Is the digital excitement supported by the results?

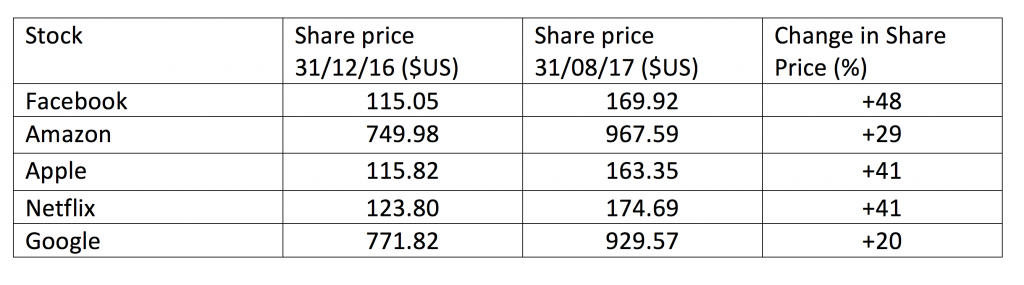

There has been enormous excitement surrounding the FAANG stocks this year, with an average share price appreciation of 36 percent.

But not all digital networks are created equally and this is illustrated via our own home-grown Freelancer Limited (FLN), its results for the six months to June 2017, and the fact its share price has declined by 55 percent to $0.45 in the past eight months.

Freelancer is engaged in the provision of an online outsourcing marketplace and a secure online payment service. Through its Freelancer market place, “employers” can hire freelancers to do work in areas such as software development, writing, data entry, design, engineering, sales, marketing, accounting and legal services. The online payment services, Escrow.com, is a regulated entity that holds funds on behalf of its users in trust bank accounts. Escrow.com offers a platform which allows users to upload documents and have their identity verified.

Freelancer has 458.7 million shares on issue and at the current $0.45 – FLN listed in November 2013 and hit a record high of $1.89 in October 2015 – it has a market capitalisation of $206.4 million. At 30 June 2017, the company had net cash of $34.7 million, but readers should be aware that accounts payable exceeded accounts receivable by $29 million.

Freelancer has just reported a tough six months to June 2017. Relative to the June 2016 half-year, revenue was flat at $26.3 million and net earnings were negative $0.7 million. Revenue from the Freelancer online outsourcing marketplace division was up 6 percent to $23.1 million on Gross Payment Volume (GPV) up 1 percent to $82 million (a 28 percent ratio), while Escrow.com was down 28 percent to $3.1 million on a 24 percent decline in GPV to $209 million (a 1.5 percent ratio). While the Company’s total Gross Payment Volume declined by $64 million or 18 percent from $355 million to $291 million, the blended ratio of company revenue to GPV increased from 7.3 percent to 9.0 percent.

Since founding the Company in 2009, technology entrepreneur Matt Barrie, Executive Chairman, CEO and 42 percent shareholder, has done an excellent job with Freelancer accumulating 25 million users and 12 million projects. However, what concerns us is that while “accepted projects” have significantly increased, the Gross Payment Volume from both the Freelancer online outsourcing marketplace division and the Escrow.com division (on an ex-China basis) have recorded no real growth for several Quarters.

Management has done well keeping a close eye on the cost base and losses to a minimum. At 30 June 2017, accumulated losses were only $5.5 million and the Company is guiding for a small profit in the December 2017 half-year. While Freelancer Limited has some exciting digital networking attributes, the timing of any trajectory to sustainable profitability is less clear.

On the topic of technology, I would interested to hear more commentary on Altium’s recent result & future prospects. Thanks.

Do any of the Montgomery Funds have any position in Freelancer?

No Anthony. If we own a stock, we say so at the bottom of the blog to avoid potential conflicts.