How resilient are you?

There are tonnes of articles and “expert” commentary on stocks, bonds or currencies that are expected to do well or expected to fail. Pundits saying how the latest political events will impact ‘the market’ and providing their opinion on how to protect the downside, upside or even the flipside of your portfolio!

However very little is mentioned about the personality traits which drive the types of decisions we make (or don’t make), why we make them and how we rationalise them. It’s these decisions that are a big contributor to the long term investment performance we get.

With that in mind we thought we would share some interesting research and analysis that our friends at Netwealth Investments & Superannuation recently completed when trying to understand investors better. We felt this may also help you better understand what type of investor you are and how to avoid some of the common pitfalls associated with it.

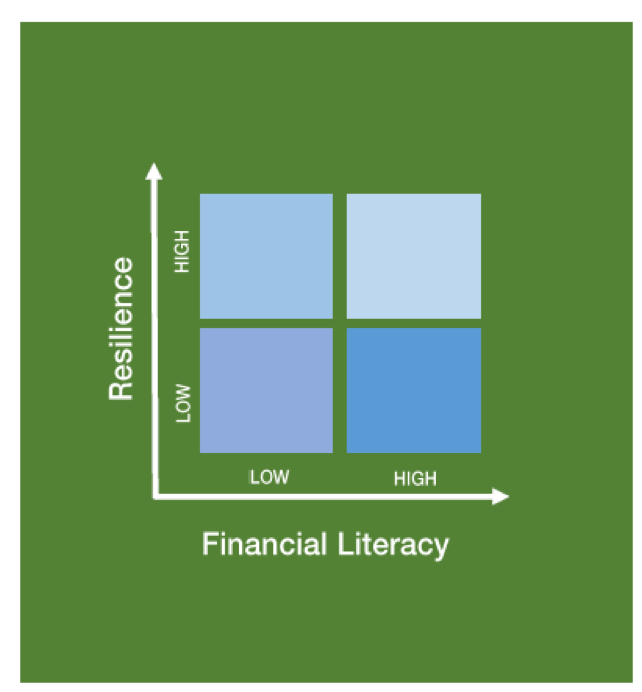

Netwealth worked The Lab, a leading ethnographic research company and discovered that they could group Australian’s into four categories based on their financial literacy and resilience.

Financial literacy was defined as the ability to understand financial products and structures and determine an appropriate solution for personal circumstances.

Resilience was the ability to set long term goals in the face of possible short term failure.

From an investment perspective, each segment behaves differently, and has different needs from its investment manager or adviser.

The top right segment (Explorers) understand that setting long term goals is the best way to reap the rewards of their investments. Their experience provides them a depth of knowledge – these people certainly understand concepts of portfolio construction. Key behaviours and attitudes of these people include:

- a focus on what they are good at, whilst often outsourcing other activities to trusted experts (such as fund managers, accountants and solicitors);

- a desire for continuous ongoing personal education via investment newsletters, blogs and books; and

- an ability to make considered (not quick) decisions.

The top left quadrant (Aspirers) have a relatively low literacy but high resilience. These people understand that success takes time and determination but in terms of investing, they need help putting the pieces together. They typically seek advice as they probably feel a little overwhelmed by all the financial jargon especially that found in product disclosure statements (what are these?). They are more likely to rely on their friend or social media and blogs for their investment advice.

The bottom right segment are Mavericks. People in this segment have low resilience and high financial literacy, however this literacy is often only perceived by the individual and may not be real. This leads to them making irrational and hurried decisions and could be susceptible to ‘get rich quick’ schemes or investing in the latest ‘boom’ industry or stock. Key traits include of this group is that they:

- want results NOW;

- are easily thrown off course by latest trends; and

- may act irrationally when things go wrong (i.e. sells out after market crash).

A Maverick investor is probably the person at a dinner party informing you (boasting) about their super smart strategy of buying an investment property off the plan in their SMSF, yet at the next dinner party they have changed tack and it’s all about gold stocks which simply can’t miss!

Towards the bottom left of the chart (Disengaged) are people who have both low resilience and literacy. People in this segment are often characterised by an apathy towards their investments and planning for their future, with a bigger focus on living in the moment. These people are at a severe disadvantage when it comes to investing as they are not good in the face of short term issues, nor do they show a willingness to learn or improve their financial literacy.

Key takeaways

The main finding of the Netwealth research and analysis was that individuals who had a plan or strategy in place and were working with trusted advisors or partners (such as fund managers, accountants, investment professionals) who they could rely on were more likely to achieve their goals. Individuals who were trying to manage all their affairs independently often made poor decisions or missed out on opportunities because they didn’t have the time to manage all their affairs properly – consequently they were less likely to hit their long term goals.

Montgomery Funds can be accessed via the netwealth platform whether you are investing personally, via an SMSF or personal super. To find out how, click here.