Is Berkshire Hathaway a victim of its own success?

There is no debate about the long term investment success delivered by Berkshire Hathaway. Since 1965, compound growth in per-share book value of Berkshire has far outstripped growth delivered by an investment in the S&P500 Index, resulting in an exceptional long term investment experience for Berkshire’s owners.

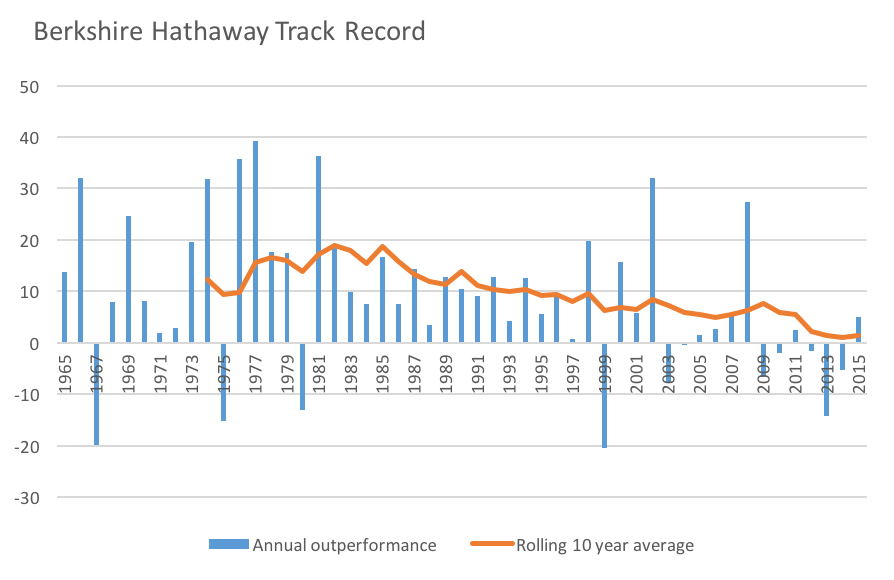

However, while the long term results are exceptional, the more recent results have been less so. The chart below shows the annual gap between growth in per-share book value and the return received on an investment in the S&P500 Index (in blue), and the rolling ten-year average gap (in orange). What the chart shows is that for recent ten year periods, the gap has been running at ever declining levels (albeit still in positive territory).

For anyone who subscribes to the Buffett philosophy – and that’s no small number of people – the question arises as to why this should be the case, and what it means for the ongoing success of this style of investing. It is possible that Berkshire has experienced a difficult period in recent times, but the long time frames and apparent consistency of the decline point to a lasting change, rather than something temporary.

Unfortunately, it is not easy to determine what factors might be contributing to such a change, and to what extent. However, we can begin with a list of some of the more likely contributors, which would include the following:

- Sheer size – it has become difficult for Berkshire to find investments that “move the needle”;

- Markets have become more efficient over time, and therefore harder to beat; and

- Berkshire’s investment style has become so widely adopted that it is now a “crowded” space.

There are no doubt other factors that could be proposed, but I suspect the above factors all make a meaningful contribution to the apparent decline. We offer the following observations:

- Size is undoubtedly part of the issue. As an investor grows in scale, the universe of meaningful investment opportunities inevitably shrinks. This is an issue for all fund managers, and something Buffett has noted in annual letters. Berkshire now has a market capitalisation of around US$350 billion, and even with global markets to fish in, that’s a lot of capital to deploy.

- It seems reasonable to expect that markets do become progressively more efficient over time. Natural selection means that successful investors, practices and innovations will attract increasing amounts of capital, while the less successful lose relevance. This is perhaps a double whammy for Berkshire, because a more efficient market can be expected at the large end of town, meaning that increasing size pushes Berkshire into a more efficient and more limited investment universe, and that limited universe becomes even more challenging over time.

- Finally, there is no doubt that Berkshire’s success has spawned a great many investors looking to follow a similar path. Over long periods of time Buffett’s willingness to share his investment wisdom may be contributing to the challenge Berkshire faces. Even without this sharing of wisdom, it is likely that there would be an army of followers seeking to adopt a similar philosophy.

We can’t tell from this what the future returns from following a Buffett style investment approach might be, but there are a couple of points worth keeping in mind:

- Scale is your enemy, and having a smaller pool of capital to deploy is a definite advantage; and

- Simply following an approach that has worked for others is unlikely to provide a material investment ‘edge’. The Buffetts of the future will probably not be those that emulate Buffett. They will be innovators who see things that others have not seen, and invest in ways that others do not.

Who’s up for a challenge?

Tim, could you bring together your thoughts from this piece on BH with the strong theme of Montgomery of low expected investment returns going into the future (e.g. the Norway piece from 27 October, the white paper on bond yields, etc)? I should say upfront that I agree with most of what Roger has been saying of late on this and regarding Australian property (though I have been bearish on property for a while now – and though I didn’t go “semi-naked up Kosciusko” I did try to keep up with Steve on the first day of his trek – of course a lot of ammo went into stopping house prices from falling during the GFC… and btw, where is Rory these days?).

What I am getting at is this. Whilst I agree with your depiction of the challenges that BH faces, Tim, I am not sure that you amply discussed the nuances (which admittedly is not easily done with the brevity required in a blog article) and the favourable factors it possesses with reference to the current and likely future investment environment.

When I look at that graph of rolling 10 year performance it springs immediately to my mind that BH peaked in the early to mid 1980s coinciding with a very significant historical point in markets – the commencement of the great bull market. It’s generally accepted that there have been two periods of serious under-pricing of BH stock – when markets have become irrationally exuberant with “new era thinking” overtaking tried and tested, old-school investing (of which Buffett and Munger are the poster boys) – the late 1990s tech bubble and the euphoria running up to US property market crash.

The current very high prices for stocks makes me wonder whether we aren’t in fact experiencing another significant relative undervaluation of BH which will become apparent over the years ahead. (I know that statement might seem silly with it trading around 1.3x book but one only need consider that 30 year US treasury bills with a 13.5% coupon were not seen as a lay-down-misere in 1984, but were a hard sell, to understand how difficult it can be to see opportunity in markets.)

Perhaps a case can be made that BH stock performance displays a general inverse relationship to the level of enthusiasm towards the stock market. I realise this might seem counter intuitive initially, but on deeper reflection, perhaps not…

The straightforward, ethical, common-sense approach is not particularly amenable to hyperbole and slick advertising by ticket clippers making hay while the sun is shining brightly on a bull market.

If we also consider just how rare it is for businesses to steer clear of the wall street crowd – the $million dollar fee consultants recommending all manner of mergers/ acquisitions/ general financial shenanigans – and the fads that short-sighted executives follow (such as paying out record high proportions of earnings, or even borrowing to pay dividends, rather than investing in growing the business, as they do presently) I would tend to think that BH has a huge advantage over many capital allocators that gives their managers a better than average chance – even with all of their challenges – of outperforming for at least another decade or more…

Any thoughts?

(Disclosures – I hold BH in my SMSF and intend to invest in Montgomery funds as soon as I can meet minimum allocation levels.)

Apologies if my first comment was not so clear. What I mean to ask is: what are your thoughts on the impact that Berkshire’s accounting conservatism has on this measure of performance given much of the company’s BV is not marked to market as it was when it was more heavily weighted to listed securities, particularly given both the operational headwinds low interest rates pose for the insurance subsidiaries (obviously a ‘real’ impact which can’t be discounted, but which is important given the very high probability that this is temporary), as well as the obvious yield chasing in asset markets over recent years (i.e. the stock price may not be a good substitute in the case of Berkshire if trying to argue that BV has been ‘unfairly’ penalised as a measure of performance)?

Appreciate the insights of your team, and well done on all your successful hard work.

Fair points Jake. In a world of expensive equities, the BV measure is likely contributing part of the gap we see.

Regarding the point on size, does the Montgomery fund have a figure where the fund will close? I imagine this is only applicable to the Australian funds at this stage, given the relative size of the investable universe

We do William. We will have greater clarity as we get closer to the limit, but at this stage we estimate that we will need to close the domestic long-only funds at a combined $2B. We’re about half way there.

Hi Tim,

It might be worth doing an article on the proliferation of small and microcap fund managers that are doing very well of late and what the future holds as investors put more money into them.

Phil

Hi Tim, yes is Montgomery looking to set up a small cap fund?

Thanks.

Kelvin

Not at the moment, Kelvin. Small caps is an area where good outperformance can be achieved, but we can access reasonably small companies with the existing funds, so incremental value add is limited.

Hi Tim, thanks for putting this up for discussion. I think that perhaps another factor is the divergence between conventional accounting practise and that which is applied at Berkshire. Specifically, the avoidance of marking up (but still marking down where required) non-traded asset values where not required by GAAP in combination with the increasing importance of these balance sheets assets and the effect of low interest rates on capitalised earnings for Berkshire’s market ‘benchmark’ competitor. While cash produced by Berkshire’s wholly owned businesses gets added to book value or can be translated into other assets (e.g. wholly owned businesses, stocks etc.), there is no substantial tailwind for Berkshire’s book value while there are substantial headwinds for both its insurance and other financial businesses and, I imagine, its investment opportunities universe as a result of higher prices.

On this basis, I take the view that while the convergence trend between Berkshire’s per share book value results and those of the S&P is certainly real and material, the easily obtainable reported figures are likely to overstate the rate at which it is occurring and particularly so over the past 8-10 years. The ‘chase for yield’ that has been a feature of asset markets over much of this same period would also seem unlikely – without having looked at the numbers – to make the price of the stock an appropriate substitute for Buffett’s preferred measure (i.e. one that might capture the value uplift from lower rates), which I suspect is the main counterargument against my suggestions, given the lack of a yield to chase in the case of Berkshire – and perhaps even the rejection of the stock by a great many investors.

If you have a chance to look into this it would be great to see what you conclude.

Hi Tim, that’s really interesting. How is Montgomery evolving its investment style in light of this? (in relation to the long only funds).

Thanks very much.

Kelvin

Hi Kelvin. Some of the things we are focused on include understanding how we can best combine analyst research with insights from data analytics/machine learning, and developing better frameworks to identify and assess business quality.

Thanks Tim. Yes I would imagine data analytics/ machine learning may have great potential.