Is it worth investing in bonds with yields so low?

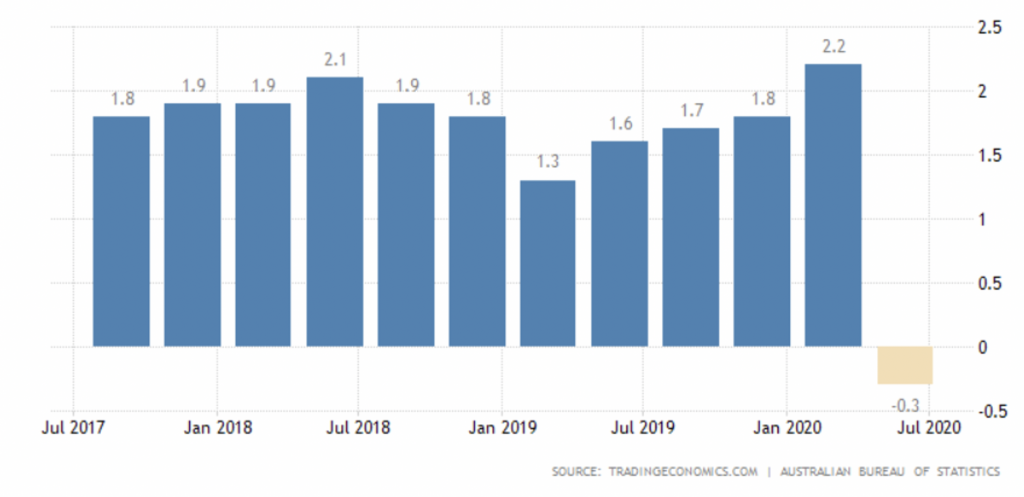

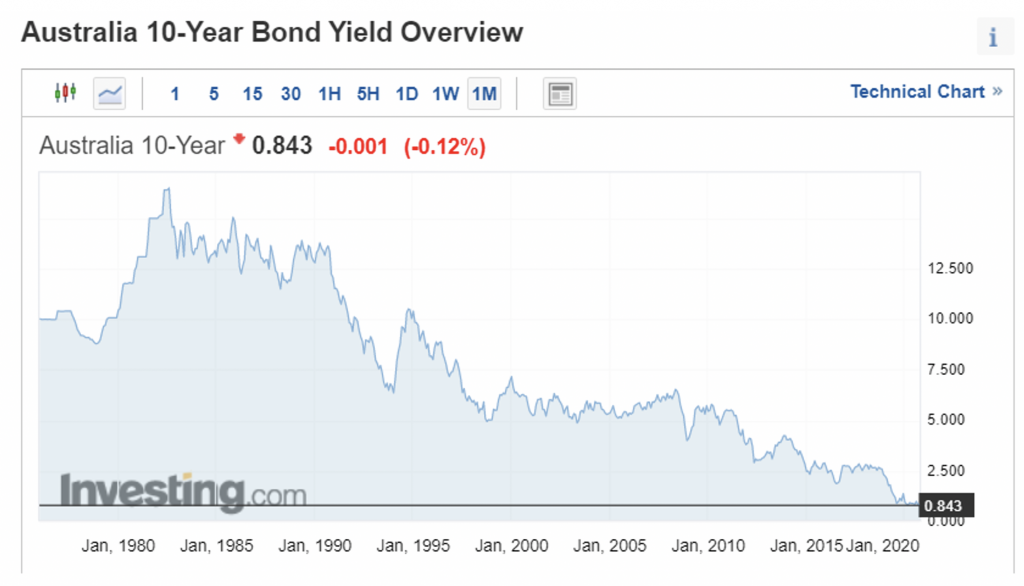

The typical balanced portfolio being a 60/40 mix of growth assets to defensive (bonds) has been a mainstay of investors for many decades. But with 10-year Australian government bond yields at just 0.84 per cent and inflation running somewhere around 1.8 per cent (as seen in Figure 1), the return you get on the yield from your risk free Australian 10 year treasury bond is trailing inflation by around 1 per cent per annum.

Figure 1 – Australia’s annual inflation rate measured quarterly

Now the goal of investing is usually to increase your purchasing power over time or at the very least to maintain it, so can these bonds be considered an “investment”? Well, if in fact these 10-year bond yields fall further then their price will rise. However, even if the yield say fell to zero in the year 2025, five years from now, then an initial $100,000 investment would be worth $108,400 representing a return of only 1.7 per cent p.a. which is still below the 1.8 per cent inflation that we have been witnessing. So, while an allocation to bonds in a balanced fund makes sense in the past, the assumption going forward that it deserves a role faces serious doubts.

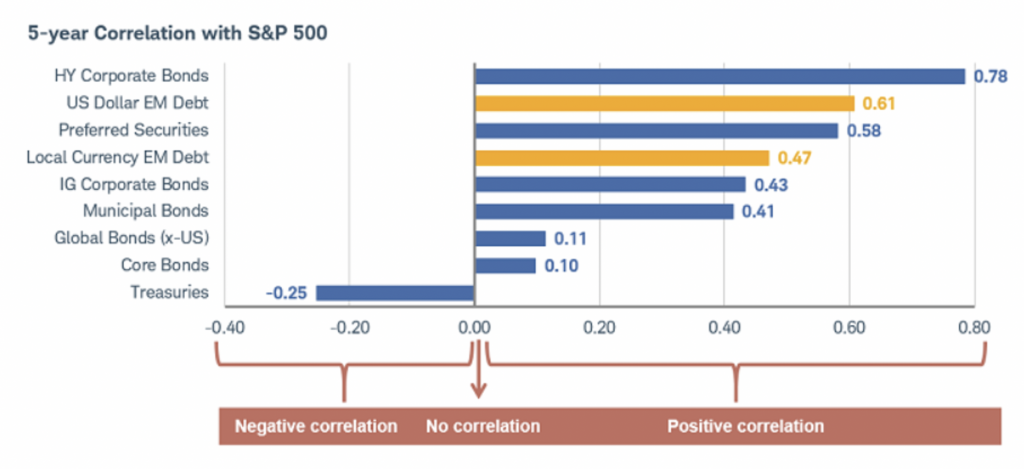

Well the story is not much better here either. The US 10-year Treasury yield is 0.73 per cent, Japan is 0.02 per cent and in Europe most places are yielding negative returns such as France -0.3 per cent, Germany yielding-0.56 per cent and the UK positive but at just 0.24 per cent. If you did want some yield you can look into emerging market sovereign bonds such as Russia offering 5.97 per cent, Egypt at 15 per cent, South Africa at 9.4 per cent or Uganda at 15 per cent but the problem an investor faces here is that when you want the defensiveness of bonds – usually during a stock market sell off, then emerging markets bonds tend to follow the price movements of equities and sell off as well. This can be further exacerbated if the bonds are held in local (the emerging market’s own currency) which can tend to be sold off more heavily when compared to USD and even the AUD. High yield bonds (corporate bonds below investment grade) also act in a similar way to emerging market debt in an equity market sell-off. These correlations are illustrated in Figure 2 below.

Figure 2. – 5-year correlation with S&P 500 Equity index

Are there alternatives?

A well-diversified portfolio contains investments which offer differing levels of return and correlation between those return streams. So if bonds are not generating acceptable total returns, or in the case of emerging markets bonds or high yield securities where they are too correlated with your equities holdings, then maybe other assets like market neutral funds, or real assets like natural resources, property, gold, infrastructure (roads, airports, railroads) or dare I say it some hedge funds might be worth considering.