Is gold going to $20,000/ounce?

Every few years – usually after gold has enjoyed a significant rally (the narrative always comes after the fact) – headlines pop up with increasingly bold predictions: “Gold is going to US$20,000 an ounce!”

To anyone outside the financial world, and with gold trading at about US$3,285 an ounce as of 16 April 2025, that sounds like hitting the jackpot – especially if you’re already holding some gold.

But before you imagine retiring early, there’s some useful concepts to understand with respect to the drivers of gold’s price.

Gold as a hedge against inflation

One framework says that gold is nothing more than an inflation hedge. Those who proffer this idea suggest, in simple terms, gold isn’t gaining value. Instead, they argue, the U.S. Dollar is losing value. Beyond the daily volatility triggered by Trump’s on-again, off-again tariffs, gold isn’t “going up” because it’s becoming more valuable. It’s going up because the money used to price it (the U.S. dollar) is losing its purchasing power. They suggest one thinks of gold as a constant – like a yardstick – and the U.S. dollar as a shrinking ruler trying to measure it.

Supporting their view is the idea that over the past century, the U.S. dollar is estimated to have lost roughly 99 per cent of its purchasing power. That means what US$1 purchased in 1915 now requires US$100. Gold’s inflation hedge status is reinforced by the observation that gold’s price has increased right along with that decline in the U.S. dollar – not because gold became more valuable, but because the purchasing power of the dollar declined.

Using this logic the price of gold tracks inflation. Back in 1980, one ounce of gold could be purchased for US$660. Fast forward to, say, 2020 for example, and an ounce of gold traded at US$2,060. Continuing the logic, in both years, one ounce of gold bought about the same amount of everyday goods – rent, groceries, fuel, etc.

According to the ‘gold-is-an-inflation-hedge’ logic, gold may reach US$20,000 in the future, but not because it’s suddenly more “valuable.” They suggest it will be because prices everywhere have expanded almost six-fold. A litre of milk? Maybe A$18. Renting a two-bedder in inner Sydney? A$4000 to A$5400 per week. You’re not richer owning gold – you’re just treading water amid a deterioration in the purchasing power of the dollar.

What does history say?

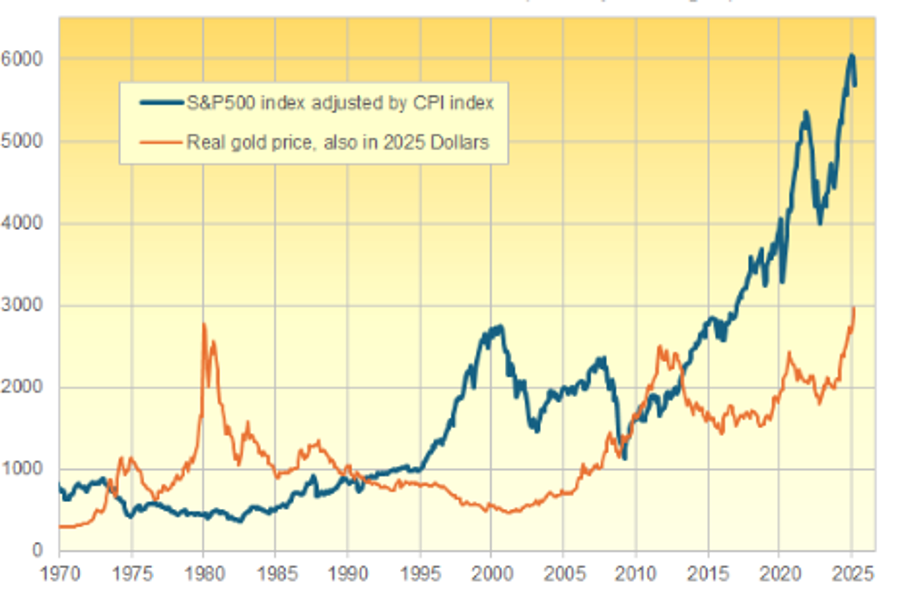

Wouldn’t it be neat if markets always acted in a way that made sense? But because they don’t, the above logic may not hold water. Indeed, a more nuanced examination of history suggests gold’s role as an inflation hedge has not always met expectations. Figure 1., shows the U.S. inflation-adjusted price of gold.

Figure 1. Gold versus U.S. equities in real terms (inflation-adjusted)

Source: LBMA, S&P, St Louis Fed

Figure 1., reveals, that gold’s role as an inflation hedge has worked only in very recent times. Only in late 2024 did the inflation-adjusted price of gold (using the Federal Reserve’s preferred measure of inflation – Core PCE index) rise above the 1980 peak.

In the 1980s, the nominal price of gold declined by about two per cent per annum; in the 1990’s it declined by three per cent per annum. In those two decades gold was definitely a very poor inflation hedge.

And while some may point out that commencement points matter and gold has done well as an inflation hedge recently, the reality is the S&P500 has done a whole lot better as an inflation hedge (Figure 1.).

So, if you want an inflation hedge, invest in the equity of successful businesses over the long term, or invest in a high quality private credit fund that yields an annual return greater than the rate of inflation.

Interest rates and gold

Further, many suggest demand for gold rises when interest rates fall. The reverse should also be true – when rates rise, gold demand should fall, and its price should reflect that. Yet, between March 2022 and August 2023, when the U.S. Federal Funds rate rose from 0.08 per cent to 5.33 per cent (and inflation screamed higher), the price of gold tracked sideways, albeit after a brief 20 per cent dip between March and October 2022.

A bet on fear

Then there are those, including your author, who label gold as a bet on fear. When fear increases, so does the price of gold in nominal terms. Some say gold is where investors go when they are worried about exogenous events that could cause the stock market to crash. But this too is not always true. In 2024, the stock market rose, and gold went up too. And the last time anything like that happened was in 1980.

Markets are always changing and evolving and the narratives people fit around the price always come after the fact.

China reducing dependence on the U.S. dollar

The simple reason for gold’s recent price rise is that central banks around the world, especially China’s are buying a lot of it.

China’s significant gold purchases in recent years are driven by strategic objectives aimed at enhancing its economic resilience and reducing reliance on the U.S. dollar. For them, gold appears most definitely to be a hedge against what one presumes they are predicting will be a declining U.S. dollar.

A primary motivation for China’s gold accumulation is to diversify its foreign exchange reserves away from the U.S. dollar. By increasing gold holdings, China aims to bolster the credibility of its currency, the yuan, on the international stage. This strategy aligns with broader efforts by countries like Russia and India to minimise reliance on the dollar in global trade and finance. This movement is partly driven by concerns over the dollar’s dominance being used as a geopolitical tool, prompting countries to seek alternatives like gold to safeguard their economic sovereignty.

Some analysts also interpret China’s stockpiling of gold as a precautionary measure against potential economic sanctions that could arise from geopolitical tensions, such as a conflict over Taiwan. By holding substantial gold reserves, China seeks to insulate its economy from external financial pressures and ensure stability in adverse scenarios.

China’s aggressive gold purchasing strategy serves multiple purposes: diversifying its reserves, enhancing the yuan’s international standing, and preparing for potential geopolitical and economic challenges.

Is $20,000 per ounce of gold a win?

Irrespective of which school of thought you subscribe to, if gold hits US$20,000 per ounce, you might be surviving a financial storm others weren’t prepared for. But it won’t feel like a win. It’ll mean the U.S. dollar has likely collapsed or nearly done so, or war between several nuclear powers has broken out. And if that happens, it won’t matter what the “price” of gold is anymore – because the system used to price it (the dollar) may no longer be functioning normally.

If the temperature is so hot that it breaks the thermometer, it no longer matters what the temperature is. It is simply too hot.

Are you able to comment on PLS (Pilbara Lithium)? Thanks.

Hi Anne,

We haven’t covered Pilbara recently. However, please find below some older articles from 2024 mentioning Pilbara:

https://rogermontgomery.com/rio-tinto-half-year-results-are-the-shares-reasonable-value/#more-47296

https://rogermontgomery.com/pilbara-minerals-the-asxs-most-shorted-stock-yet-poised-for-long-term-success/

Thanks.

Gold is not money Nevada. Humans have arbitrarily given it a price, like they do with potatoes and cars.

It’s a commodity.

Have you ever used Gold to purchase something in a store ?

Hi Carlos, you’re right. We have written many posts explaining gold is an inferior long-term investment to assets that produce income. I have also regularly explained it’s nothing more than a bet on fear increasing. And yes, Gold is not accepted as legal tender in any country today but in some regions, particularly in parts of Africa, the Middle East, and South Asia, gold is used in informal barter or trade systems, especially in areas with unstable currencies. However, this is not equivalent to being legal tender, as it’s not mandated by law for settling debts or taxes.

Gold physical gold should not be compared to shares ,its money and should be compared to similar assets , gold should be bought as insurance as an alternative to fiat , not as an alternative to shares , you buy gold so you can sell the gold buy shares or producing assets when the right time arrives ..

Thank you for your thoughts, Nevada.