Looking forward to: JB Hi-Fi results

On Thursday, Dick Smith Holdings (ASX: DSH) released a solid quarterly result, revealing a continued period of buoyancy in household electronic goods sales. Whilst we don’t own shares in the business – as we prefer to own the dominant player in any sector – we couldn’t help but take note.

DSH reported positive like-for-like sales in Australia of 2.4 per cent, and are guiding for 3 per cent for the June quarter. Given we are large holders in JB Hi-FI and believe the shares are worth close to $23, this naturally impressed us.

What we take away from DSH’s positive sales experience is that when JBH release their next report (which is likely to occur within the fortnight), they should continue to show improved momentum in both sales and growth. Indeed, if DSH’s 3 per cent like-for-like sales forecast is applied to JBH’s guidance, then an upgrade is likely.

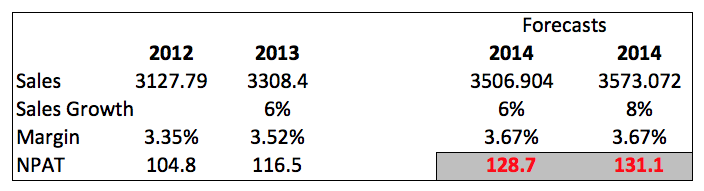

For the first half, JBH reported total sales growth of 6.8 per cent, and same-stores sales growth of 2.8 per cent. Sales were guided to increase anywhere between 6 and 8 per cent on the prior year, with an NPAT range of $126-$129m.

Assuming JBH can hold onto the 15bps improvement in reported underlying margins (which was largely driven by interest cost reductions with only minor business efficiency improvements), ballpark figures for the year ending June 2014 could, in our opinion, look similar to the below:

Given JBH is cycling off a lack of new hardware sales from new Xbox and PS4 (there are 2 million older Xbox360 and PS3 consoles in Australia currently), and only 120k new PS4 and Xbox machines hit Australia over the previous quarter, we are expecting a stock supply to rebound from mid-February. This will benefit software sales (higher margin) in the next 6-12 months, and it is now our expectation that JBH could possibly surprise, if not exceed, the top-end or $131m in NPAT.

Keep an eye for updates from JBH in the coming weeks.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Since announcing the retirement of JBH’s CEO Terry Smart (with CFO Richard Murray to step into the role), JBH has fallen almost 10%.

In the same announcement, JBH announced 3% growth in comparable sales and 5.7% in total consolidated sales growth – and solid growth figures in new HOME stores.

It appears the market has reacted to the CEO’s retirement – but in my opinion JBH is in such a strong position in the market that anyone could successfully manage it.

Current price is hovering around 18.75, quite some margin under the estimated intrinsic value, representing a nice buying opportunity given the quality and growth potential of the business.

Do you share these views or are you aware of another reason for the considerable price fall over the past week?

I think your appraisal of the reason for the share price fall appears correct but it’s not always helpful to try and explain every short term change

Thanks for the update Russell. JBH is always a company i keep an eye on and feel i have a good grasp of it.

I was in my local JB Hi-Fi store over the weekend and have to say that it was quite busy (mainly people looking at DVD’s and computer games). This may have been an extreme as the next day was a public holiday in which most if not all stores were closed so people have no option (weather permitting) but to stay at home and entertain themselves.

In contrast the Dick Smith store directly below JBH (which does seem a bit fitting) was relatively quiet as was the electronics section of Myer. Observations are telling me that JBH’s market position is still one where it is the first choice for consumers and there for i think that any improvement for Dick Smith should be similar if not better for JBH as i have not seen any evidence (albeit small sample) of Dick Smith taking away market share.

Also worth mentioning, if i wanted to buy the 3rd series of Rake on DVD I basically had two options. Go to the ABC store (approx $48) or go to JBH (approx $39). This is obviously a pretty significant price advantage.

Look forward to hearing more.

As we recently discussed on TV, JBH commands the dominant share of mind.