Incremental ROE

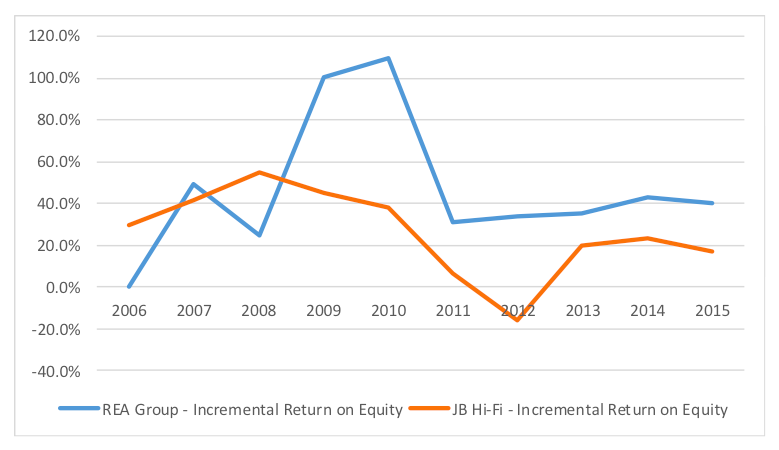

Return on Equity (ROE) is a powerful metric to assess the value of a company, but investors must be careful to distinguish between Incremental ROE and Overall ROE with forward projections.

Return on Equity measures the overall returns a company is generating on shareholder’s equity, while Incremental Return on Equity measures how profitably additional equity is being invested over distinct time periods. Valuations are assessments of how profitably a company can continue investing capital, which makes Incremental ROE a more powerful insight into future prospects than Overall ROE.

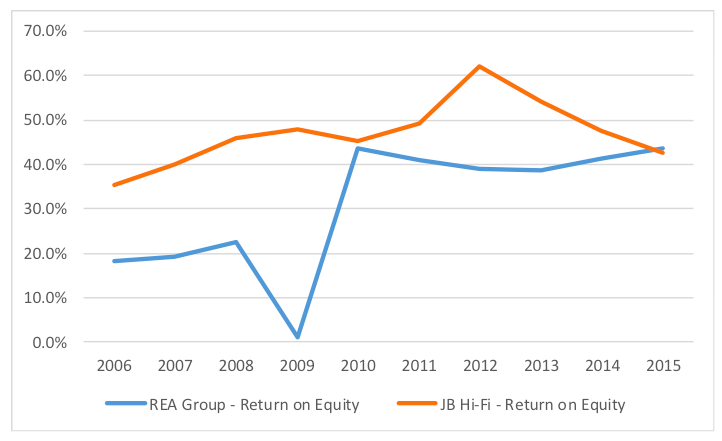

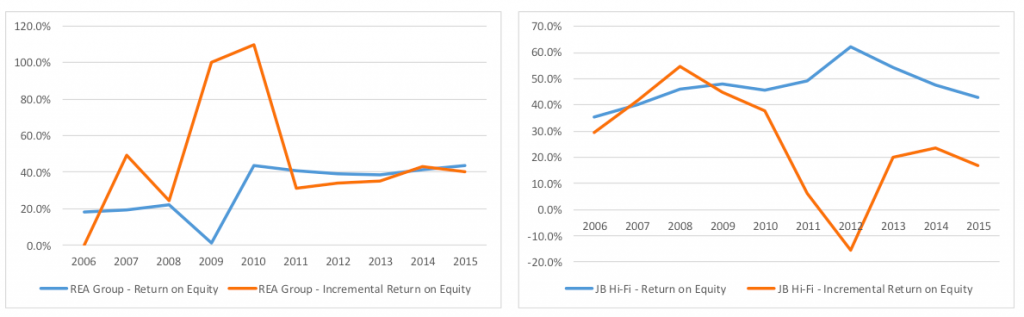

Let me illustrate. REA Group (owners of realestate.com.au and a holding in the Montgomery funds) and JB Hi-Fi (the electronics retailer) are both generating Overall Returns on Equity of around 40 per cent, which is a very high return.

However, the incremental returns that both companies are generating on reinvested equity are significantly different. REA is generating returns above 40 per cent on reinvested equity, while JB Hi-Fi is only managing 20 per cent returns on reinvested equity. (JB Hi-Fi conducted a significant share buy-back in 2011).

JB Hi-Fi engaged in a considerable store rollout between 2005 and 2012, deploying large amounts of capital at high rates of return. But in 2013 management began rolling out HOME concept stores which are only generating incremental returns of 20 per cent. While 20 per cent is still an impressive return, the Overall ROE will gradually drift to this level if management maintains the dividend payout ratio.

As such, on a theoretical basis, using the Overall ROE of 40 per cent in future projections (assuming a constant dividend payout ratio and Incremental ROE) will result in an inflated valuation in this instance.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Ben, how can one be sure that “HOME concept stores [which] are only generating incremental returns of 20 per cent”, as opposed to the original business only producing incremental returns of 20%. Isn’t incremental ROE a fairly unhelpful, unless one knows which projects reinvested profits are used for, what the return of each project or business unit is, and what the re-investment opportunities in the out years are for such projects? More over, isn’t the overall ROE more instructive because it indicates the direction and level of the business’ overall return (e.g. steadily down in the last 3-4 years in the case of JB HI-FI)? Wouldn’t it be potentially helpful to place weight on incremental return, where such return is a function of the overall business cycle or perhaps changes in established business units, as opposed to anything to do with capital reinvested or the current projects in may be invested in? For example, in the case of JB HIFI, what if the newer lines of business were actually more profitable than the older ones and actually a lower incremental return mistakenly justest lower ROE to come for the business over all, as opposed to maintained or increasing ROE in the future years, as the mix of business changes to the new lines. I just have never been able to see the insight that can be gleaned of IROE. It seems merely to be a directional indicator, which ROE itself indicates at any rate. It seems to be a dangerous indicator, because it magnifies increases and decreases in returns without detail as to its cause, such that it lends itself to over-weight or over-bias in analysis.

Hello James,

This is a very thoughtful and considered response. When valuing businesses, we must assess the likely returns that can be generated on deployed capital. Historical returns are a good starting point for this assessment, but their use going forward should be critically justified. By its nature though, Incremental ROE is a volatile measure, so we must also critically consider if it is an appropriate metric.

Specifically with JB Hi-Fi, we cannot solely attribute the lower Incremental ROE to the HOME concept stores, as other factors such as business conditions would contribute (the original comment in my post was a little too direct). We do think though that the incremental returns have shifted – it helps to consider that if the core branded stores were so profitable, why is management changing the store format rather than rolling out more? JB Hi-Fi is also facing structural headwinds with the movement away from software to hardware. Of course, the closure of Dick Smith will impact the industry’s dynamics, and we are monitoring the developments closely. So 20 per cent may not be reflective of future returns, but we must critically consider if 40 per cent is appropriate to maintain.

Thanks Ben – an important concept and great examples to emphasis your point – love your work BM…