Looking at Ansell’s Long Term Incentive Plan

Upon examining Ansell’s (ASX:ANN) Long Term Incentive Plan for management, we have noticed some interesting developments in the company’s capital position.

When Ansell appointed a new Managing Director in 2010, the following Long-Term Incentive Plan was implemented, as specified in the company’s FY10 Annual Report:

- …The Managing Director and Chief Executive Officer will … be allocated 129,730 performance rights pursuant to the CEO Special Long-Term Incentive Plan …

- The rights will be granted in two tranches, with 20 per cent of the total allocation to vest at the completion of four years (30 June 2014) and the balance of 80 per cent to vest after five years (30 June 2015). In addition to the applicable service condition, the rights are also subject to a performance condition.

- The applicable performance condition is that Ansell’s Return on Equity (ROE) in each of financial years 2014 and 2015 much equal at least 1.5 times Ansell’s Weighted Average Cost of Capital. The Board has selected this performance target as the Board believes ROE to be a strong long-term measure of performance based on capital employed in the business which should translate to an appropriate level of return for shareholders.

We at Montgomery also agree that Return on Equity is an appropriate measure of long-term performance for a business. Yet we question the appropriateness of the Weighted Average Cost of Capital (WACC) as a benchmark. Those familiar with financial metrics may have already identified an inconsistency with this approach.

Comparing ROE to WACC is a bit like comparing apples to oranges. It turns out that when a business takes on debt, its WACC should decrease because debt financing is typically cheaper than equity financing. What’s more, the Return on Equity should increase if the company uses debt to fund acquisitions or expansion. This dynamic is illustrated in the diagram below:

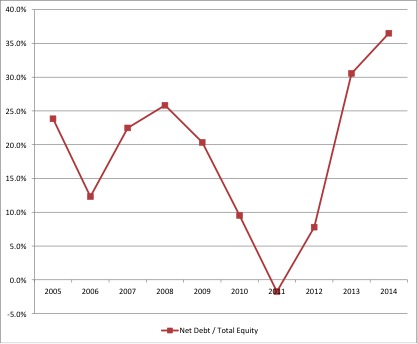

As you can see, Ansell’s Long Term Incentive Plan could encourage management to increase leverage in the business. But higher leverage does not necessarily translate to higher value for shareholders.

With this in mind, it’s interesting to observe how Ansell’s capital structure has changed since FY10. Ansell has a made a number of large acquisitions in recent years that have involved debt financing. This has resulted in considerably higher leverage as the company enters the key vesting periods for the performance rights.

It’s important to note that we’re not commenting on whether these acquisitions have added or detracted value from the company. We are also not claiming that a causal relationship exists between Ansell’s leverage and management’s incentive plan. We simply find the developments interesting.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

How about this remuneration plan:

CEO saves up some of their own money and buys shares in the company. Not only does the CEO then win and lose at the same rate as the regular shareholders, it shows they’ve got their own budget & savings in order (and therefore might be better suited to manage the companies)

Sadly too frequently this is a novel concept to remuneration committees

It would not surprise me. Remuneration of Management and Directors in general seems unusually generous and not in the best interest of shareholders. Not much a small investor can do, but why do institutional investors support it at the AGMs?

Such a basic misunderstanding of corporate finance is simply unforgivable. I wish it was an isolated instance, but I have seen a few examples of this type of apples / oranges approach to KPIs in Australian listed companies beyond just Ansell. Surely this is a case of management outsmarting the oldies on the Board?!

I like that companies are thinking about performance in ways such as the above but think that Ansell has mixed and matched or compared apples with oranges so to say.

If you want to use ROE than i think you should be using the cost of equity as your benchmark whereas ROC is the better measure to compare against WACC.

As you say, the WACC tends to be get lower when debt makes up more of a company’s capital structure and there for sets a lower hurdle. This is particularly so as financial leverage will increase the ROE at the same time.

On the other hand, at least in my experience, the cost of equity will increase as debt is taken on which should at least partly offset the effect the increased debt is having on ROE. There for you are measuring the return to shareholders against the expected or minimum return to shareholders.

I think the setting of performance hurdles really needs to be looked at by the market as it can greatly impact the behaviour of management. Not surprised to see the changes in capital structure over this time as it seems like the most logical outcome from this particular hurdle. Where as if you said ROE>1.5 x cost of equity, firstly it is less likely the hurdle will be reached but the manager would need to really ensure they only acted on shareholder value increasing actions which is the way it should be.

This post raises some interesting questions that Ansell share holders might want to ask at their next AGM.

Thanks Ben, interesting relationship indeed.

I understand the cost of debt, which is the interest that must be paid to the debt provider. What is the cost of equity (9%) in your WACC formulae? equity is injected into the business by raising capital, for example. But how is the cost of it worked out? It does not appear in the company’s statutory accounts, i.e. no tax deductibility, etc… like interest cost.

Regards,

Yavuz

Hi Yavuz,

Loosely speaking, the cost of equity is simply the return required or expected by the shareholder for investing in the companies shares. You won’t find it in the financial statements. There are many ways of calculating it and would not be uncommon for people to have different figures. As is the case with equity investment and valuation, there can be a few subjective inputs that will lead to differences of opinion.

The most common way is the CAPM but others such as the arbitrage pricing model exist but we will keep it simple and focus on the CAPM.

the CAPM states that the cost of equity is equal the risk free rate plus the beta of the stock multiplied by the market risk premium. I am sure if you google CAPM you will find lots of info on it.

If i do a really quick calculation for Ansell using historical figures and a beta pulled from Morningstar (this is not how i specifically do it in practice) i get a cost of equity for Ansell of 9.58%.

Not sure how Ben calcualtes it personally but the above is a brief snapshot and very similar obviously to the companies ROE. If Ansell used the cost of equity as a benchmark (which i feel is correct) the managers would not have received their performance bonus.

However, if you assume that the cost of debt and equity do not change regardless of the capital structure (unlikely but for simplicity) and the firms ROE stays constant as well then the CEO and MD can artificially lower their benchmark for their performance rights by taking on more debt as the WACC will trend towards the lower cost of debt.