Keep a close eye on the New Zealand economy

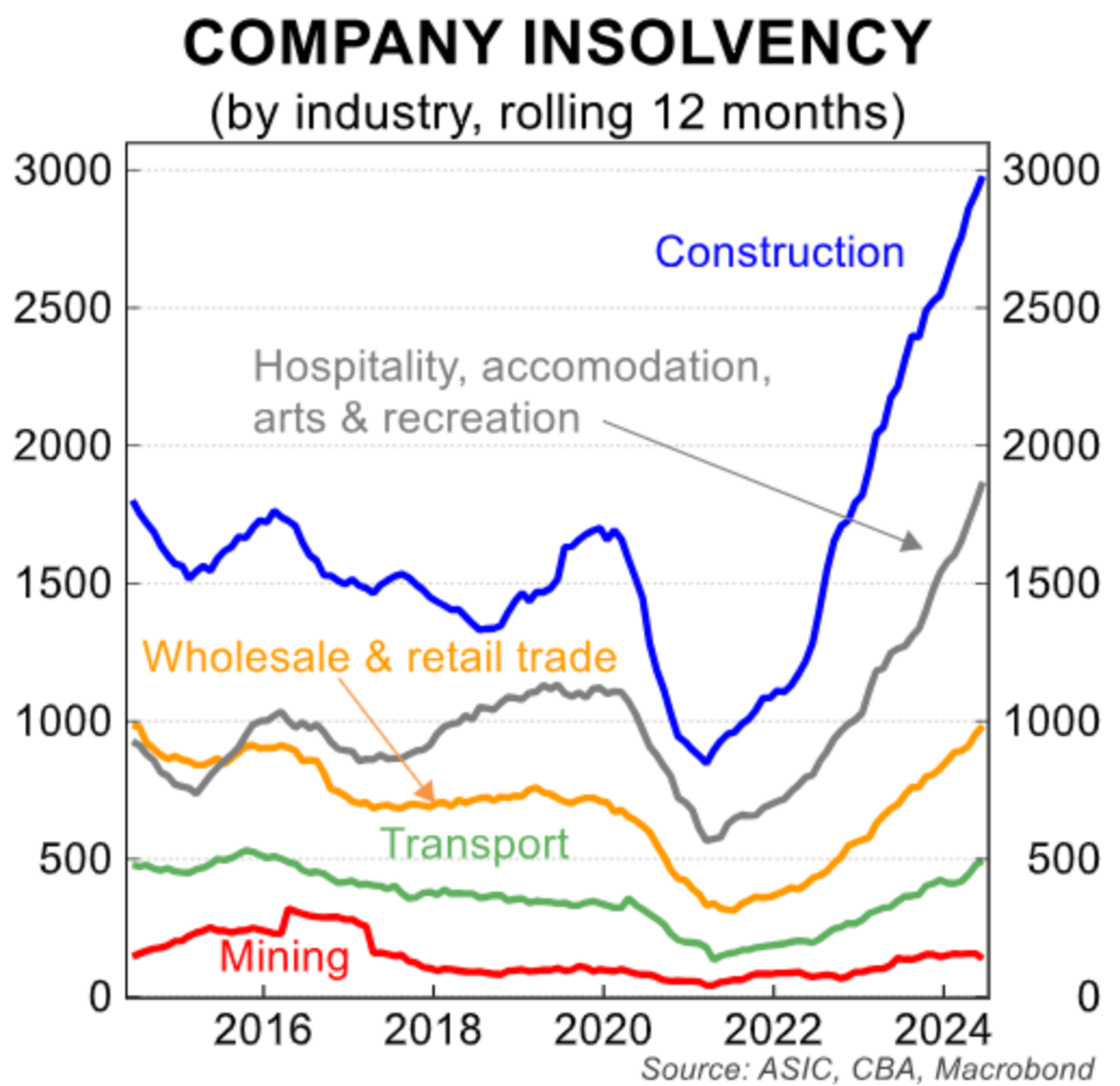

Over 11,000 Australian companies entered administration in the 2023/ 24 financial year. The bad news continued with a further 3,300 insolvencies in the September 2024 quarter. This is around four times the quarterly average since the business insolvency data was collated (from 1999). However, when we consider the total number of companies registered with the ASIC, the data doesn’t look that bad.

That said, operating conditions for small businesses are painful with strongly rising energy costs, a cost-of-living crisis, and Australia recording the longest period of negative gross domestic product (GDP) per capita since the early 1980s. This negative stretch (on a per capita basis) looks like it will continue with the Organisation for Economic Co-operation and Development (OECD) having just cut Australia’s GDP growth forecasts to 1.1 per cent in 2024 and 1.5 per cent in 2025, below the expected growth rate of our population.

According to the “Small Business Perspectives Report” from the Council of Small Business Organisations Australia (cosboa.org.au) and the Commonwealth Bank of Australia (CBA), one-third of small business owners are not paying themselves due to cashflow concerns. The hardest-hit industry has been construction.

Together, with much higher construction costs and a shortage of labourers, it is unsurprising that dwelling commencements have come down to 40,000 in the June 2024 quarter (from well over 50,000 per quarter), thus exacerbating the housing and rental crisis, especially given Australia’s population has recently been growing by over 600,000 people per year.

On the assumption that the Australian economy continues to exhibit recessionary attributes, I suspect we will need to follow the New Zealand example. Only in May, the Reserve Bank of New Zealand (RBNZ) said it wouldn’t start easing policy until the second half of 2025. Three months later, in August 2024, there was a 0.25 per cent easing in their official cash rate to 5.25 per cent, and this was followed up on Wednesday with a further 0.5 per cent cut to 4.75 per cent.

Like Australia, New Zealand’s per capita GDP has fallen for several consecutive quarters; however, unlike Australia, the Real Estate Institute of New Zealand (REINZ) house price index has fallen 17 per cent from its peak three years ago. A close analysis of unemployment for both countries (Australia at 4.1 per cent and New Zealand at 4.6 per cent) will be telling, especially given the number of applications per job ad, according to Seek NZ employment data, has risen for the ten consecutive months to August 2024 and is tracking at a 15-year high.

I wish your are correct. However, they are a few key differences.

One, net migration in NZ has been down. Hence more supply then demand. Australia still have a steady of net migration, demand will continue to outstrip supply for years to come

Two, NZ has a higher interest rate compare to Australia, over 1%.

Three, Australia have lower unemployment and underemployment and bigger GDP compare to NZ.

Thanks for sharing those differences.