Is Flight Centre a Bargain?

Following a recent trading update, Flight Centre (ASX:FLT) shares are trading at around their lowest levels for some years. In its announcement to the market FLT attributed the weak trading to a wide assortment of issues including: the Federal election; Brexit; airfare price wars; investment in key improvement strategies and the Zika virus.

Each of these likely has some contribution to make to subdued short-term performance, and to the extent these issues are temporary, a question arises as to whether FLT shares may now represent appealing long-term value.

On the face of it, FLT shares are trading at undemanding multiples, and given the business has a history of generating solid growth and healthy returns on equity, it is reasonable to ask whether the market has become too focused on the short-term. However, there are a couple of important points to factor into a longer-term analysis.

The first point is that while the specific list of maladies above may well be temporary, maladies of some sort are very much a recurring feature of the travel industry: The Federal election will not confer long-term certainty on Australian politics, a Brexit vote will not end European instability, and Zika will not be the last pandemic we see. Indeed, the recent environment for international travel does not seem especially calamitous in the context of history.

The second point is that in working through the near-term concerns, we need to keep sight of longer-term structural changes that may be at work, one of the important ones being the impact of the growth in online travel services.

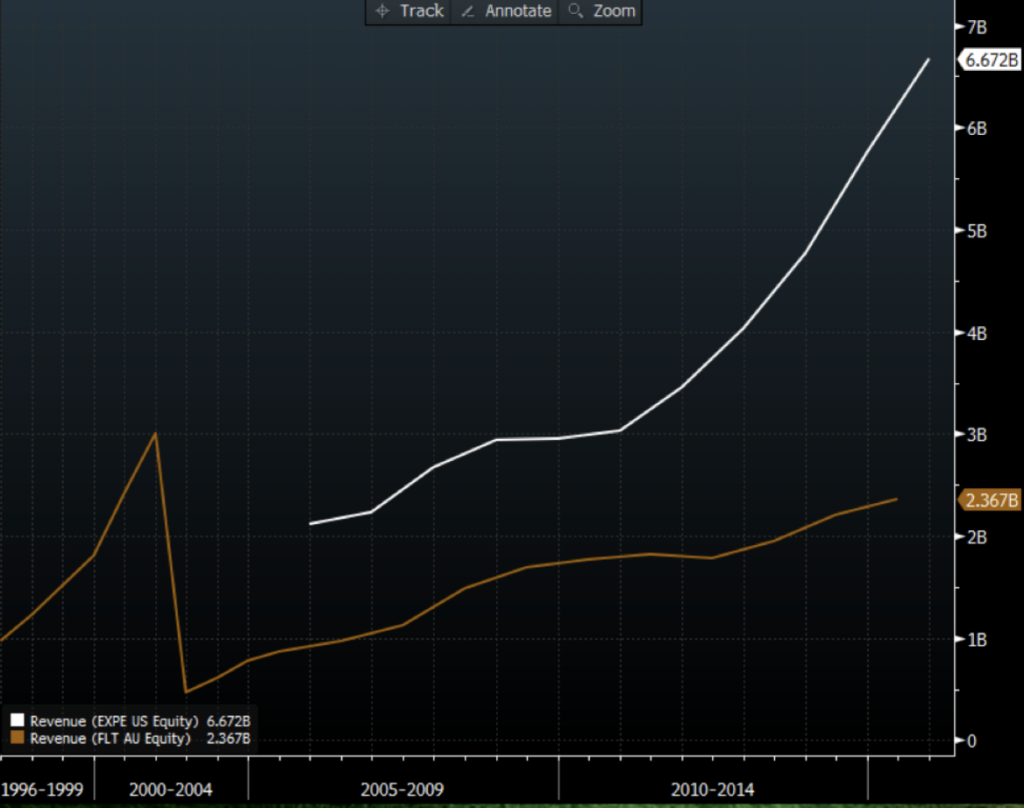

To date, FLT appears to have weathered the storm fairly well, however, it is undeniable that structural change is making the travel industry more competitive, and eroding the advantage of businesses with a large bricks-and-mortar presence. The chart below, which shows the revenue of Expedia (in white) and FLT (in brown) illustrates the point. Expedia is growing revenue quickly, and unless consumers and businesses have greatly increased their travel as a result of the online offerings, growth of businesses like Expedia must come at the expense of the incumbent players.

When we look more closely at FLT’s revenue growth, we see some additional areas of concern. For several years, FLT’s LFL revenue growth has been weak, meaning that revenue growth is a function of adding more stores. If the store rollout stops, so too does the growth. In addition, we see some signs that as time passes FLT needs to invest more in assets to generate an incremental dollar of revenues.

All of this points to the possibility that structural change may be a significant headwind for FLT in the years to come. Indeed, it would be surprising if this were not the case, given the increasing convenience and efficiency of booking travel arrangements online, and the transparency now available to consumers.

FLT is a well-run business, and it may well continue to deliver good results for shareholders. However, to make a persuasive investment case one needs to be comfortable that the recent weak trading experience is short-term, and the structural threat is relatively benign.

We aren’t.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

I’ve watched FLT for a few years now and there is too much risk for me. Although they weren’t hit by the international competition eg Expedia, BookIt, AirBnB, there are loads of travel sites. You could argue they don’t compete directly….. I just wanna keep away. I know people who use FLT agents to book their travel because its so boring booking hotels online and booking flights, I hate it, it is the most boring thing I find. But the internet is getting much more sophisticated, I’ve noticed in the last 2 years there has been so much development online and it’s pretty obvious it’s hit FLT. The internet has changed travel in so many ways….

* cheap flights

* hotels don’t sell through travel agents as much which is much better for the hotel because the travel agent would give the hotel rooms back to the hotel last minute after they couldn’t sell them.

* AirBnB

* various travel services

The thing a lot of people got wrong with the internet (by the way, I was one of the first people in Australia on the internet, I used it in my university studying computer science in the early 90’s) is…. you put something out to the public and there is going to be a lot of creativity. At first the internet was just static HTML web pages, it became so much more than that. Who predicted facebook, Youtube, apps, multiple changes in the music and travel industries and almost every single industry that has ever existed. NO ONE predicted it. The dot com boom and bust was just an immature IT bubble based on wacky predictions.

Who would’ve thought you would buy something second hand from someone you’ve never seen, ebay got around that by providing feedback and ratings of buyers and sellers.

More creativity is happening in the travel industry. In media, the amount of print keeps going down and the rates for online advertising keep going up, change is still happening.

Back to FLT, people who prefer to speak to a travel agent, well I just think there is risk that will go online too, and I think it probably will mostly. New ideas will come up, an app will come out that provides a very nice service.

FLT is just too much risk for me, therefore I can’t invest.

You both have solid reasons to support your arguments. To date, FLT has managed to avoid the disruptors.

Hi Tim,

You say it’s ‘undeniable’ that structural change is making the travel industry more competitive. Um, you haven’t given any proof and which travel industry? Online or full service? Comparing Expedia’s growth to Flight Centre is so misleading. You may as well compare a software company or a resources company to Flight Centre given their different business models. There is some crossover for sure, but really they are very different. For one, Flight Centre offers so many services that Expedia just can’t and doesn’t.

And who’s to say that Expedia’s growth isn’t coming at the expense of other online players, or that the market is creating its own growth as you suggested?

It’s the same old argument people have used for years to deride Flight Centre’s bricks and mortar business. Until a computer can think like a human, people will continue using travel agents to book their travel especially where it’s slightly out of the ordinary – which is exactly where pure online travel sites break down. As soon as a small amount of customisation is required, people will turn to a travel agent while others find it more convenient to pay an agent to book and handle it all for them.

It’s like suggesting that home cleaners wont have a business because we can all clean our own homes.

And your assumptions appear to relate only to leisure travel, what about corporate travel? Wholesale?

Then there’s also Flight’s diversification into tours, and many other travel-related services.

People thought the movie theatre business would die after DVDs were invented, and that online retailing would kill shopping centres. Digital music and movies were also supposed to kill the likes of JB Hi-Fi. It hasn’t happened so far and its unlikely to happen to Flight Centre.

Thanks Mike. Always good to get the counter view. There wouldn’t be a market without buyers and sellers holding diverging views.