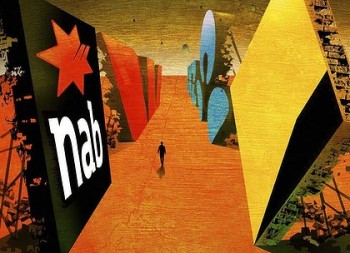

Is there Value in the Big Four Banks?

At Montgomery, we spend quite a bit of time talking to broking analysts to try to deepen our understanding of industry dynamics. Sometimes we get a good return on that investment of time, and this was the case recently when we sat down with UBS to talk about banks.

One of the things we took away was a straightforward account of some pricing dynamics currently at play. As you will know, official interest rates have been low for some time and that’s impacting deposit rates. More recently however, an improving mood in wholesale funding markets has meant that Australia’s Big Four banks have had access to wholesale funding at significantly better rates than they saw 12 or 18 months ago.

With cheap funding becoming available there, the Big Four are less interested in competing for term deposits, and so term deposit interest rates have fallen to the rather unattractive rates we’ve been seeing more recently.

When a term deposit investor is confronted with these unsatisfactory rates, their inclination is to seek out a better level of income somewhere else. In Australia, that somewhere is often shares; in particular – shares in the Big Four banks.

So, improving wholesale funding markets combined with already low benchmark rates is herding investors into bank shares, and supporting bank share prices.

Which may prove to be fortuitous for the banks in the event that the Murray review concludes that the Big Four need to think about raising additional equity.

Investors should also consider how these dynamics could work in future when interest rates start to rise.