Looking at: JB Hi-Fi’s pre-half-yearly report

We’ve recently experienced a rash of downgrades to market expectations: including Super Retail Group (SUL) and The Reject Shop Limited (TRS), along with poor showings from US electronics retailers and the material decline to the share price of JB Hi-Fi Limited (JBH).

Local investor-selling and US hedge fund shorting after a poor announcement by Best Buy Co. Inc., served to push the price of JB Hi-Fi shares down 18 per cent in ten trading days, from $22 to $18 per share.

As we mentioned last week, not all retailers can be tarred with the same brush. Extrapolating Best Buy’s, SUL’s or TRS’s poor trading experiences directly onto peers is, in our opinion, a risky strategy. And while for a time it worked by pushing sentiment negative, a positive trading update by JBH in response to the price volatility quickly polarised the market and arrested the decline.

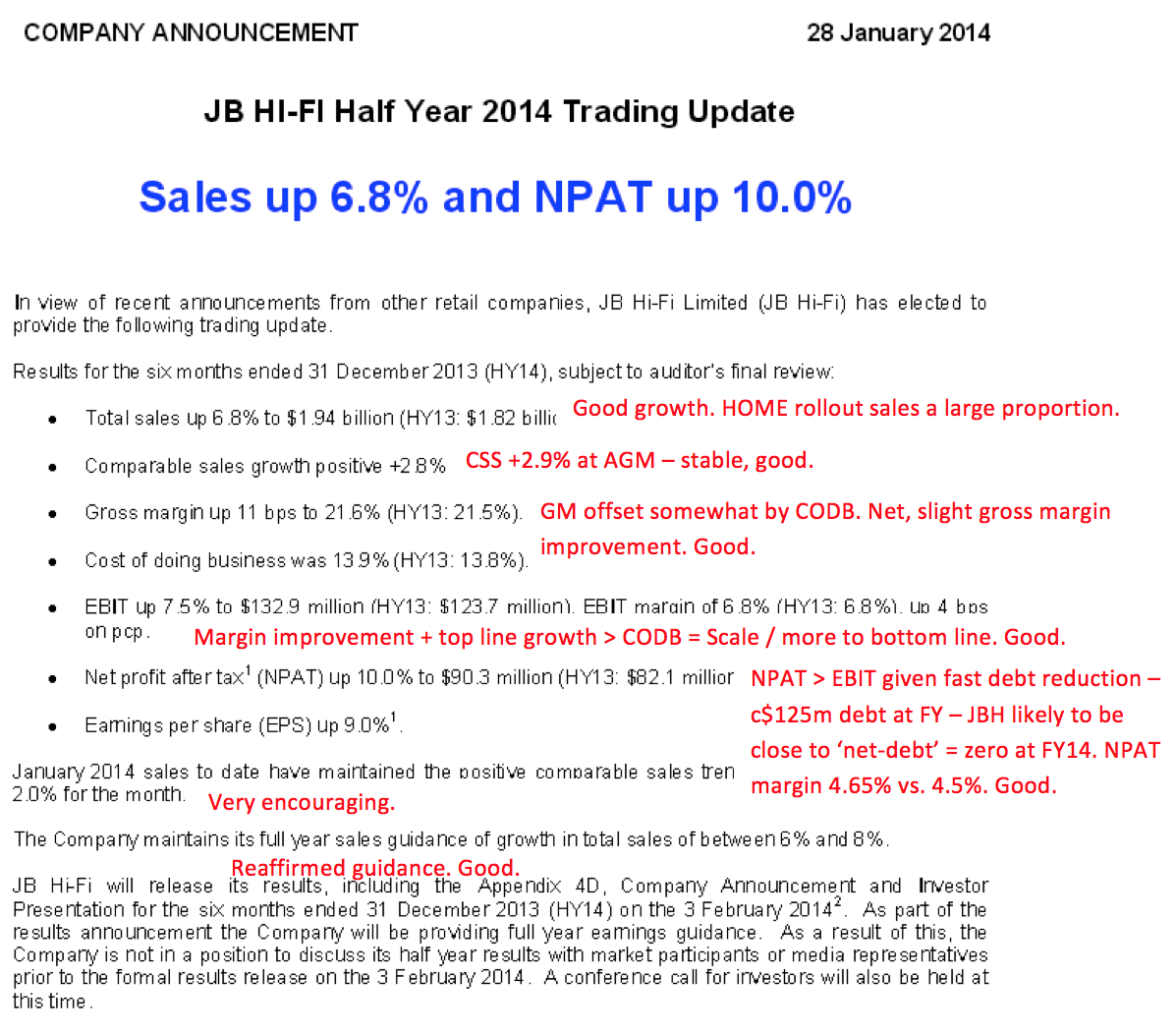

Below is their announcement, and some of our related thoughts:

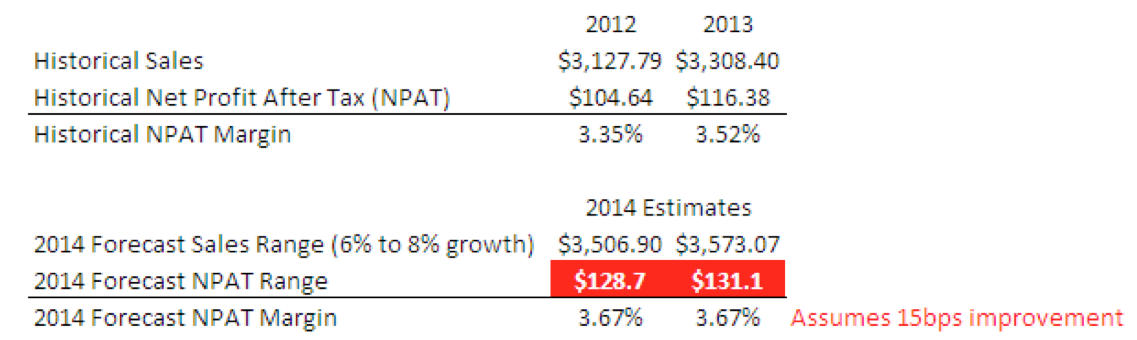

From these few lines, JBH effectively pre-released their half-year report, that’s due the following week. Armed with this knowledge, we put together our own forecast for earnings with one main assumption – that they can hold the 15 basis points in net profit after tax (NPAT) margin improvement into the full year.

Because the margin improvement year-to-date is largely due to lower interest expenses, and with the business continuing to throw off free cash flow and looking likely to rid themselves of debt in time for their full-year result, they should hold onto the 15 basis points (all else remaining equal).

With further interest cost reductions, coupled with gross margins on the rise and a 6-8 per cent sales growth guidance, we forecasted an NPAT range of $128.7 to $131.1 million, as evidenced below.

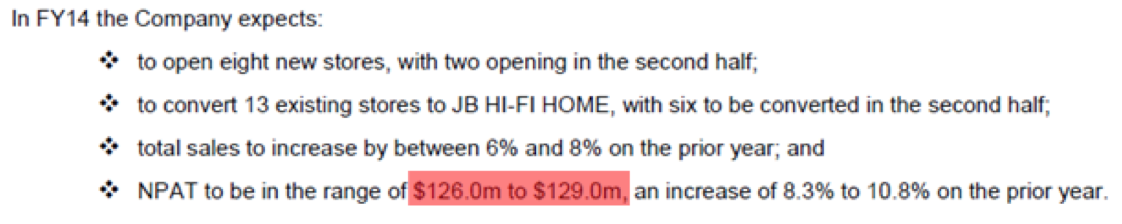

Owing to the benefit of hindsight, this has tied in with management’s actual forecast for 2014 almost perfectly:

Having adopted our forecast range and after applying modest earnings growth assumptions in outer years, we derived a valuation of JBH of around $22 per share. And as the shares continue to fall, The Montgomery [Private] Fund was a recent acquirer, so please continue to shop there.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

David Swift

:

Hi Roger,

I wonder if you would care to comment one day on the financial prophets like Harry S Dent, who continue to sell books despite their poor record of predicting anything correctly. I know you think prediction is a mug’s game. Do you think the reason for their success is our desire for certainty in an uncertain world?

David Swift Perth WA

Roger Montgomery

:

They key to successful forecasting is to forecast often. Shock and gossip etc sells!

Greg McLennan

:

I received an email from JBH yesterday regarding a move they are making into the whitegoods area. If they can sell fridges and washing machines like they do DVDs and games they’ll cause a lot of pain for competitors.

Good news though if you’ve got a new house to furnish.

Roger Montgomery

:

Thanks Greg.

Ronald Ju-Chiang peng

:

I liked the line by line ‘explanations’ that were simple & very easy to understand.

I wonder how long it took you guys BUT hope to see a few more stocks ‘explained the same way.

Thanks very much.

Norman taralrud-bay

:

Teaser headline gives the exactly opposite impression to the conclusion, which was telegraphed thankfully to subscribers. This is a rather mean way of promoting what is an excellent service and a very well -performing investment management business.

Roger Montgomery

:

Will look into it.

Daniel Rosenthal

:

I have sent a multitude of messages regarding SIV and the downgrade of earnings within the gogetta divison…Could someone please shed some light on this situation and whether you guys still have any in the fund? I find it bizarre how a company held in such high regard by the Montgomery team has all of a sudden disappeared off the radar without a wimpier.

Thanking you in anticipation

Daniel

Roger Montgomery

:

Sold a long time ago.