Legend builds its reputation

Some smaller manufacturers have good momentum in a tough market.

The media often portrays Australia’s manufacturing sector as on its knees. The high dollar, rising wage and input costs, and soft demand are clearly taking a toll. But to suggest all manufacturers are struggling is wrong. Some smaller listed manufacturers are performing well.

Transport parts manufacturer Maxitrans Industries almost tripled net profit to $12.3 million in FY2012 and its shares have rallied from 40 cents in January to 79 cents. Another parts manufacturer, Supply Network, said in July it expected full-year earnings before interest and tax (EBIT) to rise $2.2 million to $6 million. Its shares have almost doubled this year to $1.26.

Engineering solutions manufacturer, Legend Corporation, also has good momentum. In August it reported full-year net profit after tax (NPAT) grew 18.2 per cent to $9.4 million, for its fourth consecutive year of profit growth. Legend’s total shareholder return over one year (including dividends) is 8.1 per cent. Over three years, the average annual total shareholder return is 49 per cent.

EXCLUSIVE CONTENT

subscribe for free

or sign in to access the article

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Its business model appears good because they address needs of power utilities who are here to stay and also are developing a similar business in optical fibres and this will be a growing business.

They are in a sector which is difficult to enter from O’seas as they service legacy sytems of essentila utilities.

Roger has a good track record. I do not own the stock personally as I have no more money to put at risk and I have recently purchased one of Roger’s A1 picks.

BTW I have looked at LGD in the past and never swung and I am very happy about that.

Maxitrans Industries and Supply Networks are also ones I have looked and actually got remotely excited about but chose to let them through to the keeper.

Another bad decision that is not marked on my score card. I wish my gold card was as accommodating.

Ditto

As this is the pond that I love fishing in the most I think I am at least half qualified to say this is a very good assessment of LGD.

The only thing I can add is that of you look at the 2012 half time results and compare them to the full time results then the decline without an acquisition may have already started.

Cheers

Roger we have seen in the past many companies go for acquisitions and 10 years or so fall over and split up again with loss too shareholders value. eg Nylex, IXL to name two.

So is it wise to look at companies growing by acquisition especially if the acquisitions are not part of the core competency?

By the way is there any survey or report that will show the success or otherwise of growth by acquisition? Remember?

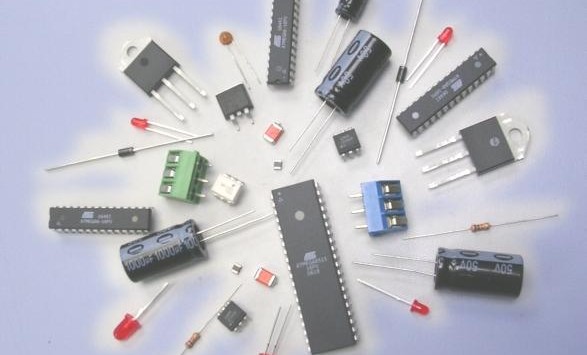

Why is the text covered by an image of electronic components?