Just how bad will the consumption slowdown be?

Continuing to explore the breadth of the expected slowdown in consumption, granular analysis of the Australian Prudential Regulatory Authority (APRA) monthly deposits and the RBA’s October 2022 Financial Stability Review, the following data is worth highlighting.

In late-2022 Australian household deposits were $175 billion above trend, and this “extra cash” was largely in the hands of the 55+ years of age, especially in the hands of the 65+ years of age cohort. After many years of financial repression, these older Australians will enjoy earning a more reasonable return on their spare cash.

30 per cent of variable-rate borrowers would deplete their liquidity buffer by the June 2023 quarter while a further 15 per cent of variable-rate borrowers would deplete their liquidity buffer eighteen months later, by the December 2024 quarter.

Despite some wealth transfer from the cohort in point 1 above to the cohort in point 2 above, the looming household cashflow crunch is expected to sharply slow consumption from mid-2023, especially when we consider the likelihood of two more increases in the RBA official cash rate to 3.85 per cent in the near-term.

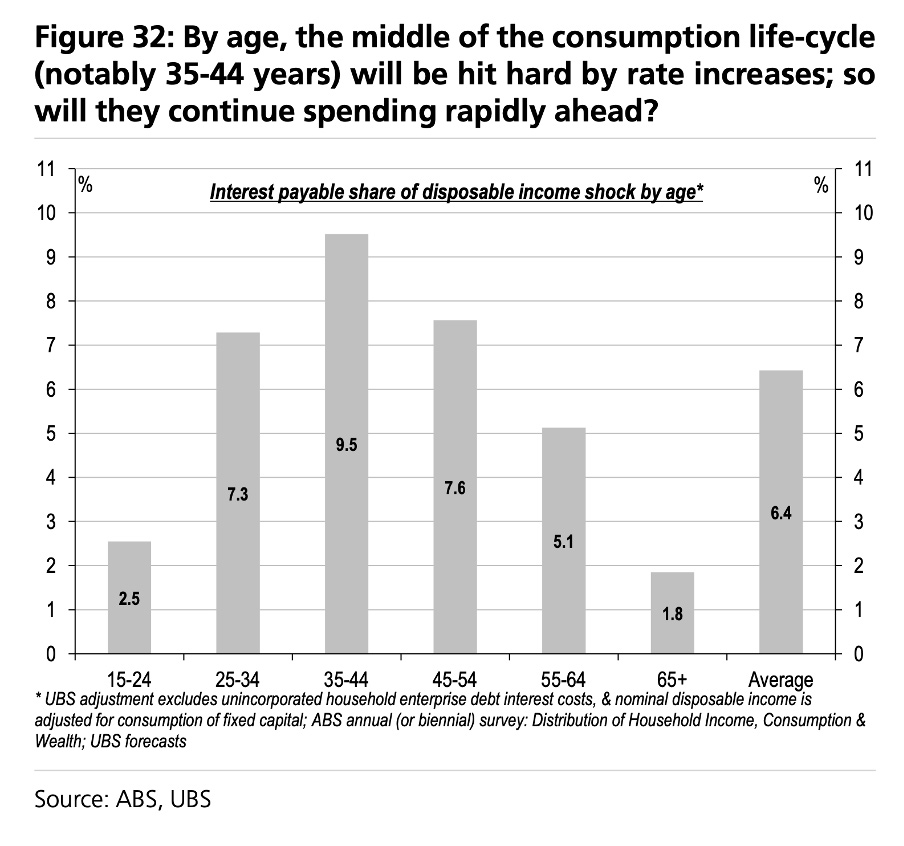

Beware of those businesses most vulnerable to the over-leveraged middle-aged (think 25-44 years of age) households, who account for one-third of total consumption. Think debt to income ratio of 2.3X for the 25-34 cohort, 3.0X for the 35-44 cohort and 2.3X for the 45-54 cohort, and a typical interest payable share of disposable income shock approaching 10 per cent.

Positioning investors’ portfolios for rising cost-of living and interest rate pressures is complex, especially when analysing companies in various sub-sectors, such as grocery, liquor, electronics, household goods, hardware, fashion, discretionary retail and service. We note that where consumer confidence has persisted at similar levels to today (1986, 1989 and 2008), volume growth has, on average, slowed from 4 per cent per annum to around nil.

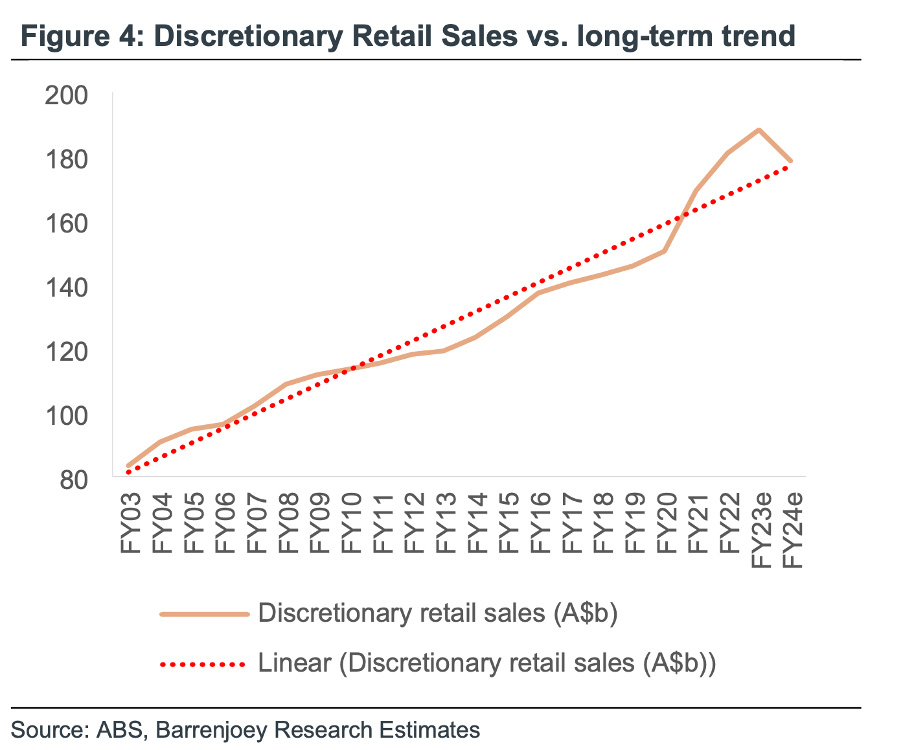

As discretionary retail sales decline below the long-term trend, as per the graph below, earnings in the year to June 2024 for the most exposed of the “discretionary spending” companies are likely to come under pressure. Examples of the more vulnerable companies include Adairs (ASX: ADH), Universal Store (ASX: UNI) and Harvey Norman (ASX: HVN).