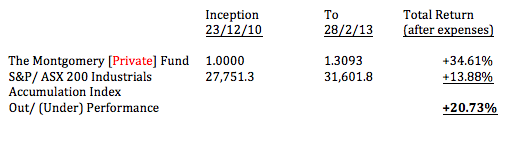

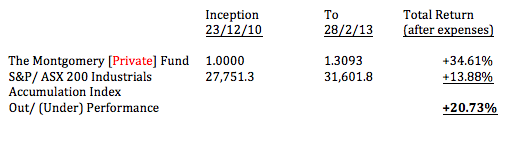

Performance to 28 February 2013

MONTGOMERY INVESTMENT MANAGEMENT

PERFORMANCE to 28 FEBRUARY 2013

The Montgomery Fund (for retail investors)

The Montgomery [Private] Fund (for wholesale investors) (1).

(1). The Montgomery [Private] Fund went ex 2.8771 cents per unit distribution on 30 June 2012.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Michael Sloan

:

Roger, I believe you are currently holding approximately 25%+ cash in one fund and approximately 35%+ cash in the other, whereas the S&P/ASX 200/300 by their nature are 100% invested in the market. Can you confirm that means your funds’ benchmark outperformance is being achieved even whilst using an invested base of funds 75% and 65% that of the S&P indices? i.e. I’m assuming your funds’ indices include the funds’ cash?

Roger Montgomery

:

That is correct Michael.