Important enhancements to Skaffold

If like me, you are a Skaffold member, you will have noticed something dramatic has happened when you logged in recently.

(If you are not a member, what are you waiting for?)

Quietly and without much fanfare, Skaffold just got a whole lot more valuable to me.

I’d like to share with you – just this once – some of the information that Skaffold members received recently and tell you a bit about the change.

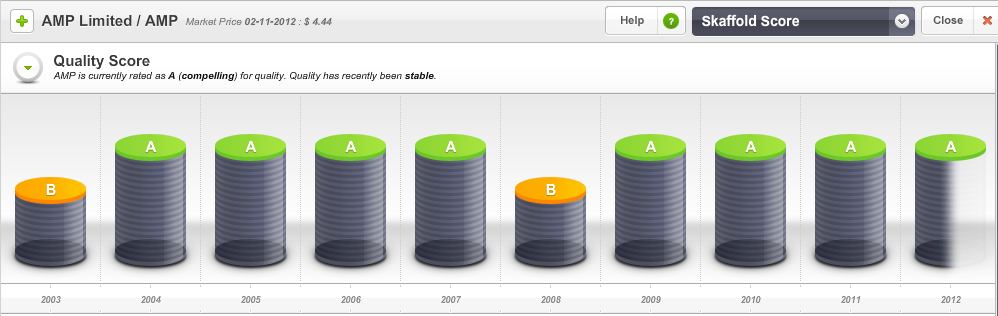

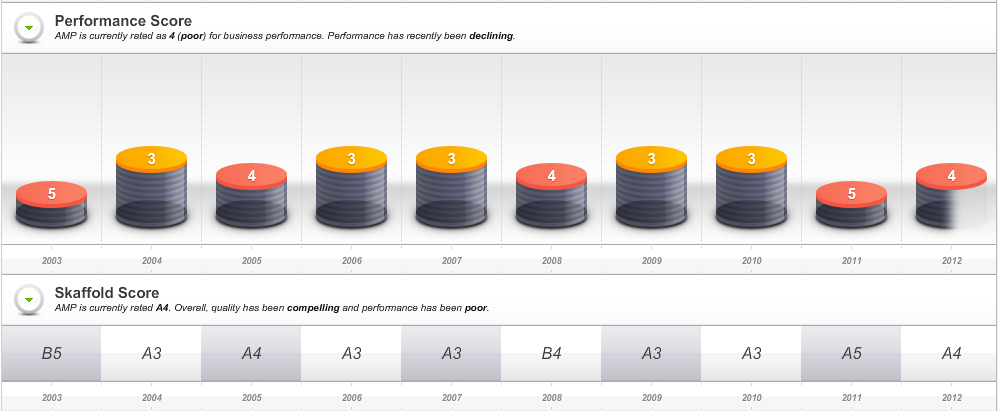

Have a look at the last column of the Skaffold Score, Evaluate Screen above. Notice the last columns are only half shaded?

You’ll notice the 2012 columns look a little different. A quarter, half or three-quarter shaded column indicates an interim Skaffold Score.

Interim Skaffold Scores are based upon interim financial reports. Interim financial reports capture all relevant financial and business activities that occur since the last full year report and provide investors with up-to-date information on the state of the business.Skaffold’s interim Scores ensure you have access to the latest reported financial information for every company.Skaffold’s Scores are completely objective and generated without any human intervention or personal opinion, which can be subject to an analyst’s mood swings or whether or not they have been out the night before! Automation also means consistency and it is consistency that is the hallmark of the very best investors.

In the case of AMP Limited (AMP) above, half of the column is shaded. This indicates AMP has reported its half year result most recently and the Quality and Performance score for AMP is based on this half-year report. AMP will report its 2012 full year results in March 2013. At that time, Skaffold’s Quality and Performance Score columns will be updated again and be fully shaded.

Here’s a summary of the companies whose half years ended 30 June and their resulting interim Skaffold Scores.

Stable Skaffold Scores, based upon 2012 interim results

ASX Code |

Company Name |

2011 Skaffold Score |

2012 (I) Skaffold Score |

| ANZ | Australia and New Zealand Banking Group | A2 | A2 |

| TNE | Technology One | A2 | A2 |

| CTX | Caltex Australia | A3 | A3 |

| TRU | Trust Company | A3 | A3 |

| NAB | National Australia Bank | A4 | A4 |

| AWC | Alumina | B3 | B3 |

| DLX | Dulux Group | B3 | B3 |

| GNC | GrainCorp | B3 | B3 |

| SGN | STW Communications | B3 | B3 |

| OMH | OM Holdings | B4 | B4 |

| WPL | Woodside | C3 | C3 |

| IVC | Invocare | C4 | C4 |

| TEN | Ten Network Holdings | C4 | C4 |

| GXY | Galaxy Resources | C5 | C5 |

| HDF | Hastings Diversified Utilities Fund | C5 | C5 |

| YAL | Yancoal Australia | C5 | C5 |

I have just finished doing my annual review of the ASX300 to find the best performing companies. IVC is in my top 20 for the first time so I was doing further research and came across this post and I was very surprised to see it rated as a C4 by Skaffold.

Look at the historical data, the company had a poor 2011, would this be why it was rated so poorly at the time? I’d love to hear how its currently rated.

Good return on equity, consistent return on capital, rising book value for the last 9 years, steady growth in earnings (other than 2011), it ticks a lot of boxes in my opinion.