Looking across the earnings valley

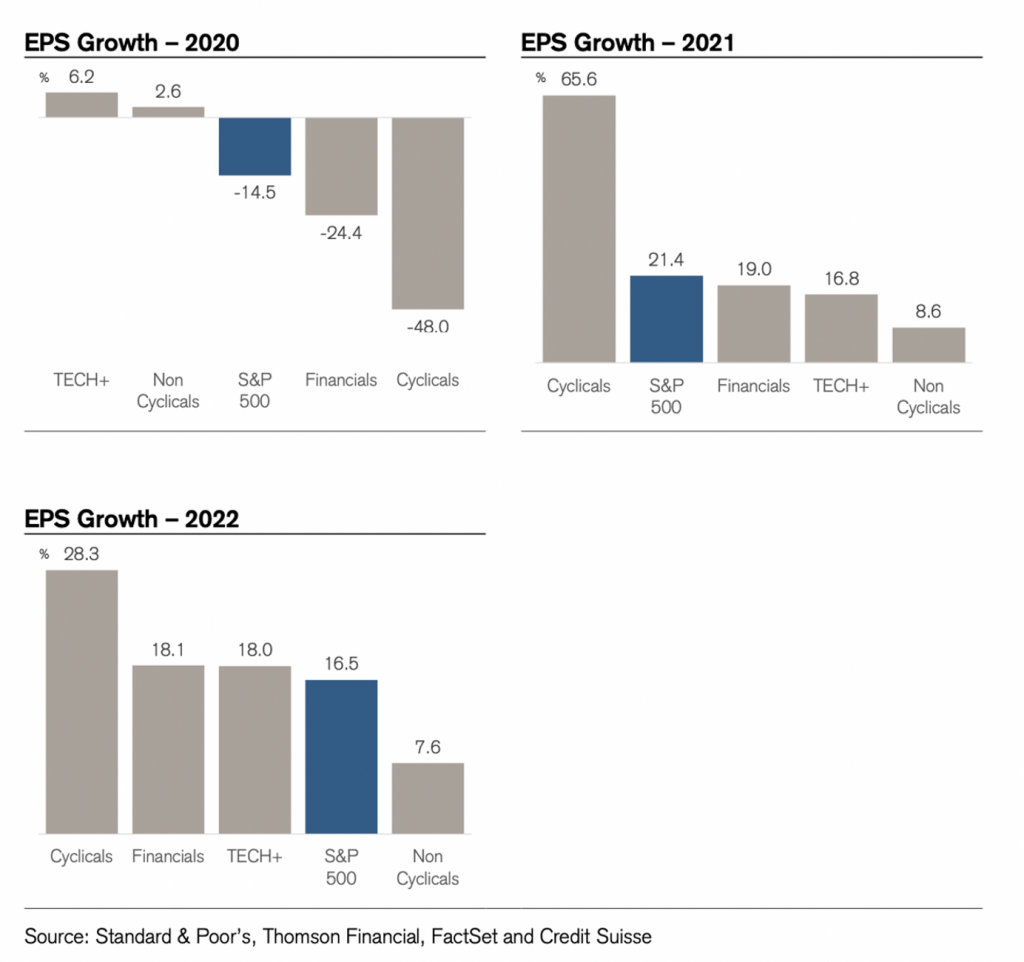

Those companies which record the largest retreat in profitability during a recession often see the biggest rebounds in subsequent years. Company reports and consensus Earning Per Share (EPS) estimates for the US S&P500 market points to a similar experience for this cycle.

And despite the daily COVID-19 infections numbers averaging approximately 600,000 or double the number in August, confidence in this view has been increased with the recent announcements from both Pfizer and Moderna of what appears to be a vaccine.

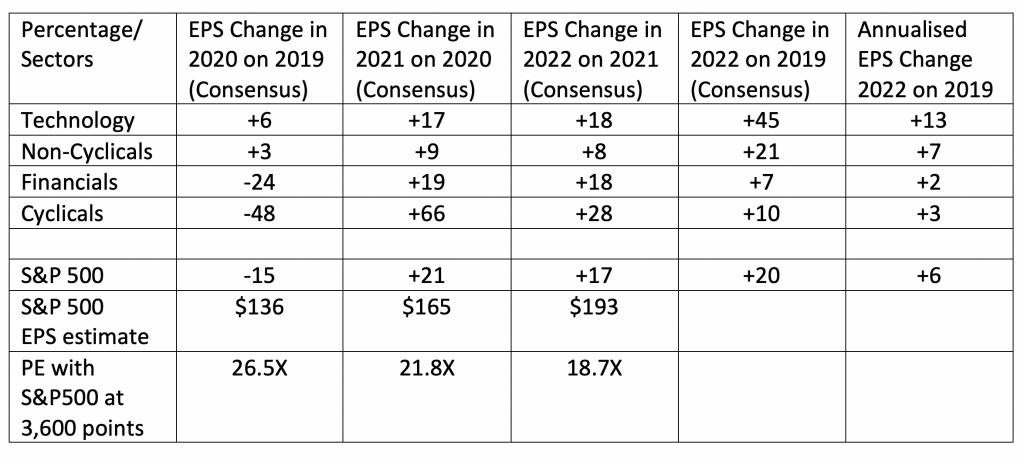

In this blog, we have broken the S&P500 market down into four broad categories, being Technology, Non- Cyclicals, Financials and Cyclicals.

Source: Credit Suisse

The table above illustrates how Cyclicals, for example, are expected to record a 48 per cent EPS decline in 2020; however this is expected to be followed by a 66 per cent increase in 2021 and a 28 per cent increase in 2022. Mathematically, we can conclude that Cyclicals EPS in 2022 are up only 10 per cent on 2019, a compound annual increase of 3 per cent.

Conversely, the EPS growth from the Technology Sector is 6 per cent in 2020, 17 per cent in 2021 and 18 per cent in 2022. Hence, EPS for 2022 is forecast to be 45 higher than in 2019, a compound annual growth rate of 13 per cent.

As investors, the question we ask is to what degree does the market look through the valley of earnings in a recession at the sunny uplands in the recovery.

That is with the S&P 500 currently close to a record high at 3,600 points, it is on an historic 2019 PE of 22.0X EPS of $163 and a prospective 2020 PE of 26.5X EPS estimate of $136. This then declines to a prospective 2021 PE of 21.8X EPS estimate of $165; and 2022 PE of 18.7X EPS estimate of $193.

Interestingly, the 2020 EPS estimate of $136; the 2021 EPS estimate of $165; and the 2022 EPS estimate of $193, are all around 10 per cent higher than the consensus forecast figures made in the darker days following the March 2020 pandemic lows. In simple terms, the recovery from the recession has been somewhat stronger than was then anticipated.

The enthusiasm toward the market seems to reflect a strong recovery in consensus EPS forecasts over 2021 and 2022, particularly in the 13 per cent annualised EPS growth from the Technology Sector over the three years to 2022, combined with the view interest rates will remain near record lows for the foreseeable future.

I would be interested to hear whether the Montgomery team agree with the consensus and, if not, in seeing your probability distributions attached to the forecast EPS for each of these categories.

Thank you Joe. All our work indicates the forecast EPS growth for the Tech Sector should meet or exceed the consensus forecasts.