Is BigAir Flying High?

The subject of telecommunications advances and the companies that make up the telco sector are regular topics of discussion at Montgomery Investment Management.

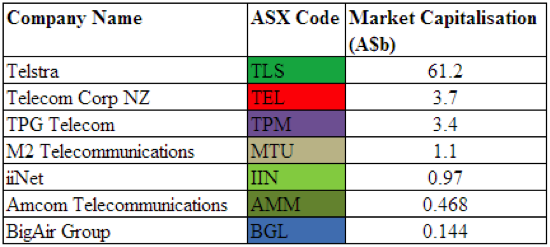

The group’s stalwart is of course Telstra, but despite its popular acceptance as a ‘blue chip’ company, we have tended to avoid investment and preferred, and still own, a number of the second tier competitors.

A few might criticize a process that steers its operators and funds away from Telstra, but a simple comparison is all that is needed to see that Telstra doesn’t “stack-up” against the other incredibly attractive opportunities on offer.

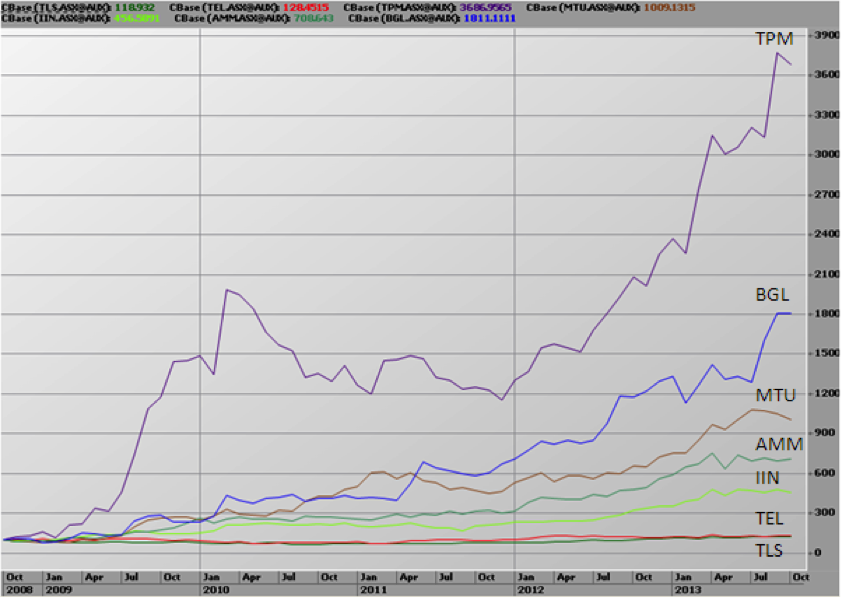

Remembering that we believe there is a strong correlation over the long term between a business’s economic performance and its share price performance, you might be interested in the following comparison of the capital movements (excluding dividends) of a number of listed Australian telecommunication companies, since October 2008. Where would you have preferred to invest?

As they say, a picture tells a thousand words and several much smaller telecommunication stocks have had stellar gains in the past few years.

Demand for internet connectivity (what we refer to as “the internet of everything”) and mobile telephony is booming and smaller players are eating into the market share of the incumbent. For this reason, Telstra ranks poorly on absolute growth and market share growth metrics.

Gains have been especially strong for TPM, BGL, MTU, AMM and IIN as each company continues to consolidate a highly fragmented industry – and the market rewards their relatively stable, predictable and recurring revenue streams.

As an aside, if you had built a portfolio replete with such businesses, would it matter if this week we woke up to discover that the US had defaulted on its debt? If anything, the ensuing volatility should provide a temporary opportunity to buy these businesses at even more attractive prices.

Each and every month, more than $100 is direct debited from the bank accounts of millions of Australians to fund their telephony and internet appetites. Just knowing that revenue can be relied upon to come in the door each month, each quarter, and each year, despite any ‘external shock’ enables a business to accurately budget, reward staff consistently and plan expansions with fewer surprises and greater focus.

Investors therefore who have acquired higher quality telco stocks have benefitted from their earnings visibility and “defensive growth” characteristics and have been well rewarded, and we expect, are likely to continue being so.

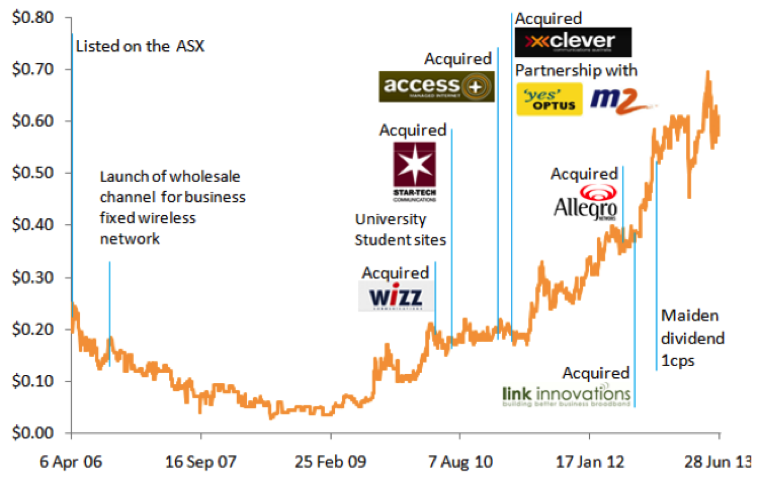

Let’s focus on just one of these companies. Whilst not the best performing stock in the sector over the past five years, BigAir Group Limited (BGL) is one of the better performing small capitalisation telcos we have surveyed. Interestingly, it remains one of the sector’s lower profile stocks.

BigAir owns and operates Australia’s largest metropolitan business fixed wireless broadband network providing fixed wireless internet services to businesses in capital – and some regional – cities.

The fixed wireless division contributes the majority of the business’s revenue, while its community broadband division, which offers internet services to the student accommodation market, provides the rest.

Companies use BigAir’s services for direct high-speed internet access and to extend their local area networks to wider area networks, and connect their outlets, employees, customers and suppliers nationwide.

The company has grown significantly since it first floated in 2006, raising $7 million at 25 cents a share, and since 2009 when, after a string of acquisitions, its shares were trading at just 3 cents and its future was uncertain.

However, under the guidance CEO Jason Ashton, the business began to build a very strong base, achieving strong organic growth and delivering the cash flows needed to continue funding smaller, astute acquisitions.

As illustrated above, BigAir has embarked on a significant growth-by-acquisition strategy, buying competitors since listing and extending its footprint in key regional markets, its fixed wireless reach in cities and its share of the fast-growing tertiary student market for internet services.

When integrated under one roof, they have given the group the scale and efficiencies needed to create the highly profitable business it is today. But that’s not where the story ends.

BigAir enjoys significant tailwinds. As acceptance of fixed wireless as a reliable, high-speed service rises, more businesses are demanding wired and wireless internet services to ensure uninterrupted web access as they take advantage of innovation such as cloud computing.

BigAir’s expanding reach in regional markets also offers new opportunities, as do student accommodation internet services, which could grow faster than the market currently expects as international student enrolments recover on the back of a lower Australian dollar.

A key risk for BigAir is how the National Broadband Network (NBN) rollout and implementation will affect demand for its services. Another risk is increasing competition. TPG, with their recent acquisition of 2×10 MHz spectrum in the 2.5 GHz band, will be able offer innovative and value-adding products to its customers that are similar to those offered by BigAir, particularly in the increasingly important wireless broadband market.

BigAir believes that the NBN will create opportunities and that there will be pent-up demand for super high-speed broadband as hype builds. Interestingly, BigAir’s network can deliver NBN speeds today.

BigAir has carved out a competitive position in the business wireless market and it is racing towards the point where greater scale will produce even higher returns on equity, and greater free cash flow generation and value-add for shareholders. This is all being reflected in its increasing share price.

Enjoying organic growth combined with a continued focus on exploiting synergies from acquisitions, we are cautiously optimistic that BGL, in the years ahead, will be a bigger business then it is today while maintaining high levels of profitability. If the basic recipe for success is bigger equity and bigger returns on equity, then we believe BGL meets the grade. Value investors however will need to consider the price value equation and ensure that a sufficient margin of safety is available. And that’s a subject for another column.

That’s always been the trouble with statistics. They can tell a tale to suit a story.

I’m not really a Telstra lover but if you show the comparison graph for the last 3 years instead of for 5 years then the tale for Telstra is quite good with a 90% gain+ dividend.

And back in October 2010 it might have been easier to put your money in the safer option of the big kid on the block who looked cheap rather than the small cap who looked cheap.

Now that they all look expensive it’s not so simple.