Is PointsBet Holdings worth a bet?

Finding growth businesses with a long runway of opportunity, that can also grow independent of the economic cycle, can feel a bit like looking for a needle in a haystack. But we think PointsBet Holdings (ASX:PBH) is one of those businesses. PointsBet Holdings is at the ground floor of the commercialisation of legal online sports betting in the US. Its share price has doubled since June and we think there’s more growth to come.

Let’s examine the background, a framework for assessing the potential market level economics and some early stage valuation scenarios that could apply to PointsBet Holdings over time.

PointsBet Holdings provides online sports and racing wagering products through its cloud-based wagering platform in Australia and the US. It offers traditional fixed odds betting on racing and sports; and spread betting, a form of betting where the bettor wins or loses money based on the margin of variation of outcome from the spread of expected values quoted by the bookmaker.

US sports-betting – the background

In May 2018, the US Supreme court overturned the Professional and Amateur Sports Protection Act of 1992, which until then had the effect of banning sports betting in the US in all but a few States.

Now each US state can enact legislation allowing sports betting, and open up the market to legal operators, in a regulated way offering consumer protections, whilst paying rights revenues to sports leagues and taxes state coffers.

Having pushed to repeal the legislation, New Jersey is the poster child state for the US sports betting market and has built a regulatory and fiscal regime that has proved attractive for the online mobile sports betting business model like PointsBet Holdings. And the results are spectacular.

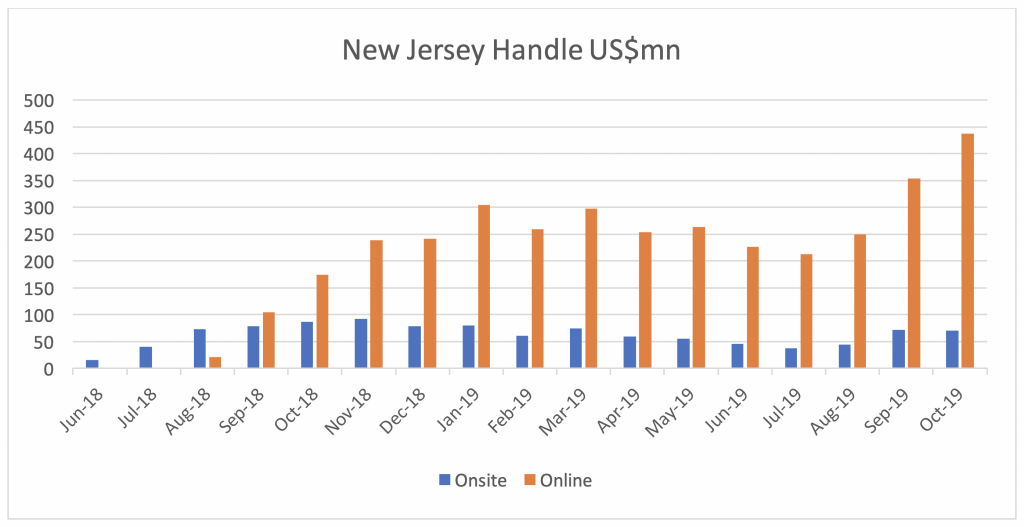

The chart below highlights the rapid market development and impact of the introduction of online betting.

Source: New Jersey Office of Attorney General

In the 17 months since sports betting operations commenced, regulatory filings show New Jersey has wagered $4.7 billion, with revenue to the operators of $293 million or a take rate of 6.3 per cent.

The latest available data for the month of October 2019 shows $508 million was wagered, 86 per cent of that online. Read that again, here is one state with 2.7 per cent of the US population, in one month, more than half a billion USD wagered. Huge. The market is shaping up to be big, and not the normal kind of big, but the once in a lifetime kind.

An assessment of Long Term Steady State Industry Economics – how big is the prize?

In an early stage assessment of the market potential, using the data we have and some sensible assumptions, there are many factors that will likely influence the overall size of the market.

A key factor is the number and size of the states that legislate for sports gambling and open up to commercial entities, allowing online/mobile versus restricted to physical outlets, with acceptable fiscal regimes (licence cost and taxes).

These are the conditions that allow sports gambling to move from the black market to the legal regulated market, providing all existing participants a better outcome – offering consumers protection, the sports leagues an opportunity to monetise gambling and taxes to flow to state coffers. Win, Win, Win. And the sports bookmaker businesses get to make money at the expense of the current illegal black market operators.

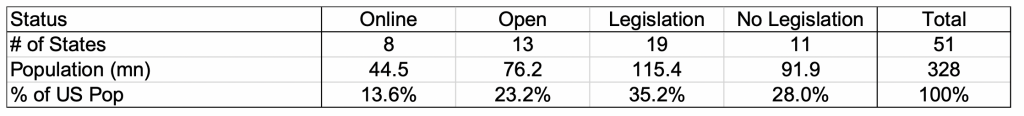

The roll out of legal gaming in the US varies State-by-State. In the 18 months since the legislation repeal, some 20 states plus Washington DC, have passed legislation to allow sports betting to some degree. Of the 21, our assessment is 8 states will allow commercial operators online or mobile gaming at un-restricted locations within the state.

Of the remaining 30 states, 19 have legislation before state legislature, 11 have no legislation slated for debate (or have had legislation rejected). There will likely be a steady growing pool of states opening up to gaming in the next 3-5 years.

*For this example we include Washington D.C to the # of states.

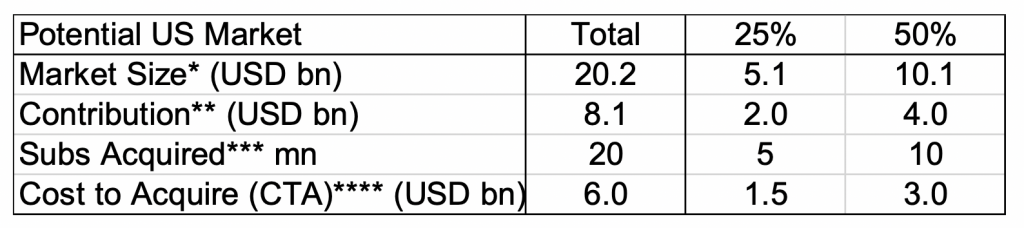

The case study of New Jersey and its biggest operator – Fanduel, majority owned by UK listed Flutter – offers some insight of what the market size may look like if the regulatory and fiscal settings converge over time.

In March this year Fanduel suggested in disclosure that the end market size in Gross Gaming Revenue (GGR) terms (not handle/wager) will be in the range $500-600 million p.a. for New Jersey, which equates to $56-67 per head of population.

Fanduel’s parent, Flutter, operate a leading online sports betting business in Europe, and suggest that a rough rule of thumb of economics for the sports betting is that some 40 per cent of GGR drops through to contribution post spending on marketing, incentives, fees to sports authorities and taxes and suggest that similar market level economics are likely to apply in the US.

On this basis the profit pool available to the industry if all 51 states move to allow online could be $8.1 billion per annum. Big potential, but based on the progress observed, a more realistic scenario we think is to assume that somewhere between 25-50 per cent of the US potential market opens up to full online status.

The Prize – Long Term Steady State Industry Economics

Source: Montgomery,

* applying New Jersey Revenue economics to population size in each state

** assuming 40 per cent contribution ratio

*** applying PBH revenue per Sub for 1Q20

**** applying a cost to acquire of USD$300 per subscriber

Big opportunity, but at what cost?

Opportunity doesn’t come free. The subscribers required to generate the revenue pool firstly need to be acquired and at that potential scale could cost serious blocks of capital. Here we again make some assumptions.

In FY19 PointsBet Holdings added 88,000 net subscribers to its user base for a total cost in sales and marketing of A$25 million – or a cost per sub of A$282. Unfortunately the bulk of these subscribers were added in the competitive Australian market. We don’t have a specific data on the unit cost of acquisition for the US, but it’s the best guide we have for now. We have assumed USD$300 (55 per cent higher than costs observed in FY19). On that basis, if the whole US market opened up, with 20 million subscribers being acquired, we estimate the industry would spend USD$6 billion to get there.

How can this be applied to PointsBet Holdings?

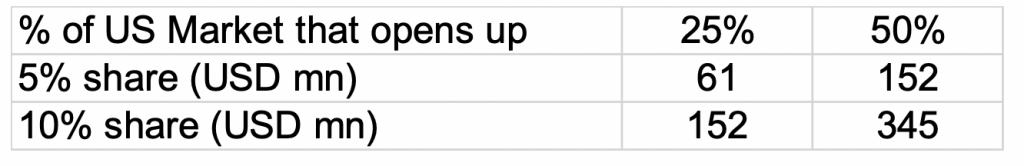

In just nine months post its US launch, PointsBet Holdings reported 6.7 per cent share in New Jersey in 1QF20, achieved from a zero subscriber start against well-funded competitors already in market with live databases of sports gaming customers. PointsBet Holdings looks to be competitive at this crucial land grab stage of market formation. They look capable of targeting a 10 per cent share longer term. We think understanding the profit potential of 5 per cent or 10 per cent share of the US market and what that might be worth is an interesting valuation benchmark for the company.

EBITDA Potential (USD)

Source: Montgomery, assumes overhead structure of USD$40-60 million

How to value this?

Tabcorp, offering limited growth, trades at roughly 12x EV/EBITDA. Flutter (no doubt influenced by its exposure to the US gaming market) trades at 18x EV/EBITDA, and both companies offer some valuation benchmarks.

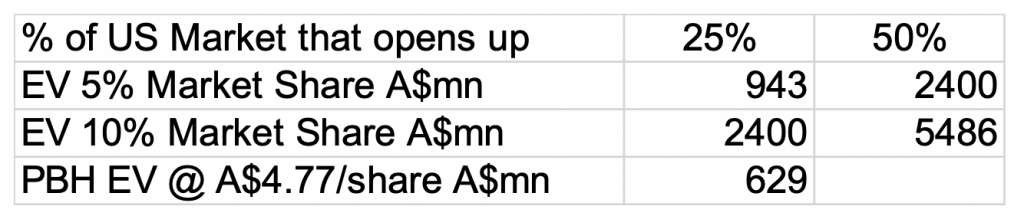

We also need to adjust for the cost to acquire a 5 per cent or 10 per cent share when calculating our EV and convert the valuation scenarios to $AUD.

Valuation of 5 per cent/10 per cent market share at 12x EBITDA in $AUD terms.

A structural growth opportunity

PointsBet Holdings today ($4.77 per share) has an enterprise value (EV) of A$629 million, highlighting considerable scope for upside should management execute on the opportunity, and if greater than 50 per cent of the US market eventually opens up to online sports betting.

In our view PointsBet Holdings is a challenger, it has a competitive product offering (technology) and marketing skills leveraging its experience in operating in the competitive Australian online sports betting market into the rapidly growing US online sports betting market that looks set for many years of structural growth.

It’s too early to tell what levels of success PointsBet Holdings may or may not enjoy. And if they don’t execute in the US market, there is considerable downside to the share price. However, as we can see from the table above, there is also scope and potential for the shares to double and more.

The Montgomery Small Companies Fund own shares in PointsBet Holdings. This article was prepared 03 December with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade PointsBet Holdings you should seek financial advice.

Also one must consider the fact that currently its unprofitable unlike peers Flutter, GVC and others. Those are already profitable companies.

This will either become a Xero, or Afterpay, or go the way of an Openpay/Splitit, to use the BNPL analogy. Its impossible to call.

Thanks for your comment Nihal.

very detailed article about the current dynamics.

Pointsbet will highly likely be a pretender- if this merger goes ahead. the Cross promotion with Murdoch and other media will make these behemoths too competitive i feel. Also Draftkings looking to IPO and Bet365 hasnt even started yet.

https://bookies.com/news/how-flutter-tsg-12b-merger-will-change-us-sports-betting

Thanks for your additional comment. The market is attractive, and the market here is only going to form once. It will attract competitors, it has already, there are 14 operators trading in New Jersey today. The fundamentals are forming for some big credentialed players to have a crack at the market. That said there are plenty of examples of large companies with big budgets, with industry capability that fail to gain significant market shares when markets go digital. The Australian gaming market is an example, the online bookmakers have taken massive market share, from well capitalised brand names with industry capability. Its early in the market development phase, too early to call the outcome.

Had an enormous run, probably the best run for an individual stock in 2019. High burn rate and losses. Going up against giants mainly Flutter, GVC and William Hill. At already $760m mkt cap today, it has nearly factored in a full success in obtaining a consistent 5% share on the 25% of states opening up($943M).

Thanks for your comment Nihal. Thats the idea behind the assessing the Industry level economics – breaking open the assumptions, estimating the potential and applying a value framework to that. Its allows an assessment of whats in the price and what the potential might look like from here.