Is Woolies headed for a downgrade?

The Sydney Morning Herald today reported, what appears to be shocking behaviour, by Woolworths (ASX:WOW) and suggests the company is really feeling the pressure at the moment. If the allegations reported by Fairfax are correct, one must wonder how the methods are any different to the stand-over tactics employed by the gangsters of the 50’s and 60’s. It certainly doesn’t seem to be the behaviour of responsible corporate citizens, rewarded with millions in salaries and bonuses.We quote: (emphasis is our own)

“Just days after Coles requested to settle a similar case with the Australian Consumer and Competition Commission, and paid a $10 million fine, Fairfax Media has obtained emails that reveal rival Woolworths requested extra payments from suppliers by the end of the month.

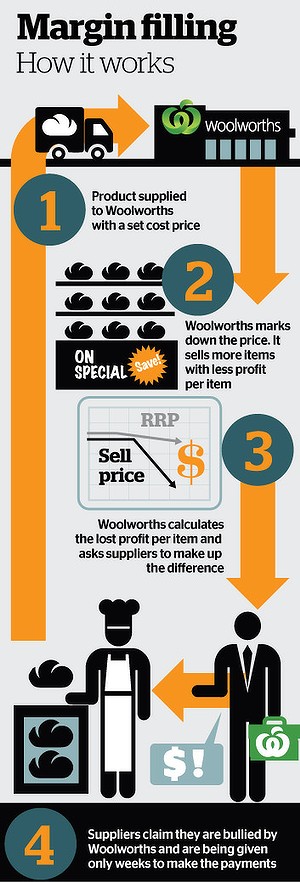

Only suppliers who have had their products discounted by Woolworths as part of its new “Cheap Cheap” marketing campaign have been hit with demands for extra cash payments, which will fund “the gap between sales and profit growth” on discounted lines.

According to the staff member, managers are under “extreme pressure” to recoup money and help the retailer avoid a profit downgrade.

Suppliers have been asked to fund about 80 per cent of the lost profit Woolworths would have made if it had not discounted prices.

The practice has been described as “margin filling” by Woolworths staff. “Woolworths expects to maintain the same profit margin per item, even if it’s our choice to discount it,” said a Woolworths staff member.

Professor Caron Beaton-Wells from Melbourne Law School, a specialist in competition and consumer law, said the described actions may breach provisions of the Competition and Consumer Act relating to unconscionable conduct.

According to a Woolworths spokesman the company “has worked very closely with the Australian Food and Grocery Council and suppliers to build constructive, mutually beneficial relationships and we believe issues are best resolved though this channel.”

Sounds like gangsters suggesting, “If you have a problem with our tactics come and see us and we’ll have a little chat.”

Surely anyone at the head of a company that has conducted itself this way should resign?

For at least 5 years the writing has been on the walls for Coles and Woolies and they’ve been slow to respond to foreign competition. They have a more expensive business model than Aldi and Costco. Some of the store managers at Woolies are deadbeats. But history has shown that you can get that when you don’t have enough competition.

Harvey Norman has been sooooo expensive and ripping us off for decades. Now competition has come and they have an expensive model and they are dinosaurs. Same thing for Woolies especially.

Aldi have lower labour costs. Aldi don’t do as many specials and have State wide pricing so head office costs are lower. Coles and Woolies have promos and store level pricing making head office costs more expensive. Aldi are streamlined and when they get scale, are very hard to compete with. Buffett loves these sorts of companies.

I think there is going to be real future pressure on pricing in itself as a margin contractor.

over the years I have seed the price comparison of Asian ‘market’ places against coles/safeway become increasingly larger.

a bunch of unwrapped correander 70c at the market, $3 for a nicely wrapped on at the supermarket.

other vegetables usually 30% cheaper except for whatever the ‘cheap cheap’ vegetable is.

meat prices are also around 30% cheaper.

coles/woolworths bullying out the premium meat brands on their shelves and replacing with increased supermarket brand.

Value investors must always have their eyes firmly peering through the front windscreen and not taking their cue from history past.

It has often been said that the UK grocery shopping trends are several years ahead of Australia.

So I would strongly encourage value investors to investigate J Sainsbury and Tesco.

Look at the strategic problems they are having.

Australia has a better situation in that there is only an oligopoly. But this is also a double edged sword, it makes it far easier to the likes of ALDI to increase its market present in Australia.

Our market is perfect for ALDI (read up on what ALDI considers its key success factors for long term penetration of a foreign market, such as high labour costs, high margin encombents, high middle class %.

Plenty in Australia hasn’t yet witnessed the structural damage ALDI I can do.

Those in the UK do.

Then take a look at the problems at Tesco with supplier bulling.

I am not going anywhere near WES or WOW for the moment.

IV is more than just a spreadsheet calculation on historical numbers and broker forecasts. If it was robots could do it.

Strong suggestion to stay away. There is a season for everything, that this is not the season for WES/WOW

A long time ago i managed a company supplying Coles Woolworths Etc

When negotiating a “special” we would agree in a price for a period Coles would reduce their selling price We did not know the price Until we saw the “Ads” Some smarter buyers would “over buy”

Now it seems the Buyer can say I want to sell at 50% discount But we want to make the same profit You wii take our figures as being correct

So this is how “Woolies” is selling “Ferrero Rocher” half price this week

GREAT FOR CUSTOMERS DISTRESSING FOR SUPPLIERS)

IF the “Boards” of Coles & Woolworths are happy with this strategy.

Then every Shareholder Commentator Paper should make their feelings

Vote the Board “OFF” Sack ACCC if it doesn’t act NOW (2 yeaes on)

ReallyAngree

Don

If you look at the charts of WOW and MTS, what you see are stocks falling off a cliff. If history is any guide, both are likey to go lower still. But here’s the puzzle. Why is WES being so well siupported by the market? One would have thought the same dynamics affecting WOW’s supermarket margins would be affecting Coles.

Hi Martin,

It could be 1) Coles margins are already lower than WOW and 2)while we believe that the turnaround is mostly complete given their revenue/sqm is now reaching Woolowrths’s levels (which have been stable for many years), the market may believe the turnaround is still underway and has further to progress.

I agree Roger, i think people feel that Woolworths has the most to lose as it has been so far ahead. Whilst Coles margins may remain approximatley same in the future, Woolworths EBIT margin of almost 8% is definitley at significant risk of falling back to more normal industry levels.

My guess would be that Coles has a more diversified business than WOW, but it’s just that – a guess.

The more news and developments that happen regarding WOW the better your decisions to get out of it and sit on the sidelines appears to be (happy about myself coming up with that Sell rating for my assignment as well). The Australian customers thirst for low prices is now causing significant problems for Woolowrths. The issue is that all major players are relativley well funded so waiting for one to go out of business and then raising the prices will likely not work or at least for a long long time. Years of people arguing about the lack of competition in this sector have now seen it become one of the bloodiest competitive battles (albeit very concentrated) in the country. Would not like to be Grant O’Brien at the moment.

With margins at the upper end of the scale for a grocery chain, it seemed inevitable that they would have to decline at some point, especially considering the increased competition in the market. They no longer have the marketplace to themselves. Would not be surprised to see a downgrade, be very interesting to see the aftermarth of that as well.

Thanks Andrew. ALways appreciate your contributions and insights.