The price you pay determines your return

Whether it’s art, collectible cars, or shares in a company, your returns are determined by two things – quality and price. And the higher the price you pay, the lower your return. It’s an aphorism that‘s stood the test of time – probably because it’s mathematically irrefutable.

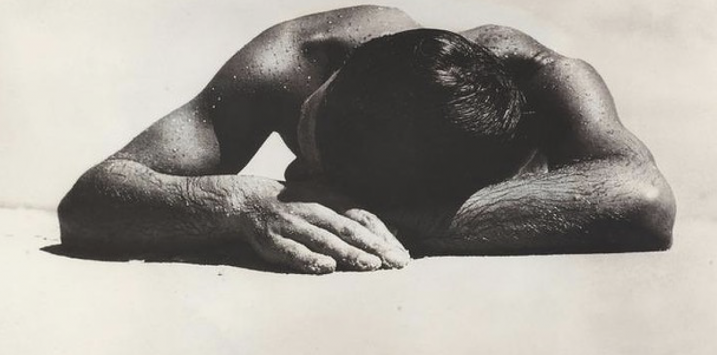

This thought came to me last weekend when I saw the sale results of some rare Max Dupain photos at Mossgreen’s Sydney auction rooms. They included the iconic ‘Sunbaker’, which was estimated to sell for between $20,000 and $30,000. Not a bad price, given more than 100 of these photographs exist and, presumably, Mr Dupain’s family has access to the negatives, from which additional images can be created.

Regardless, within a few minutes the bidding flew past $60,000 – double the high end of estimates – and eventually the work sold for $85,000. Add the 24 per cent buyer’s premium and the buyer shelled out over $100,000 for the photograph.

Which brings me back to the share market. We have previously (and recently) written here at the blog about our low quality return thesis. In summary, growth is limited by a number of factors:

1) growth from balance sheet expansion (a fancy way of saying ‘borrowing’) is limited by the fact aggregate corporate debt is at record highs in the US,

2) The lion’s share of the additional debt accumulated particularly since the GFC has been deployed towards financial engineering – activities such as share buybacks (at high prices – more on that in a moment) and mergers & acquisitions, and

3) in both the US and Australia, payout ratios have increased materially despite the fact that earnings per share have not expanded commensurately.

So, staying on the theme of low returns, it appears that growth from both debt and retained earnings is limited, which leaves only new share issues as a viable option for growing a company. Of course new share issues are both diluting and paint company boards as bi-polar given the buybacks we have just witnessed.

On the quality front, then, it appears growth is limited and investors should expect modest returns from the larger-cap ‘blue chip’ companies and, by extension, the indices in which they are major constituents.

And what about prices?

With the US S&P500 trading on a P/E of about 18 times, the US stock market can be broadly described as expensive compared to history. Of course with interest rates near zero, some investors may say this is justified. We don’t, citing the lack of growth articulated earlier.

Image: Max Dupain’s ‘Sunbaker’, taken at Culburra Beach on the NSW south coast in 1937.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.