Look who else is worried about house prices

The RBA is not alone in voicing concerns about soaring house prices. Across the ditch, the Reserve Bank of New Zealand (RBNZ) has warned that a severe fall in house prices could cause major and long-lasting damage to households and the broader economy.

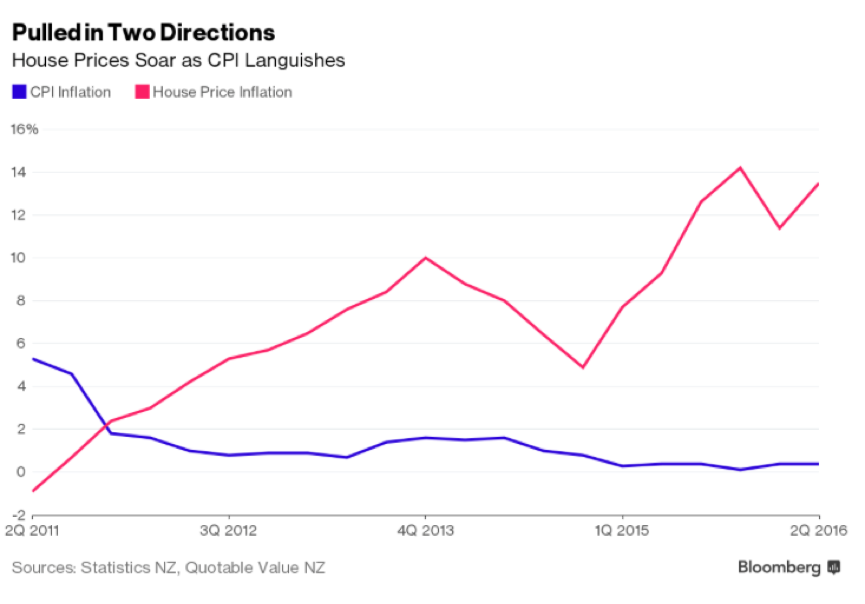

The RBNZ has a classic central bank dilemma. While inflation has been running at virtually nil, house prices are booming, up 14 per cent, on average, over the past year.

Fearing placing further fuel on the housing boom fire, the RBNZ has instead announced a new rule, to be introduced from 1 September 2016, whereby property investors will be required to have a deposit of at least 40 per cent of the value of any property purchase.

Fearing placing further fuel on the housing boom fire, the RBNZ has instead announced a new rule, to be introduced from 1 September 2016, whereby property investors will be required to have a deposit of at least 40 per cent of the value of any property purchase.

This paves the way for the RBNZ to further cut their record low cash rate (currently 2 per cent). RBNZ Governor, Graeme Wheeler, tried to hose down speculation in the New Zealand housing market, with a very direct warning: “a sharp correction in house prices is a key risk to the financial system, and there are clear signs that this risk is increasing across the country. A severe fall in house prices could have major implications for the functioning of the banking system and cause long-lasting damage to households and the broader economy”.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

They definitely move quicker than all the others, seem more nibble.

Reserve Banks…so late to the party.

The most sensible central bank in the world that I know of.

Agreed Jason