Industrials vs. Resources

Long-term followers of Montgomery Investment Management would know all too well that we have had very little (we have had some) exposure to resources and energy companies since we began on our investing journey. Looking forward, we are just as unlikely to ever hold anything like benchmark weights to these sectors in our funds and for good reason.

Whilst resource-like businesses do represent a fair share of the Australian Stock exchange both by number and market capitalisation, the logic / reason why we prefer to avoid wholesale investments into this area is pretty simple: we prefer to own high quality businesses with bright prospects that have control over the product(s) they sell and also the prices they charge to their clients.

In our experience, resource-like companies are almost the polar opposite of this. Their prospects are often hard to lock down with any certainty given they are highly cyclical businesses and they cannot control the prices for their production. At all points in the cycle from a buyers perspective, it doesn’t matter where you buy your copper from for example – it’s all the same stuff and they (the buyer) just want the raw input to turn into other products as cheaply as possible. That’s not attractive from a business economic perspective.

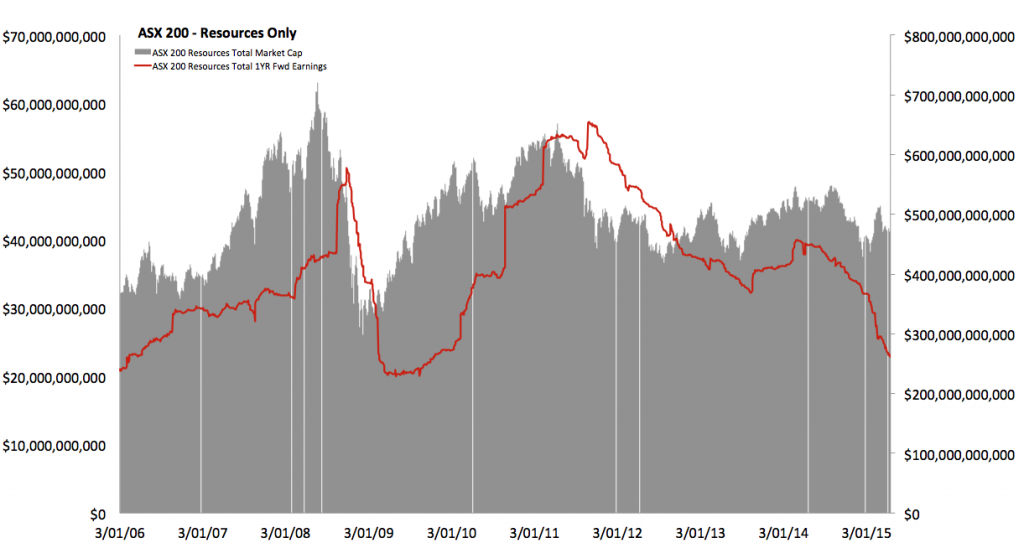

This dynamic is perhaps best presented graphically and below you will find two charts whereby we have broken up the ASX 200 into 1) Resource only and 2) Industrial only companies. Further to this, we have graphed the current constituents total market caps (grey area of the chart) and total 1YR forward earnings estimates (red line on the chart) since January 2006 to compare their profiles over time.

As we would expect, given their highly cyclical nature, earnings for resource only companies and thus their market capitalisations (remember in the long-term share prices / business valuations tend to have a high correlation to the earnings power of the business), have done little other than being highly volatile. Indeed, forward estimates today (red line) for this collection of ASX 200 resource and energy companies are effectively the same as they were almost 10 years ago.

As we would expect, given their highly cyclical nature, earnings for resource only companies and thus their market capitalisations (remember in the long-term share prices / business valuations tend to have a high correlation to the earnings power of the business), have done little other than being highly volatile. Indeed, forward estimates today (red line) for this collection of ASX 200 resource and energy companies are effectively the same as they were almost 10 years ago.

Conversely, the second chart graphs the same fundamentals associated with the industrial sector of the ASX 200 (everything else outside of Energy and Materials). As shown clearly, earnings estimates have steadily improved over the years (apart from the GFC) and as such, the market capitalisation for this group of companies is materially higher, about double, what it was at the start providing fertile ground for stock pickers.

Whilst we do appreciate that investor’s can and do make money investing in energy and material companies, we believe that these charts show a simple truth in that investing in commodity based businesses is very volatile (risky from a share price point and emotional point of view) and should only be attempted if you know what you are doing. Even then you’ll have to get your timing right or require deep insight into geology, global economic macroeconomics (demand), global supply growth and finally the businesses prospects. This is something that’s just not within our circle of competence. Theres simply too many moving parts.

Whilst we do appreciate that investor’s can and do make money investing in energy and material companies, we believe that these charts show a simple truth in that investing in commodity based businesses is very volatile (risky from a share price point and emotional point of view) and should only be attempted if you know what you are doing. Even then you’ll have to get your timing right or require deep insight into geology, global economic macroeconomics (demand), global supply growth and finally the businesses prospects. This is something that’s just not within our circle of competence. Theres simply too many moving parts.

Despite the interest they gather daily and the amounts of ‘tips’ these commodity based sectors generate, we often hear of portfolios that have been too exposed to this side of the market and have suffered catastrophic loses which will take years to recoup.

It’s a basic human trait to try and make simple things more complicated, but for us we believe when it comes to your hard earned savings, most investors (including us) will sleep better at night and will ultimately do just fine (from a return perspective) if one never owns another commodity business ever again.

Whilst that may seem to be a big call, particularly when we all live in little-china, for these reasons (which are not exhaustive), we have preferred over the years to avoid the guess work that’s naturally inherent in the resources sector. Instead, we have focused the majority of our effort and energy on the higher level of earnings reliability and predictability that is afforded to those businesses associated with the quality end of the Industrial market.

Shouldn’t you?

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

What about agriculture? do you think it is as volatile as resources?

Yes.

This question piked my interest and I decided to do a bit of research on the matter. I compared the AUD price of various commodities over the past 5 years to get a feel for the volatility of each. I tried to get a cross-section of various types of commodity including bulk commodities, base metals, precious metals, energy and agricultural commodities. I just had a simple look at the standard deviations of each. Nicho if you’re not familiar with standard deviation it essentially measures how far members of a series of numbers (in this case, monthly prices) deviate from the mean or average. It’s how volatility is measured in financial markets.

Here’s the results:

Bananas – 5.34%

Wheat – 9.32%

Beef – 5.09%

Iron ore – 5.38%

Gold – 4.71%

Natural gas – 9.81%

Thermal coal – 4.32%

Copper – 3.96%

Thanks Patrick – that’s interesting. Given the noise around ‘Iron Ore’, I would have guessed it would be the most volatile. It appears that ‘Iron Ore’ is just sliding on a relatively consistent basis.

Hi Russell, thanks. That’s right, resources companies are highly cyclical business. If you were to invest in them, you’ve got to buy them when they’re totally unloved and sell them when they (hopefully) become glamour stocks (no such thing as a holding period of forever). People have just got to be prepared for that. Of course easier said than done. Further, each individual commodity has its own cycle. There’s no one cycle across the board. But if you’re astute (or perhaps lucky?) it can be done. Like Mick Davis in building up Xstrata. At this point, with certain commodities (not iron ore or LNG I would suggest), you’ve gotta ask the question – are we closer to the bottom of the cycle or to the top? I’d suggest we’re much closer to the bottom. Kelvin

I think you might be right Kelvin, but this cycle has the potential to wipe out anyone who is too early in picking the bottom. The decline in the iron ore price, for example, may yet have some way to run.

Your top graph actually indicates a reasonable correlation that could be argued that right now or soon is the time to be buying resources. More data is needed, but it took two seconds to see a clear pattern there.

Hi Matt, where you see an opportunity (potentially), I see an industry that would never interest me in being invested into wholesale. Why jump over 12 foot hurdles when you can jump over 1 foot hurdles instead? Prefer to keep investing simple and relatively predictable (from an investment perspective).

Good points Russell.

Plus mining is inherently difficult. Its difficult to keep pumping out more and more product each quarter to satisfy the market’s thirst for earnings. And when this happens, supply exceeds demand leading to price suppression as we have seen in recent years.

This happens time and time again. The supply response is always in earnest when there is commodity price appreciation.

Then there’s resource depletion. These companies always are on the run looking for new resources otherwise they die. And the risks of getting a new mine to production within budget are very high.

Caveat Emptor!!!

All good points John. Cant argue with any of that.