How to reduce the interest rate on your mortgage

A new report by the Australian Competition and Consumer Commission (ACCC) has found that, as a whole, Australians are paying too much interest on their mortgages. How much too much? Well, according to a conservative estimate, as a nation we are likely paying at least $10 billion per year more than we need to. Thankfully, there are steps to take to get a better rate.

Back in September 2018, I published a blog that showed that mortgage holders on average were very uninformed about the finer details and features of their mortgage despite it being most likely the biggest financial commitment they have in their life.

On 5 December, ACCC released its “Home Loan price inquiry” final report looking at the interest rates that Australians pay on their mortgage. The report has a number of conclusions, but the overriding conclusion is that Australian borrowers in aggregate are paying way too much interest on their mortgage.

As background, banks extending mortgages generally have a standard variable rate that they publish on their website but there are also always deals in the market where they offer more attractive interest rates than this to win new customers and gain market share. This means that there can be a significant difference between the interest paid on loans in the “back-book” of old loans and the interest paid on loans in the “front-book” of new loans.

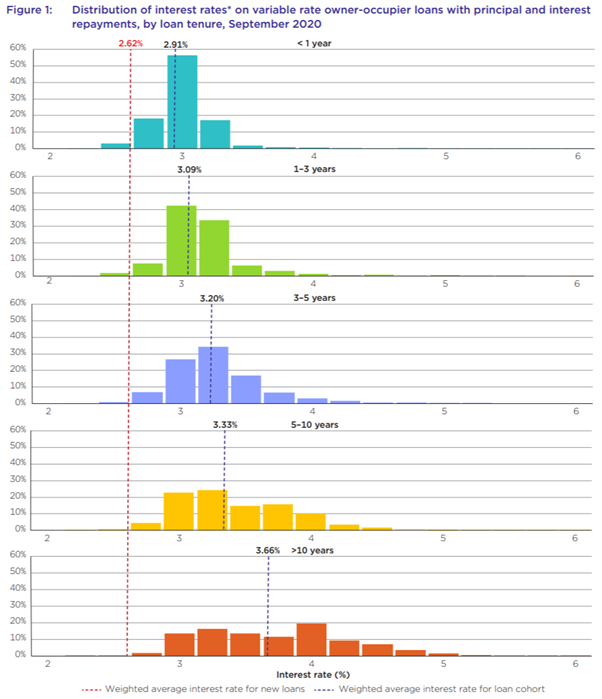

ACCC has in its report investigated what this difference in interest rate is and the numbers are large:

- Borrowers with home loans aged between 3 and 5 years are on average paying 58 basis points higher than the average interest on new loans

- Borrowers with home loans aged between 5 and 10 years are on average paying 71 basis points higher than the average interest on new loans

- Borrowers with home loans aged over 10 years are on average paying 104 basis points higher than the average interest on new loans

The older a mortgage is, the higher the average gap in interest rates as can be seen from the chart below:

To exemplify the impact of this, if we assume a mortgage of $250,000 that is 4 years old, and paying (on average) 58 basis point higher interest than new loans, the borrower would save about $1,400 per year in interest payments and if the remaining life of the loan is 25 years, the net present value of the interest savings would be over $17,000, both quite substantial numbers. This of course scales linearly with higher loan balances and larger difference in interest rates compared to the 58 basis points assumed. It is easy to see that we are talking about substantial numbers if we aggregate it up over the total Australian mortgage debt of approximately $1.9 trillion.

If we were to very conservatively just scale up the $250,000 loan to $1.9 trillion in total, it indicates that Australian borrowers are paying at least $10 billion per year too much in interest. To put this into perspective, $10 billion is equal to about 3 per cent of total retail spending during the last 12 months. This is money that is hence wasted for consumers and instead accrues to banks and other lenders.

There are a number of reasons why this situation persists:

- There is probably a perception that “I would not save much so it is not worth the hassle.” Different lenders communicate interest and fees in different ways (even though a Comparison Rate should always be published) and it can be quite confusing to compare different lenders’ offers and calculate the potential savings from refinancing. Consumer education is therefore important to raise awareness about the money that could be saved.

- There is also a lot of inertia in that once you are set up with a loan, it is easy to just go along with it unless you go through a special change in circumstances like moving to a new house or changing jobs etc.

- From personal experience, it is quite a process to be approved for a loan and it requires quite an investment in time and effort to gather the required information. I consider myself a relatively financially literate person (you would hope with the work I am doing…) but I can easily see that the process can be confusing and cumbersome for people who are not comfortable with numbers.

- A borrower’s personal circumstances might have changed so that they are not as attractive a customer as they originally were (change of career to a lower paying job etc.) which means that they are locked into their existing lender. They should still ask their existing lender for the best current deal.

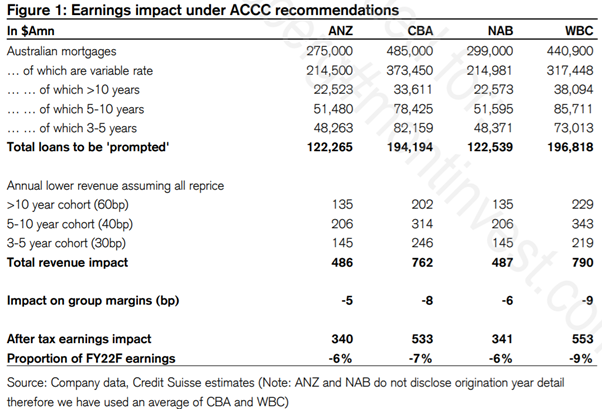

As part of the report, ACCC makes a couple of recommendations out of which by far the most important is they want to force lenders to prompt each borrower with a loan that is older than 3 years on an annual basis about the benefits they could get from switching to a loan with the average current interest rate on a loan with similar features as their existing loan.

This would of course not be in lenders’ interest so I suspect that there will be a lot of lobbying efforts towards politicians not to implement this. To see the impact on the major banks earnings if it was to be implemented and customers react and reprice the back-book of the banks, Credit Suisse helpfully published this table showing that it could have an impact of 6-9 per cent on their bottom lines.

This is the worst-case scenario with all their customers repricing their loans (but not closing the full gap to new rates) and we should not expect that to happen but it shows that there is substantial savings for households to access if they take notice and act.

I guess a good finish to this post would be a recommendation to go to a couple of banks or mortgage brokers homepages and type in your current loan balance and compare the outcome to what you are currently paying as you might be able to save quite substantial amounts of money and remember that you do not necessarily have to go through the hassle of changing lender as you might be able to use this information to negotiate down your current lender without having to go through a new credit assessment process.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thanks Andreas for bringing this piece of research to my attention and also for your article on the subject. I found both very informative.

I speak to a lot of seniors everyday who have mortgages with high interest rates. I imagine a good portion of them would be the ones with the ‘older’ mortgages. Sadly for them (many of which are completely aware/engaged that they are paying too high an interest rate) there is virtually no incentive for their lender to reduce their rate knowing that they wont be able to switch to another lender as most no longer work and are on the aged pension. Many turn to the reverse mortgage market whether it be the Government’s Pension Loans Scheme or commercial reverse mortgages to help with mortgage repayments.

Any intervention the government can implement to help incentivise banks to offer clients with older mortgages to lower their rates would be most welcome by this age demographic I’m sure.

Thanks Sam,

Yes agree that there is a big problem with switching for older people. It is therefore good that ACCC tries to put the spotlight on the issue.