Montgomery Q1 2016 Investor Sentiment Survey

Montgomery recently surveyed readers of our insights blog to gather attitudes to investing.

We had nearly 600 responses and you can read the answers to all the questions covered from the link below.

Q1 2016 Investor Sentiment Survey

A couple of interesting observations worth sharing:

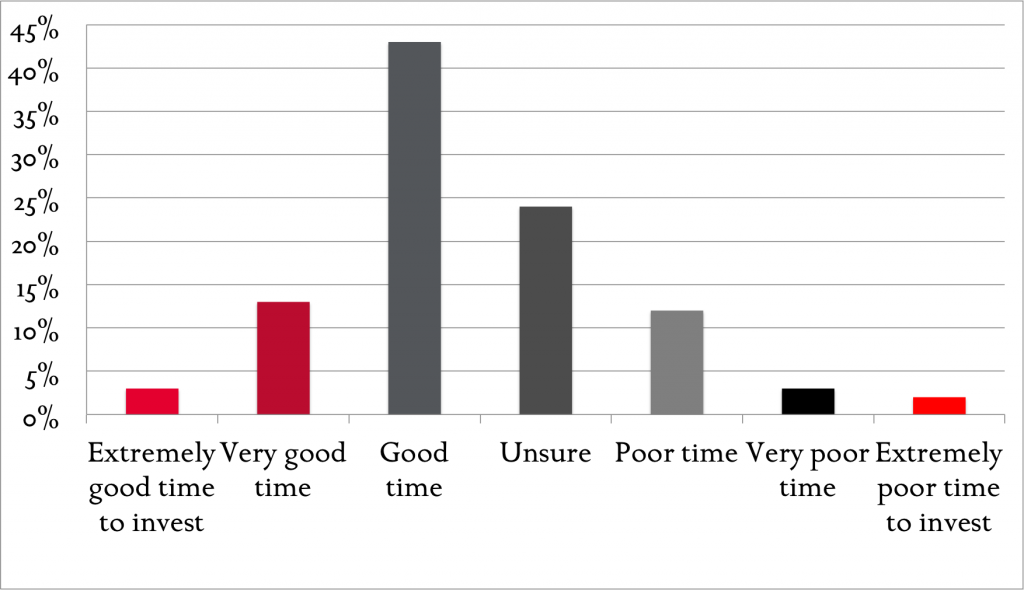

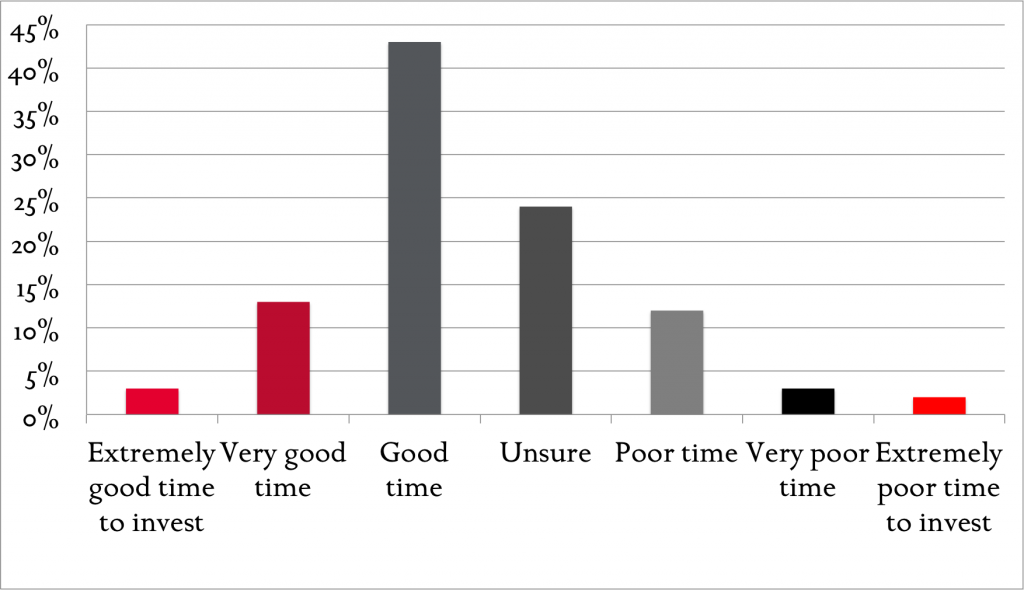

Despite the turbulent start to the year, or perhaps because of that, nearly 60 per cent of Montgomery survey respondents were positive about investing in the Australian market answering now was a good, very good or extremely good time to invest.

Conversely only 17 per cent of investors believed it was a poor, very poor or extremely poor time to be investing locally.

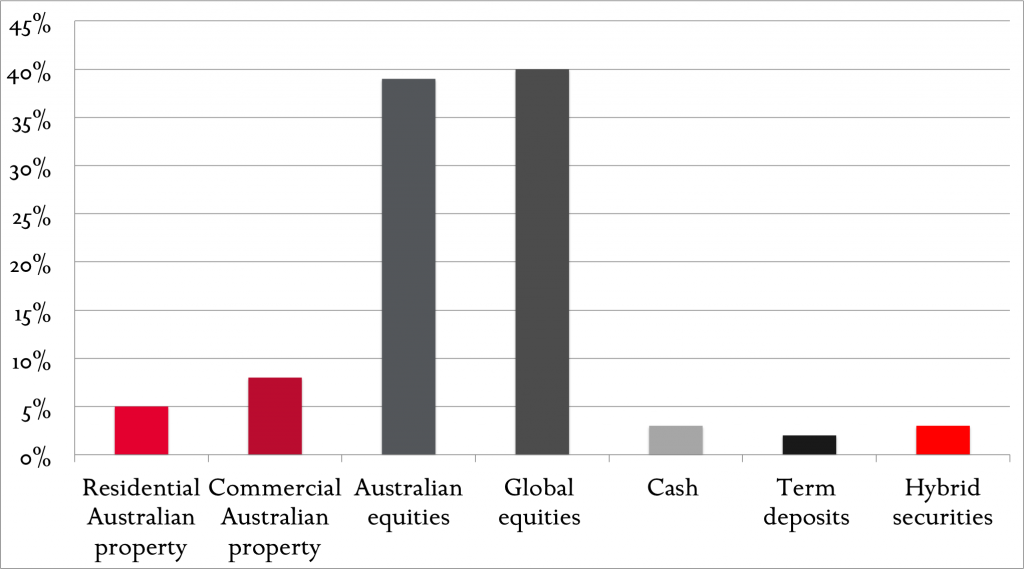

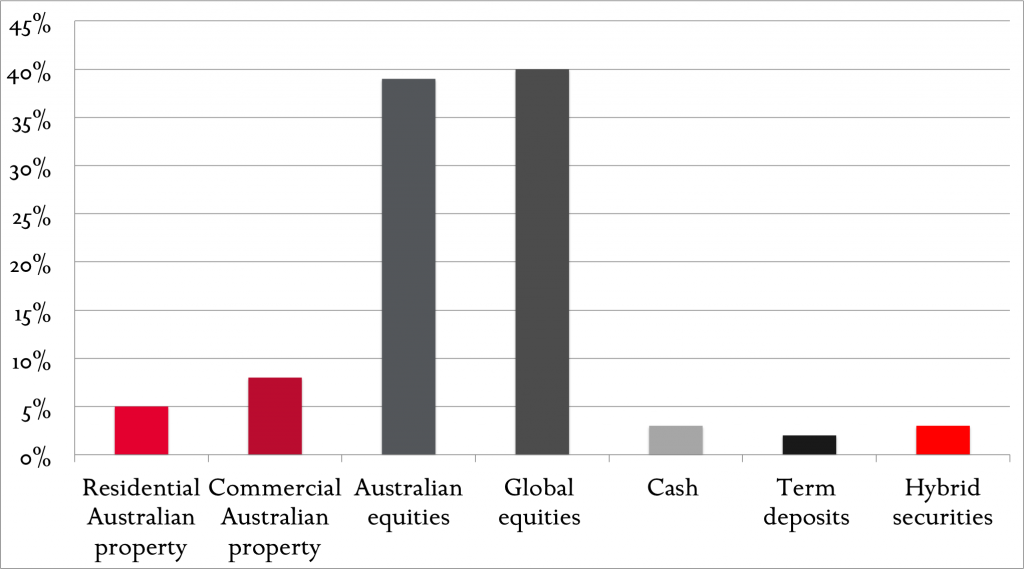

Investors were split on whether the best returns will come from overseas (40%) or domestic equities (39%) over the next three to five years. But overwhelming equities dominate with nearly 80 per cent of respondents believing they would provide the best returns.

Investors were split on whether the best returns will come from overseas (40%) or domestic equities (39%) over the next three to five years. But overwhelming equities dominate with nearly 80 per cent of respondents believing they would provide the best returns. To participate in future surveys and keep up to date with Montgomery insights, please ensure you subscribe to rogermontgomery.com to receive our monthly updates.

To participate in future surveys and keep up to date with Montgomery insights, please ensure you subscribe to rogermontgomery.com to receive our monthly updates.

You can subscribe here.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Investors were split on whether the best returns will come from overseas (40%) or domestic equities (39%) over the next three to five years. But overwhelming equities dominate with nearly 80 per cent of respondents believing they would provide the best returns.

Investors were split on whether the best returns will come from overseas (40%) or domestic equities (39%) over the next three to five years. But overwhelming equities dominate with nearly 80 per cent of respondents believing they would provide the best returns. To participate in future surveys and keep up to date with Montgomery insights, please ensure you subscribe to rogermontgomery.com to receive our monthly updates.

To participate in future surveys and keep up to date with Montgomery insights, please ensure you subscribe to rogermontgomery.com to receive our monthly updates.

Chris

:

Where the question states “through ETFs or LICs”, there is also the option of “index funds”.

An ETF can still be an index fund but an index fund does not necessarily equal an ETF, as they can be unlisted and therefore, are also managed funds (“all red cars are cars, but not all cars are red”). Therefore, it is not quite correct.

There is a degree of ambiguity, but I expect I will be told that I am “over analyzing things”.

Roger Montgomery

:

Correct on both fronts Chris.

Johnny

:

It just shows we are still in the early stage of the current market.