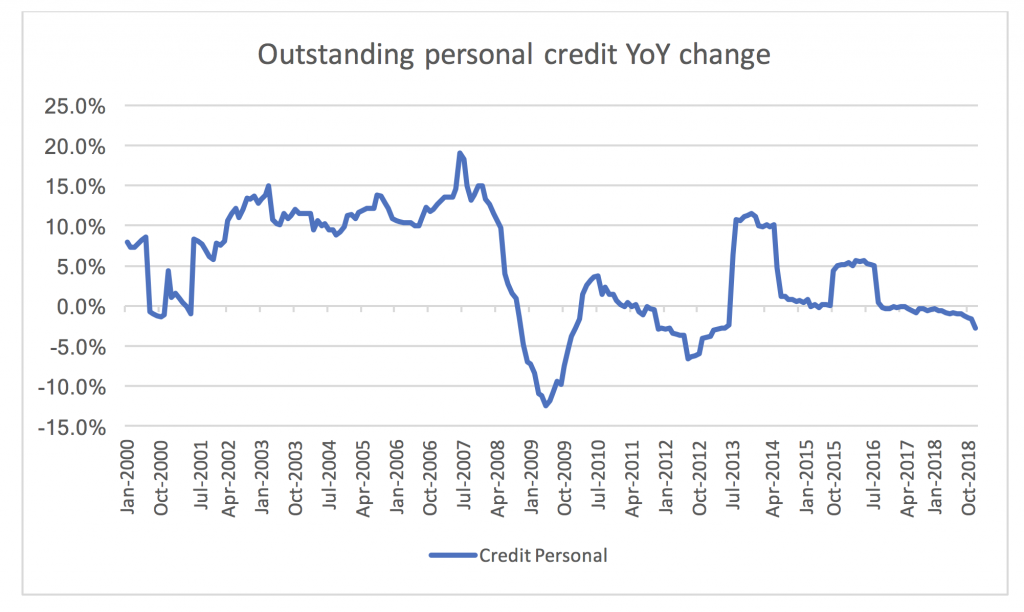

In this environment, I thought it would be interesting to look at the amount of credit that is outstanding outside of housing related loans. This credit includes consumer financing that is not secured on a residential property (either an owner occupier or an investment property) be it credit card debt, car loans or appliance financings etc. We can see the year-over-year (YoY) change in this kind of credit in the chart below.

Source: RBA

There is a lot to say about the long-term amount of credit but let us focus on the last couple of years where we can see that the amount of personal credit has been in decline since October 2016 with an accelerating trend downwards. We should remember that this is in an environment of almost 2 per cent per year population increase and positive (albeit low) inflation meaning that the amount of personal credit in a real term per capita is decreasing even faster.

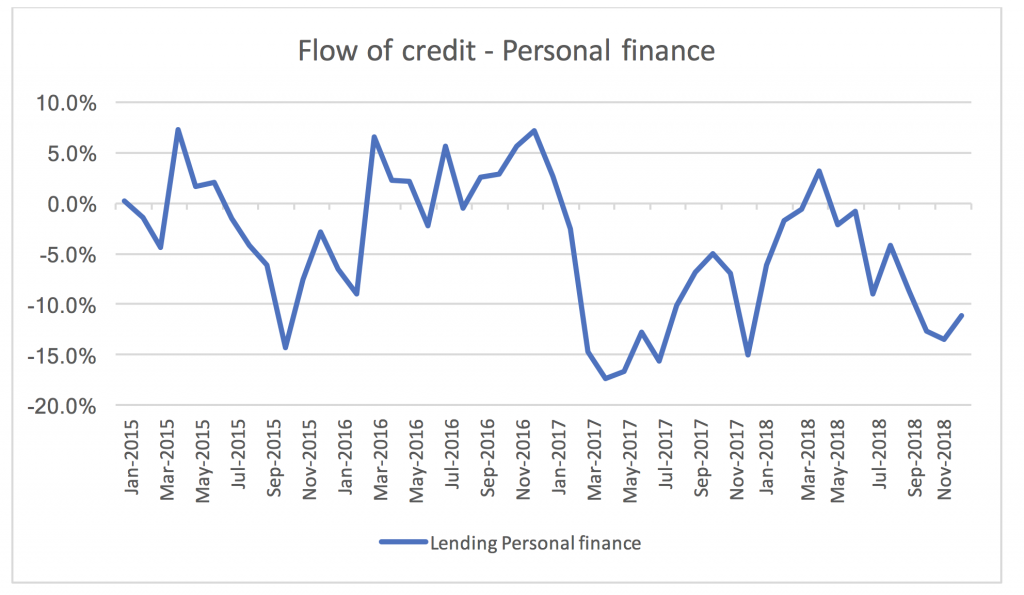

Indeed, if we look at the flow of new money going to personal credit (outstanding balance is determined by new credit issued less the amount repaid), we can see that we are indeed seeing a reduction of new personal credit by more than 10 per cent on a year on year basis currently.

Source: ABS

So what does this mean? As described in previous posts, overall consumer spending is traditionally described as a function of:

- Number of people spending money

- The disposable income of the people spending money and

- The rate for people spending money vs. saving money.

In addition to spending, we can also consider the amount of credit that people take on; as we can see above, the current trends do not look good for overall consumer spending and retail exposed companies.

The caveat is of course that the data does not capture all sources of credit but as it does capture all the major banks and most other financial providers active in Australia, it should give a pretty accurate picture. The one source of credit that is not captured in the data is the buy-now-pay-later type of credit like Afterpay, but given that ASIC found that the total debt outstanding for the players was $903 million and the total fall in personal credit outstanding between now and the peak in December 2015 is about $6 billion, I think it is fair to say that this is not a major factor.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Andreas Lundberg

:

Hi Darren,

It is about $5.7bn in total for December for new lending commitments to households excluding housing (the number for housing is about $27bn).

The debt outstanding is about $150bn excluding mortgages (mortgages are in total about $1.8tr)

Agreed that it should be a good thing for personal balance sheet but it is not a good thing for companies relying on consumers spending. Also worth noting that a fall in new commitments does not necessarily lead to a fall in the total amount outstanding if arrears go up. The total outstanding amount of non-mortgage debt is currently going down by about 2% compared to the same month last year.

I believe it does include Harvey Norman financing as this is generally back to back with a major bank (it is not Harvey Norman that issues the credit) and it should capture all major financial institutions lending. What it does not include is payday lending/cash converters and buy-now-pay-later firms.

darren franklin

:

Andreas do you gave the dollar figures of this debt outstanding..Any reduction in this personal credit has to be a good thing for personal balance sheets. Also does this type of debt includes the likes of harvey norman debt issuance?