Is it time to cash in?

There are four major criticisms for holding cash as an investment. But what if there was a simple alternative that went some way to invalidating those criticisms?

The four major reasons cash is seen as an inferior investment are as follows:

- Erosion from inflation

Holding cash exposes a portfolio to inflation risk, where the purchasing power of money diminishes over time as prices rise. In the short term, this can be exacerbated during periods of high inflation (e.g., spikes due to economic events like supply chain disruptions), leading to immediate real losses if cash yields fail to match inflation rates. Long-term, even moderate inflation compounds, historically outpacing low-interest cash returns and significantly reducing the real value of holdings – for instance, at a 3 per cent annual inflation rate, cash could lose half its purchasing power in about 24 years. In other words, whatever you enjoyed spending your money on at the age of 30, you would only be able to afford half as much at age 54.

- Opportunity cost of missed growth

Cash typically earns minimal returns compared to riskier assets like stocks or bonds, resulting in foregone growth opportunities. Short-term, this manifests as “cash drag” during market rallies or bull runs, where investors miss out if they remain sidelined waiting for better entry points. Over the long term, the compounding effect of higher-return investments amplifies this criticism; historical data shows equities often deliver 7-10 per cent average annual returns versus cash’s 1-3 per cent, potentially leading to substantial wealth gaps over decades.

- Low or negative real yields in certain environments

In low-interest-rate regimes, cash generates insufficient income to offset even basic costs, sometimes yielding negative real returns after inflation and taxes. Short-term factors include fluctuating central bank policies that suppress rates (e.g., during economic stimulus), making cash less attractive for income generation. Long-term, persistent low yields – common in prolonged low-growth economies – can hinder portfolio income streams, forcing investors to dip into principal or seek riskier alternatives, ultimately undermining financial stability and retirement goals.

- Liquidity trap and behavioural risks

Holding excessive cash can lead to a liquidity trap, where investors remain overly cautious, hoarding cash due to fear of market volatility or economic uncertainty. In the short term, this can result in missed investment opportunities, for example, during market recoveries, as investors hesitate to deploy cash, expecting further downturns. Long-term, this behaviour can become habitual, fostering a risk-averse mindset that prevents portfolio growth and hampers returns. Data suggests that timing the market is notoriously difficult – studies like those from Dalbar show that emotional decisions often lead to lower returns compared to staying invested, amplifying the cost of holding cash indefinitely.

What if the curse of cash could be lifted?

Holding cash erodes purchasing power when the return on cash is lower than the rate of inflation.

But what if your investments could generate a higher return than inflation?

For the last eight years, the Aura Private Credit Income Fund (for wholesale investors) has generated a compounded (income reinvested) return of 9.55 per cent per annum*, handily outpacing inflation over this period, ensuring investors have increased their purchasing power.

*Performance of the Aura Private Credit Income Fund since its inception on 1 August 2017. Net returns after fees and expenses as at 31 July 2025 and assumes reinvestment of distributions.

The Aura Private Credit Income Fund has generated this return by producing monthly income with no negative months since inception in August 2017.

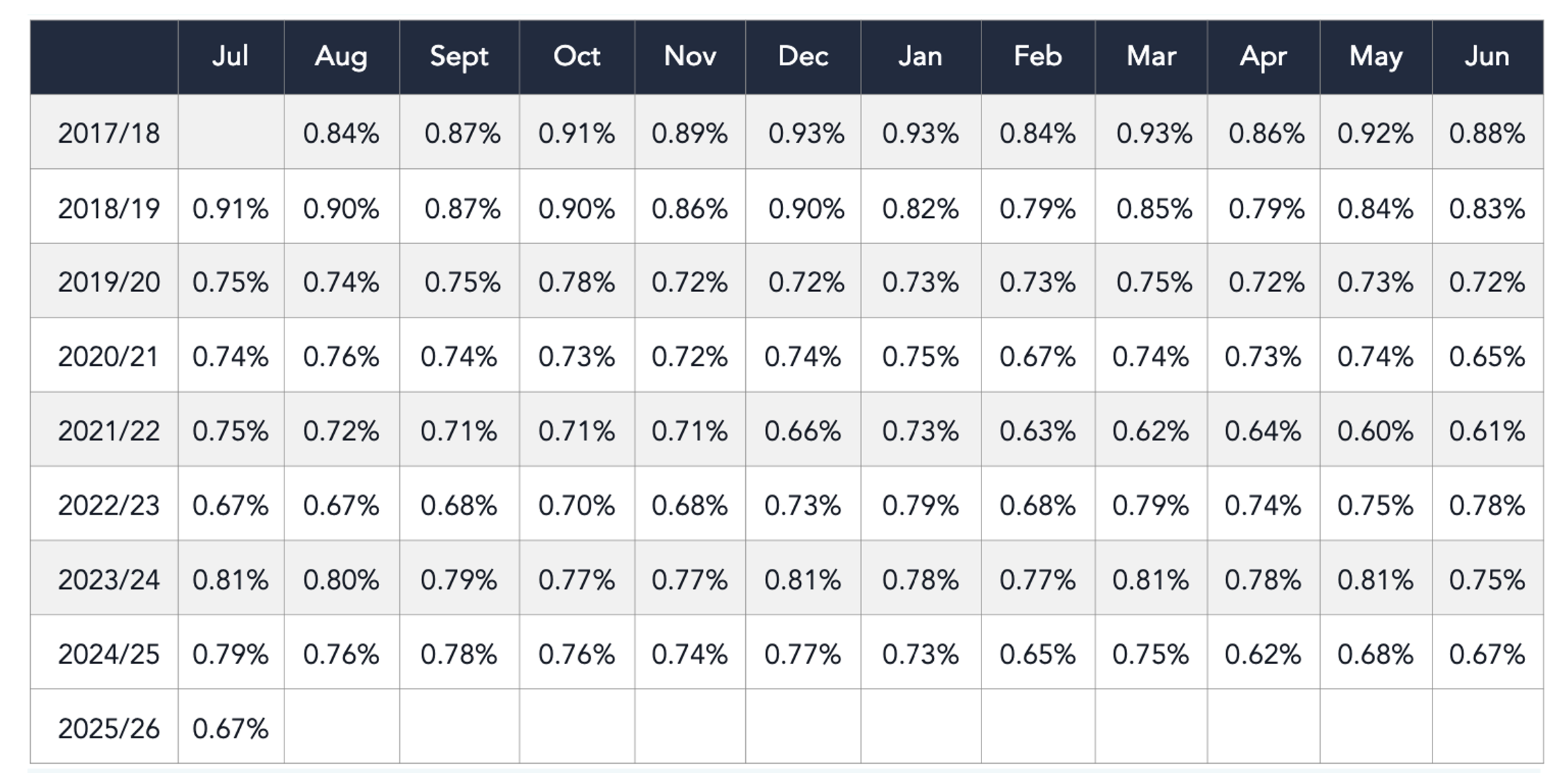

Table 1. Aura Private Credit Income Fund income since inception.

Past performance is not a reliable indication of future performance.

Inflation in Australia has caused a basket of goods and services valued at $100 in August 2017 to have risen to 127.50 in June 2025. One hundred dollars invested in the Aura Private Credit Income Fund at its inception in August 2017 with distributions reinvested would be worth $207.43 at the end of July 2025, handily beating inflation.

Holding cash is also seen as having high opportunity costs – you might miss out on gains in other assets, for example, you might miss out on gains from the stock market. But what if other investments produced a similar return as the stock market without the volatility associated with public markets?

If you are worried about the stock market’s stretched valuations, or the impact Donald Trump could have on geopolitical stability and the independence of the US Federal Reserve you might have considered parking some money in the safety of cash But by doing so, you might also have been concerned that parking your money in cash could mean missing out on further gains or having your purchasing power eroded by inflation.

There are alternatives to the stock market that work to preserve and enhance your purchasing power, and some of those alternatives have a track record similar to that produced by the stock market. You may not be missing out at all.

If you would like to learn more, please contact David Buckland, CEO or Rhodri Taylor, Account Manager, on 02 8046 000. You can also learn more by clicking here: Find out more about investing in Private Credit with Montgomery.

Disclaimer

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not a reliable indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form that accompanies the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.