Is this a minor stumble for Sirtex?

The confession season continued with Sirtex Medical Limited (ASX: SRX) reducing their “anticipated dose sales performance in the EMEA (Europe, the Middle East and Africa) and APAC (Asia Pacific) regions during the second half”.

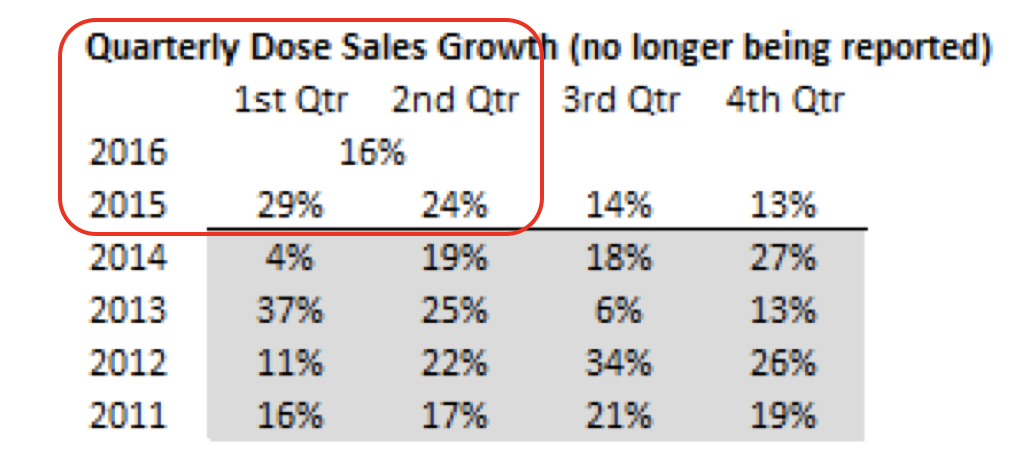

Accordingly, Sirtex has just cut the guidance of its full year dose sales growth to 15-17 per cent compared to the previous corresponding period. Previous guidance had dose sales growing “at least in-line with historic trends, which over the last five years represents a compound annual growth rate of 19.7 per cent”.

The Americas have been a powerhouse for Sirtex, typically accounting for 70 per cent of their dose sales and 80 per cent of their revenue. The Company anticipates dose sales growth from the Americas “to be in the order of 18-20 per cent” compared to the previous corresponding period. So no issue there!

The problem comes from the EMEA and APAC regions, where the implied growth in dose sales for the June 2016 half-year is now down to 3-10 per cent. And this “has been affected by:

- Delays in achieving product reimbursement in some important EMEA countries;

- Publication of the SIRFLX clinical study in the Journal of Clinical Oncology occurring later than anticipated, which restricted sales and marketing initiatives, globally;

- A tighter funding environment within several established European markets; and

- Temporary supply disruptions in some Asian markets”.

The Sirtex share price declined $2.26 or 7.2 per cent to $29.24 yesterday. Keen readers of our blog will be aware the Montgomery Funds exited Sirtex Medical Limited earlier this year.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Well done David & Russell!

Kelvin

Roger, I can’t help asking… so is this result a small blip along the long term uptrend or is it a potentially indication of significant change in direction?

Hi Andy, we can see that the US grew dose sales close to historical averages in the update. US dose sales are now 70% of the total and are a larger % of revenue (about 80%) given a higher level of reimbursement per SIRT treatment than that in other areas such as ASIA and EMEA. So I guess your question is aimed at the other 20% of SRX’s revenue line – that of predominantly the EMEA regions sales.

Basically, EMEA is a highly complex market versus that of the US. US has a single regulator (FDA), has a single reimbursement regime which governs all of America and the country is dominated by private operators who are able to better / more quickly adjust to changes / take advantage of new treatments / devices.

EMEA on the other hand, whilst they also have a single regulator (CE Mark) that where the similarities end. Because the region is made up of numerous countries, each one has their own body responsible for setting and providing reimbursements for medical devices. Further, EMEA is largely made up of hospitals as apposed to private operators and hence can be hamstrung and be much, much slower in adoption. EMEA in SRX’s words; “they simply work under different conditions”.

These bottlenecks were not apparent before given EMEA did 19% dose sales in 2015 on the back of the UK funding regime being fixed (which caused an apparent short-term spike in pent-up demand) and inclusion into ESMO clinical treatment guidelines. Previously the company has been steadfast in their view that once they had inclusion into ESMO treatment guidelines and with UK and other funding now on track, and others to follow, sales would begin to ramp up. It appears that this was not appropriate to consider and model high EMEA sales growth rates given they are vastly different markets – one relatively easy one (the US), one difficult one (EMEA).

Long way of saying that EMEA has a few structural hurldes to get over before it will begin to act like the US and be smooth sailing. Timing on that is an unknown give all the complexities.