Is a BRICS gold-backed currency and bad idea?

The idea of a gold-backed currency proposed by the BRICS countries (Brazil, Russia, India, China, and South Africa) as an alternative to the U.S. Dollar has gained attention. However, there are numerous reasons why this concept is considered impractical and unwise. This article explores the challenges and drawbacks of adopting a gold-backed currency, highlighting historical evidence and expert opinions that point to its shortcomings.

The dominance of the U.S. dollar in the global economy

After Russia invaded Ukraine, U.S. $300 billion worth of Russian foreign exchange and gold reserves were frozen by Europe and the U.S. Treasury’s Office of Foreign Assets Control. Meanwhile, the U.S. trade war with, and sanctions on China has whipped up increasing fears similar ongoing reprisals for being bad state actors towards Western interests. In response the BRICS countries are proposing a gold-backed alternative currency to the U.S. Dollar, which is unambiguously the world’s reserve.

I am first reminded there is no honour among thieves, however there is a host of other reasons why such an idea is folly, least of all the failure of the Bretton Woods System in the 1970s. More on that in a moment.

The current Post WWII rules-based world order includes a currency system dominated by the U.S. dollar, which accounts for about 42 per cent of all currency transactions, according to the Society for Worldwide Interbank Financial Transactions, 59 per cent of global central bank reserves, according to The International Monetary Fund (with euros at 20 per cent, and the yuan just five per cent), enshrining its status as the world’s reserve currency, and almost every commodity, including oil and gold, trades in dollars. Even cryptocurrencies are paired predominantly with the U.S. dollar.

BRICS’ influence and economic standing

While the influence of a BRICS coalition and the establishment of a new reserve currency could be significant, including leading to a decline in demand for the U.S. Dollar, given the group commands 42 per cent of the world’s population, economically, they are less influential.

BRICS deliver just 23 per cent of total global output and are responsible for just 18 per cent of trade. And as an aside, according to the Society for Worldwide Interbank Financial Transactions, the Chinese yuan is used for just two per cent of currency transactions, as its non-domestic usage does not extend significantly even within Asia, or outside of trade-linked finance.

Historical evidence against the gold standard

According to the Washington Post, the “defining element for a reserve currency is where it is the second-most used currency for domestic transactions, and the U.S. dollar is pretty much the most-utilized method of exchange across the world after each nation’s own currency”.

“Far from being synonymous with stability, the gold standard itself was the principal threat to financial stability and economic prosperity between the wars.”

Barry Eichengreen, 1996, Golden Fetters: The Gold Standard and the Great Depression, 1919-1939

A gold-backed currency: logistical difficulties and geopolitical tensions

Some of the difficulties of an even partially gold-backed currency include the difficulty of moving gold bars around the world[1], the fundamental differences of the countries that make up the BRICS, the requirement of a single central bank, which China would want to dominate and which would therefore sit uneasily with India who is frequently defending its borders against China, and the unlikely scenario of replacing a liberal democracy-backed currency with a system dominated by a totalitarian state.

As Marcus Ashworth from Bloomberg points out “If the Organization of the Petroleum Exporting Countries cannot come up with a petro-currency, what chance does a random bunch of geographically disparate nations have?”

But fundamentally, the very idea of a gold-backed currency won’t work and is considered by many as a profoundly bad idea.

The return to the gold standard is at least partly motivated by the idea it will promote price and financial stability. This is simply wrong.

The gold standard’s impact on financial stability and economic growth

In his 2012 lecture Origins and Mission of the Federal Reserve, Ben Bernanke, then the Federal Reserve Board Chair identified four fundamental problems with the gold standard:

- When the central bank fixes the dollar price of gold, rather than the price of goods we consume, fluctuations in the dollar price of goods replace fluctuations in the market price of gold,

- Since prices are tied to the amount of money in the economy, which is linked to the supply of gold, inflation depends on the rate that gold is mined,

- When the gold standard is used at home and abroad, it is an exchange rate policy in which international transactions must be settled in gold, and

- Digging gold out of one hole in the ground just to put it underground again wastes resources.

The limitations of a gold-backed currency

Under the gold standard, both inflation and economic growth were more volatile that since the gold standard’s abandonment.

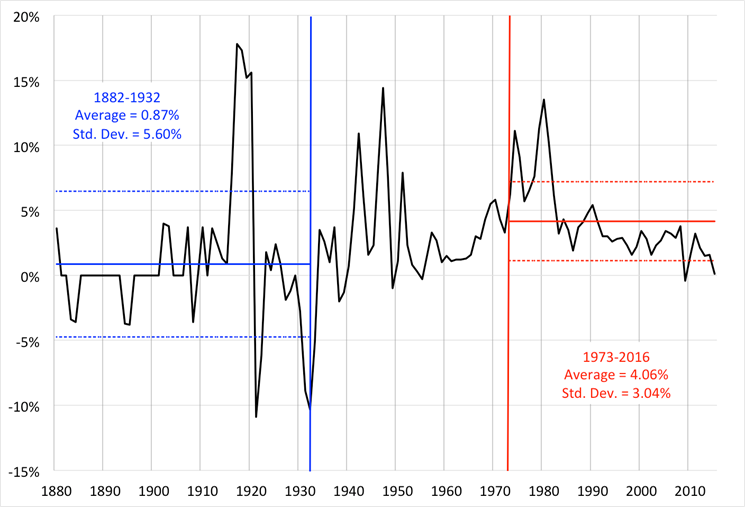

From Money & Banking, Figure 1., plots annual U.S. consumer price inflation from 1880, the beginning of the post-Civil War gold standard, to 2015. The vertical blue line denotes 1933, the end of the gold standard in the U.S. The standard deviation of inflation during the 53 years of the gold standard is nearly twice what it has been since the collapse of the Bretton Woods system in 1973 (denoted by the vertical red line).

Over the past 43 years inflation has been more stable than it was under the gold standard. Of course, isolating the influence of the gold standard is difficult. Advances in technology have increased productivity and, more recently, slowed wage growth, which has also had an impact on inflation. The most recent quarter century, however, is also the period during which central banks have focused more intently on price stability. In that period, the standard deviation of inflation is less than one-fifth of what it was during the gold standard.

Figure 1. Annual Consumer Price Inflation, 1880-2016

Source: Money & Banking, Federal Reserve Bank of Minneapolis.

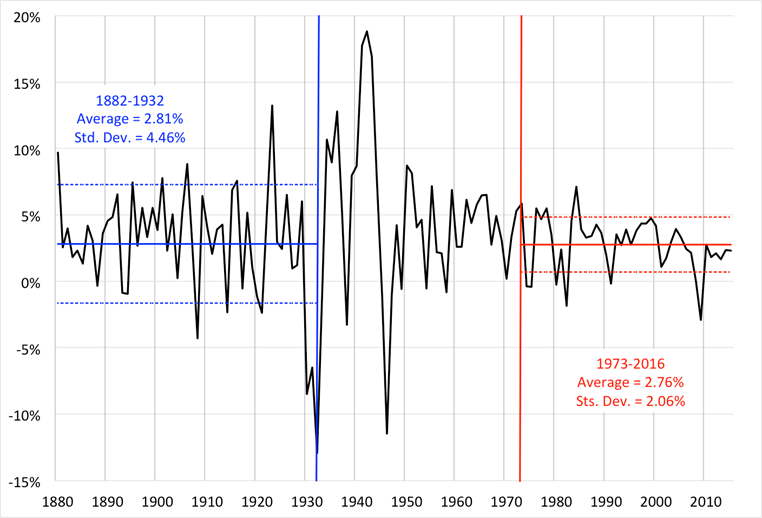

And with respect to economic growth, the picture is very similar. As Figure 2., reveals, the gold standard was associated with greater volatility in economic activity. Figure 2., plots a proxy for annual economic (and shows the standard deviation of economic) growth during the gold-standard era was more than twice that of the period since 1973. Even including the great financial crisis (GFC), the past 25 years has been even more stable.

It is also worth observing between 1880 to 1933 there were 15 business cycles identified by the National Bureau of Economic Research. That’s one recession every 3.5 years. Since 1972, the average is one recession every six years.

There were also fewer banking crises in the most recent fifty years than between 1880 and 1933. In the earlier period there were at least five banking/financial crises: 1893, 1907, 1930, 1931, and 1933. In the last fifty years, there have been two.

Figure 2. Annual GNP Growth, 1880-2016

Source: Money & banking, FRED and Romer.

It is reasonable to conclude less stability is associated with a gold standard.

A gold standard is a form of a fixed-exchange-rate system, which cannot protect against external shocks and invites speculative attacks.

Under a gold standard, a central bank’s liabilities – represented by its currency and reserves are a function of the amount of gold held in its vaults. In a deep recession, consumers and investors may fear a currency devaluation, which in the BRICS scenario would be at the discretion of…Beijing? Traders, investors and consumers would fear the central bank increasing the BRIC currency price of gold, taking their ‘BRICS’ to the central bank and exchanging them for gold. A self-fulfilling spiral transpires – the central bank loses gold reserves, compelling it to act precisely as traders had feared or forcing it to suspend transactions, which is what the Bank of England (BoE) did in 1931, when it was driven off the gold standard and again in 1992 when George Soros forced the BoE to abandon its fixed exchange rate.

And let’s not forget the gold standard exported the Great Depression from the U.S because a surplus country’s central bank can choose whether to convert higher gold stocks into money or not. A central bank can therefore have too little gold, but it can never have too much.

In the late 1920s, both the U.S. and France were running external surpluses, absorbing the world’s gold into their central bank vaults, including at the New York Federal Reserve (see Footnote 1.). Instead of allowing the gold inflows to expand the quantity of money in their financial systems, authorities in both countries tightened monetary policy to resist booming asset prices (gold standard is pro-cyclical). The result was catastrophic, compelling deficit countries with gold outflows to tighten their monetary policies (deflationary). As the quantity of money available worldwide shrank, so did the price level, adding to the real burden of debt, and prompting defaults and bank failures globally.

A gold standard also restricts a central bank’s ability to act as a lender of last resort – arguably the most powerful tool at a central bank’s disposal to mitigate banking panics. Under a gold standard, the availability of gold limits the scope for expanding central bank liabilities. Quantitative easing (QE) is off the agenda! Once again, a gold standard proves to be pro-cyclical. Had a gold standard been in place at the advent of the GFC, another Great Depression and a banking collapse would have followed.

Finally, because the supply of gold is finite and reliant on mining, its availability is supplied more slowly than present rates of economic growth. The long-term result is deflation and negative interest rates – and we know how that worked out!

The bottom line is a gold-backed currency would lead to greater volatility in inflation, economic growth and the financial system of the BRICS – if they choose to preference trading among themselves over western countries. A gold standard is pro-cyclical and therefore futile, if not witless.

[1] A gold standard in which international transactions are settled in gold, means a country with an external deficit—one whose imports exceed its exports—has to pay the difference by transferring gold to countries with external surpluses. The loss of gold forces the deficit country to shrink its balance sheet, reduce money and credit in the economy, driving domestic prices down. Under a gold standard, countries running external deficits face deflation. It’s pro-cyclical producing more volatility in the economy and in the economy’s key measures.

NAAA cumulative inflation went from about 100 to 300 from 1915 to 1970. Then coming off a gold standard inflation has gone from 300 to 2500.

Thanks for sharing, Ron.

Nice article. Seems like the limitations in the gold standard (mainly it’s restriction in being able to easily be moved through space thereby affecting its salability) throughout history, that have been remedied with the fiat system have new limitations, being that in some societies inflation spirals out of control under governments that take it too far with quantitative easing, for example Argentina.

What do you think of countries using Bitcoin as a reserve asset? It has all the qualities of gold yet it isn’t limited by its space/time/huge costs to transfer.

Love the articles. Always keen to learn from a master of economics such as yourself.

For Bitcoin to become a gold standard and or reserve currency, it needs to be accepted as a reliable store of Value, which at the moment it isn’t. And exploration of the broader issues is also worth reading HERE.