How the Coronavirus is infecting China’s activity

Humans often take their cues from the news and their assessment of risk often coincides with the subject’s prominence in the media. However, to be a successful investor you need to see through the noise.

Here are the facts as recently reported in the Weekly survey by China’s Chamber of Commerce [and presumably propaganda] in Shanghai, which covers companies in Shanghai, Suzhou, Nanjing and the Yangtze River Delta.

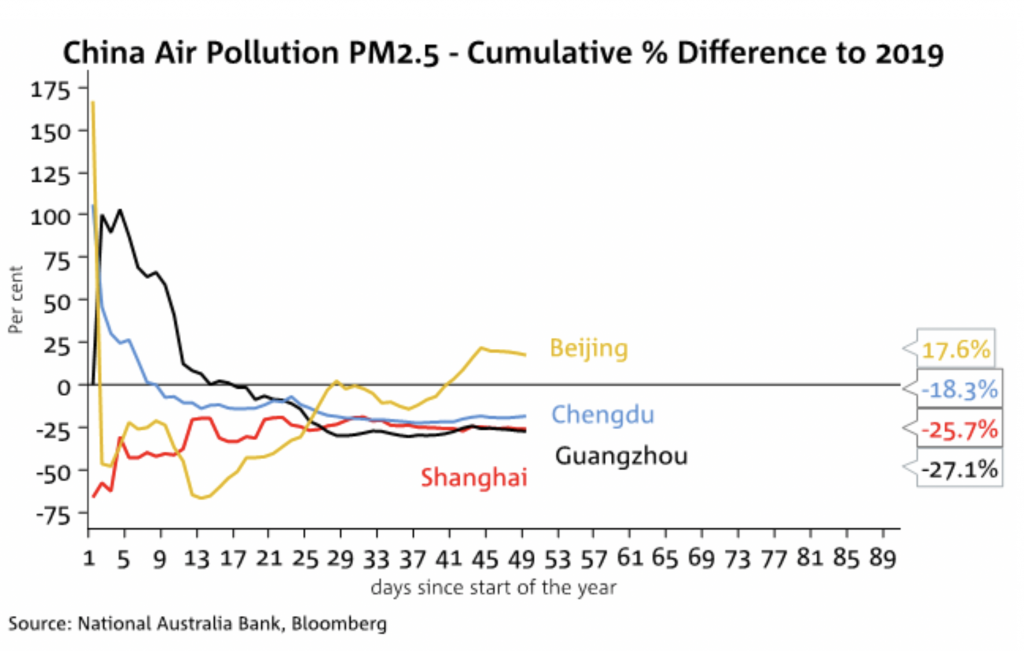

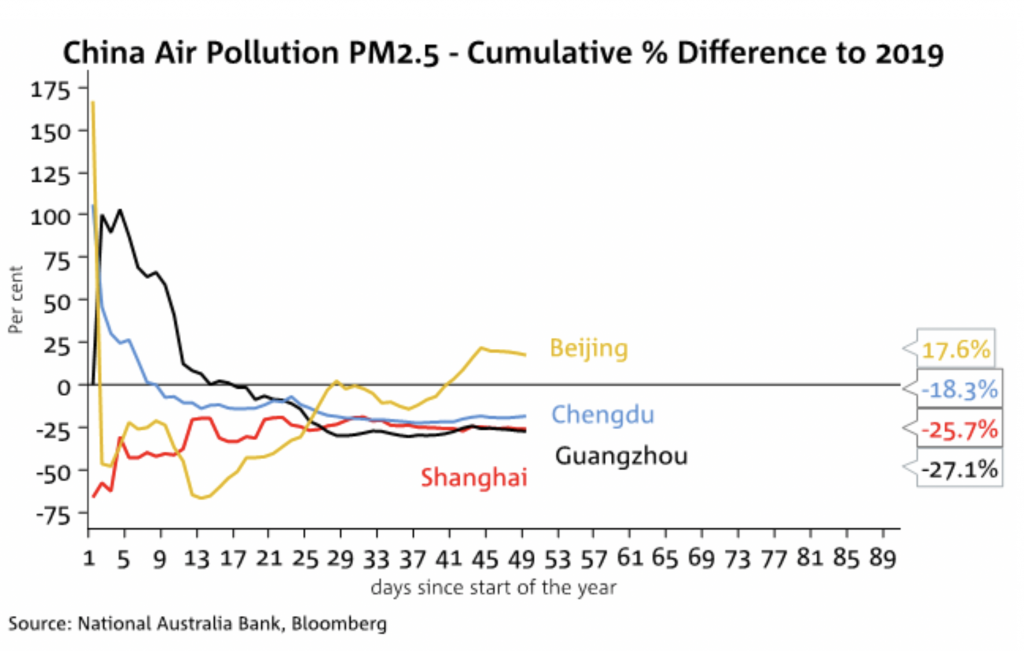

Additionally, cumulative pollution levels are 20-25 per cent lower than at this time in 2019, so a substantial decline in industrial activity is evident.

Observations:

- 48 per cent of companies report their global operations are already impacted by the shutdown

- 78 per cent of companies do not have sufficient staff to run a full production line

- 41 per cent of companies say a lack of staff is their biggest challenge in the next 2-4 weeks; 30 per cent of companies say logistics issues will be their biggest concern

- Over the next few months, 58 per cent of companies expect demand for their output to be lower than normal

- 38 per cent of companies do not have sufficient masks/other supplies to protect their staff from coronavirus infection

- 35 per cent of companies ranked a clearer explanation of requirements as the most important thing government officials could do to speed up factory opening approvals.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.