Longing for Liquidity

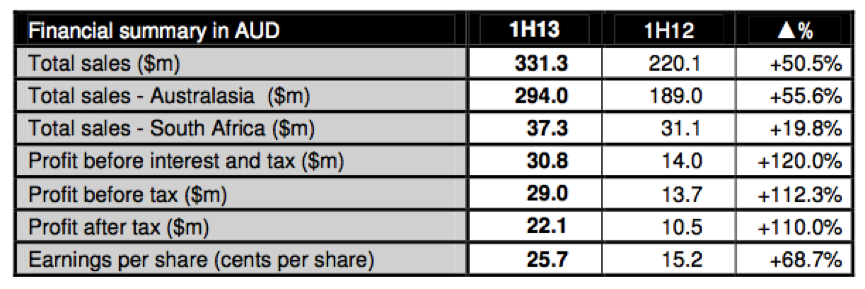

Below is one of the most spectacular half-year financial results we have seen this reporting season.

This is a company that has a net debt/equity ratio of 6.5 per cent, and cash flow from operations that are 2.5 times net profit. Its shares are currently trading at $3.50, which presents attractive value when you consider that the half year earnings were 25.7 cents per share (note that the second half earnings will be lower as the first half includes Christmas sales). Oh, and it’s a fashion retailer!

The company is Country Road – a retailer that sells their namesake brand, and also distributes the Mimco and Witchery brands.

Unfortunately, we can’t even get a look-in to this company because of one critical element – illiquidity.

Even if a company has the best fundamentals in the world, it all amounts to nothing if you’re unable to purchase a share of the company. Liquidity is a concept which we don’t usually touch on in these blog posts, but it is a very important consideration when investing.

Liquidity refers to the ease that an investor can exit or enter an investment without materially impacting the share price. A stock is said to be illiquid if it very rarely trades, or if there is a low volume of potential buyers or sellers that are willing to trade at the current price. It is important to easily exit or enter your investments in light of unexpected information – even the most heavily researched and stable companies can throw curveballs that have a material impact on their value.

In the case of Country Road, there are two major shareholders that own 99.76 per cent of the company. This means that only 0.24 per cent of the company is up for grabs to ordinary investors. With Country Road’s fundamentals, it is highly unlikely that these two major shareholders would sell their shares at current levels. As such, the shares are very rarely traded, and move in very static intervals when the remaining buyers and sellers agree on a price.

So it is with a heavy heart that we move on from Country Road, in search of companies with comparable value, but with a much larger pool to invest in.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

The first share i bought was amway and yes it was illiquid.

I was lucky though amway america had a buy back which allowed me to sell them at a very nice profit.

Will never buy an illiquid share again.