Is it time to buy gold?

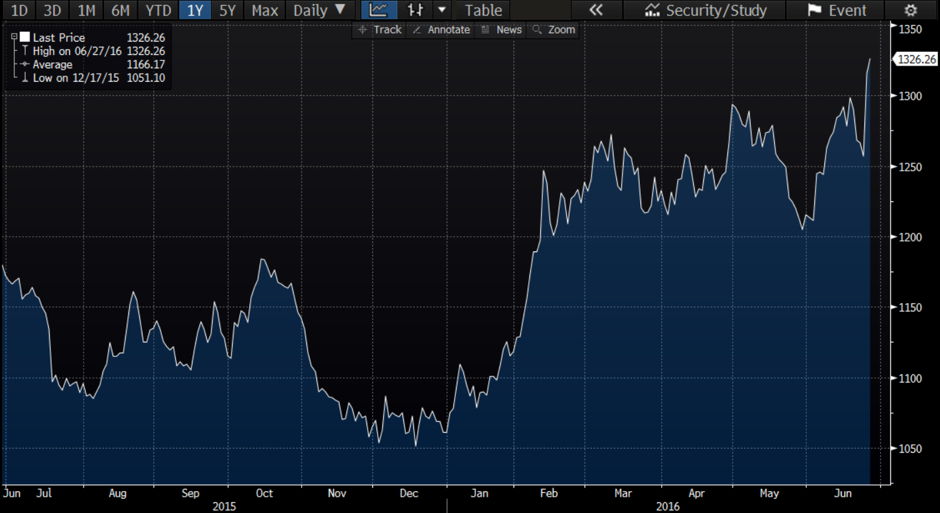

When the world gets uncertain, gold invariably becomes the go-to ‘safe haven’ for many investors. And, sure enough, since the start of 2016, the gold price has risen strongly. With global jitters around the Brexit vote, has the case for buying gold just got stronger?

From lows of less than US$1,100/oz at the start of 2016, the price has risen to above US$1,300/oz. This has prompted renewed interest in gold as an investment option at a time when other assets are, for various reasons, looking a bit underwhelming. While we understand that market uncertainty increases the attraction of gold as a store of wealth, the issue for us has always been making gold stack up as an investment. Central to the traditional idea of investing is the notion that the future cash flows generated by an asset provide a satisfactory return on the capital outlaid to acquire it. It is these cash flows that give financial assets their value and allow an investor to estimate where price and value sit relative to one another.

While we understand that market uncertainty increases the attraction of gold as a store of wealth, the issue for us has always been making gold stack up as an investment. Central to the traditional idea of investing is the notion that the future cash flows generated by an asset provide a satisfactory return on the capital outlaid to acquire it. It is these cash flows that give financial assets their value and allow an investor to estimate where price and value sit relative to one another.

Gold, however, does not get its value from cash flows. There are none. Some may argue that in a negative interest rate world a cash flow of zero is more than enough to service any debt used to acquire the asset, but that is not a rabbit hole that we would want to venture down.

If gold can’t be valued in the way other financial assets can, we are left with the idea that gold is worth whatever people think it is worth at the time; an amount that tends to be higher in times of uncertainty, and lower in times of stability.

But nowhere is there an ‘anchor’ to tell us whether the current level may be too high or too low.

If you have the ability to predict changes to the future level of uncertainty, then gold may be something you can profit from. You might also view it as an alternative store of wealth to other currencies.

As an investment in the traditional sense of the word however, you probably need to look elsewhere.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

They say gold is not an investment because it has no yield – then why are they investing in bonds with negative yields?

http://www.marketslant.com/articles/market-brief-opec-wins-uk-grins-and-gundlach-calls-bond-market-crazy

Indeed. A historical first and a difficult concept to get one’s mind around.

I just sold some gold. The last time gold was this high in USD terms we were at parity with the USD. The AUD used to mirror gold price fluctuations but seemingly no more. As the AUD has crashed so much in recent years against the USD, the return on my gold investment in AUD was good. If someone holds a view the AUD is to go lower against the USD it may be a good hedge. This can also be achieved by investing in gold producing companies if desired.

Gold is not an investment in the common sense of the word, it is an insurance policy against financial excess and credit market dysfunction. I believe its role has been overlooked for decades due to the growth in credit and flawed confidence in the CAPM which is now known to be based upon “near enough” but not true models of the underlying dynamics of financial market prices (returns) (see “The MisBehavior of Markets” http://www.goodreads.com/book/show/665134.The_Mis_Behavior_of_Markets).

We know that returns on investments are not distributed on bell or Gaussian dynamics but rather on power law dynamics. This is very important as Gaussian distributions have finite standard deviations whereas power law distributions’ variance is infinite.

Sure you can save by not paying insurance on your home for years and years and look very clever, but eventually a fire or flood will wipe out your house. Gold is the same. All prudent investors should have a permanent allocation to the only financial asset that has no credit risk of around 5 to 10% of their portfolio. Given there are few with such an allocation at present (gold is less that 0.5% of financial assets value in the world) its upside cannot be underestimated.

I not buying any more but deciding if I should take some profit after this recent rise.

Hi Tim, as a value investing firm I’m very glad you don’t invest in gold. Its not value investing. Let the macro funds deal with it.

Kelvin

Personally i think the european union will eventually

collapse in its current form . i know for a fact that the majority of swedes want out and not just the older generation .. So i personally can se gold going much higher ..

Germany will eventually go back to the d-mark but thats many years away . Their is weak support in denmark and sweden netherlands for the european union and swedens second biggest politichal party wants a referendum to leave .. it will be a domino effect in my opinion . im a free market free trade libertarian capitalist i voted for sweden joining eu i but i would vote leave now . best reg

as an alternative to shares gold does not stack up never has .

problem is people allways try to compare gold to shares but gold is money it is held as an alternative to $ currency it pays no yield but it does not have to cause currency loses it value over time some more than others . if your cash reserve is for ex 20% maybe having half in gold makes sence .

Gold is not the only asset class that is very difficult to value. People disagree all the time about the price of shares and property also

We’re in the midst of currency wars. No country wants their currency increasing much. So we keep hearing about intervention.

Whilst I agree with your sentiments Tim, I hold some precious metals for insurance against irresponsible central banks. .

“Investing” in gold has always been somewhat speculative. Yet it can be highly profitable and central banks do keep reserves of it as hard currency, for a reason.

Investing in any company carries risk, as the future is unknown. Any update on the Montgomery Funds UK exposures like HGG and BTI? All seems very quiet on the telegraph!