Is there strong growth ahead for Emerging Markets?

The impact from COVID-19 on Emerging Markets has, in many ways, been even more severe than the developed world. Many middle and low income countries have struggled to contain the outbreak, let alone report the infections and deaths with any degree of accuracy. Medical resources, which in most cases are in limited supply, have been stretched. Government ordered lockdowns have crippled livelihoods where few safety nets exist.

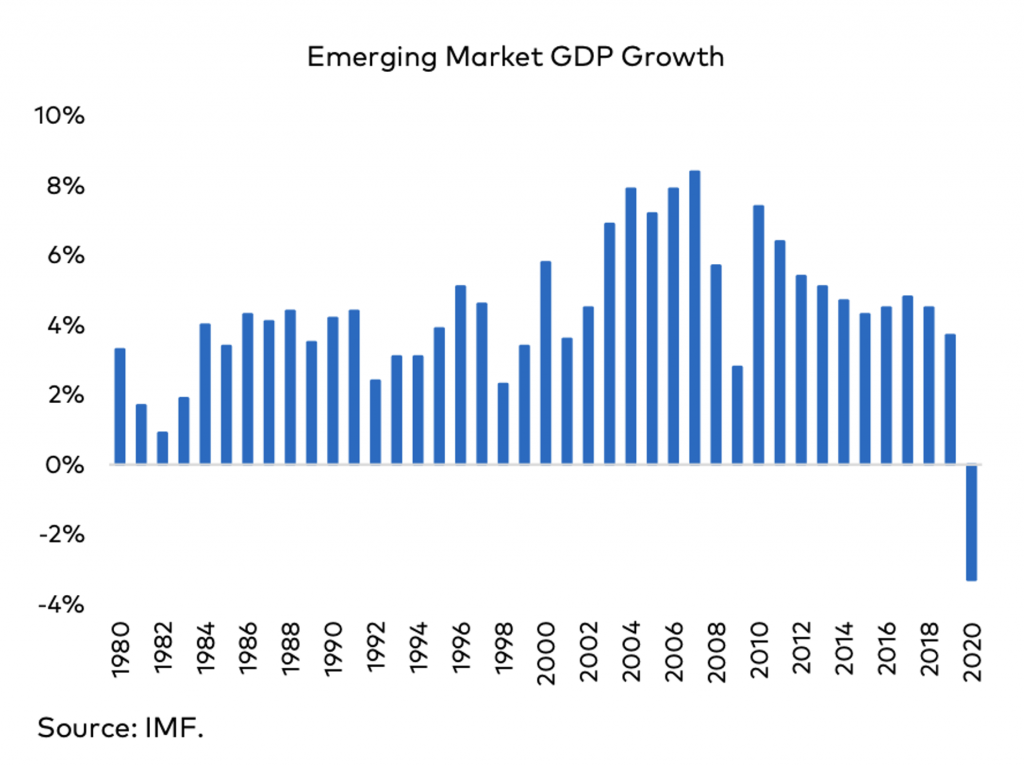

Emerging Market GDP in aggregate, according to the IMF, is expected to decline by 3.3 per cent in 2020 when the number is calculated, the first calendar year decline in four decades. This is far worse than previous economic slumps, including the Tequila Crisis (1994), the Asian Financial Crisis (1997) or the Global Financial Crisis (2008).

There are real people behind these numbers. For example, according to the Indian Ministry of Statistics and Programme Implementation (MOSPI), the average Indian is expected to see their earnings decline by 10 per cent from US$1,400 in 2019 to US$1,265 in 2020.

That said, the IMF expects a strong recovery with GDP advancing by 6.6 per cent within Emerging Markets in 2021, more than making up for the losses in 2020. With relatively restrained fiscal and monetary responses, several Sovereign balance sheets are in decent shape.

With global interest rates likely to remain near record lows for the foreseeable future, and the large numbers of people within Emerging Markets moving up into the middle class over the medium and longer-term, the foundations for strong growth ahead remain intact.

Surprisingly, 2020 saw the MSCI Emerging Markets Index, which comprises 27 countries and 1,380 constituents, out-perform the MSCI World Index (24 developed countries), with a return of 18.3 per cent versus 16.2 per cent (in US Dollars). Markets have shrugged off the immediate disruption and looked to the future with a “risk on” mentality.

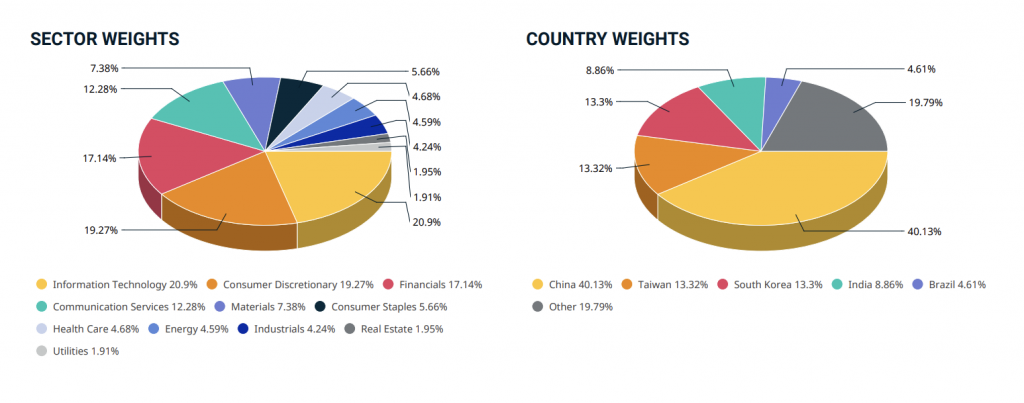

The significant country weightings in the MSCI Emerging Markets Index includes China (40.1 per cent), Taiwan (13.3 per cent), South Korea (13.3 per cent), India (8.9 per cent), Brazil (4.6 per cent) and the other 22 countries (19.8 per cent).

The significant sector weighting in the MSCI Emerging Markets Index includes Information Technology (20.9 per cent), Consumer Discretionary (19.3 per cent), Financials (17.1 per cent), Communication Services (12.3 per cent), Materials (7.4 per cent), Consumer Staples (5.7 per cent), Healthcare (4.7 per cent), Energy (4.6 per cent), Industrials (4.2 per cent), Real Estate (2.0 per cent) and Utilities (1.9 per cent).

And stay tuned for my next blog – where I examine a company which seems to be beating Google at its own game!

Montgomery will be offering an emerging markets strategy from mid-2021 in partnership with Polen Capital. If you would like to be kept updated on the opening of the Polen Capital Global Emerging Markets Growth Fund, please let us know: Express interest in Polen’s Emerging Markets capability

Hi David

What are the avenues available to invest in Yandex?

Hi Hany, Emerging Markets Funds is one of the best ways to access Yandex. In fact Montgomery will likely be launching the Polen Capital Global Emerging Markets Growth Fund around mid-2021. An introduction to Polen Capital is being uploaded to our montinvest.com website. Thank you.

Thanks for the article David. It will be great if you are able to explain why the global fund has not pivoted to capture more direct opportunities in emerging markets such as Malaysia, India etc (with the exception of China where Alibaba and others are direct holdings)? Thanks

Hi Chirayu, many Global Funds with a growth bias are relatively US (+ Alibaba and Tencent) centric due to the breadth of offerings within the technology and healthcare space. In the period 2009-2020, it is interesting to note the MSCI Emerging Markets Index has out-performed the MSCI World Index (top 24 Developed Economies) in 6 of the past 12 calendar years (and vice versa). That said, the MSCI Emerging Markets Index only accounts for around 12 per cent of the MSCI All Country World Index or MSCI ACWI (the 24 Developed Economies plus the 27 Emerging Market economies).