How much further will the WES share price run?

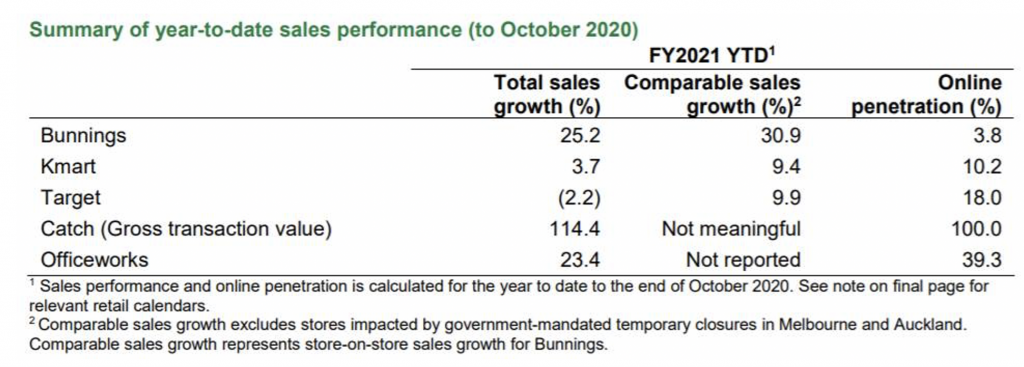

Wesfarmers’ (ASX:WES) trading update for the first four months of FY21 showed the robustness of its retailing businesses. Sales growth for its two best-known brands, Bunnings and Officeworks, was particularly strong, as was the performance of its online channel, Catch.

In brief, sales growth for WES’s core retailing operations remained strong through to the end of October.

Bunnings, which is probably the highest quality retailing business in Australia, showed particularly strong growth in the four months to the end of October with total sales up 25.2 per cent on the same time last year.

Given the very different economic conditions being experienced in Melbourne relative to the rest of the country, Wesfarmers also released figures excluding Melbourne to provide the market with an idea of how the businesses are trading outside of lockdown conditions.

Figure 1: Wesfarmers Sales Growth FY21 to 31 October 2021

Results for Bunnings and Officeworks were fairly similar irrespective of whether Melbourne is included or excluded. However, Kmart and Target have been more significantly impacted by the lockdowns despite the offset from strong online sales growth. Kmart was also negatively impacted by supply chain issues given its heavy dependence on private label imported goods.

Results for Bunnings and Officeworks were fairly similar irrespective of whether Melbourne is included or excluded. However, Kmart and Target have been more significantly impacted by the lockdowns despite the offset from strong online sales growth. Kmart was also negatively impacted by supply chain issues given its heavy dependence on private label imported goods.

Kmart and Target both underperformed Woolworths’ discount department store brand Big W, which generated 20.4 per cent sales growth in the 3 months to the end of September, and 28.5 per cent excluding Melbourne.

Wesfarmers also commented that in the early days post the 28 October reopening of stores, sales in Melbourne have surged as a result of pent-up demand. This sets its business up for a strong end to the first half of the financial year.

While current revenue growth is extremely strong, it is benefiting from a combination of:

- a shift in consumer spending away from services toward goods,

- increased spend into the home given travel restrictions,

- the work from home trend,

- fiscal stimulus, and

- loan repayment deferral packages.

At some point, spending patterns and conditions will revert to more normal levels. The big questions are whether the sales boost during the last six months unwinds returning to the absolute level of sales generated pre-COVID, did COVID bring forward future sales such that they will fall below pre-COIVD levels, or has there been some degree of permanent shift in spending patterns.

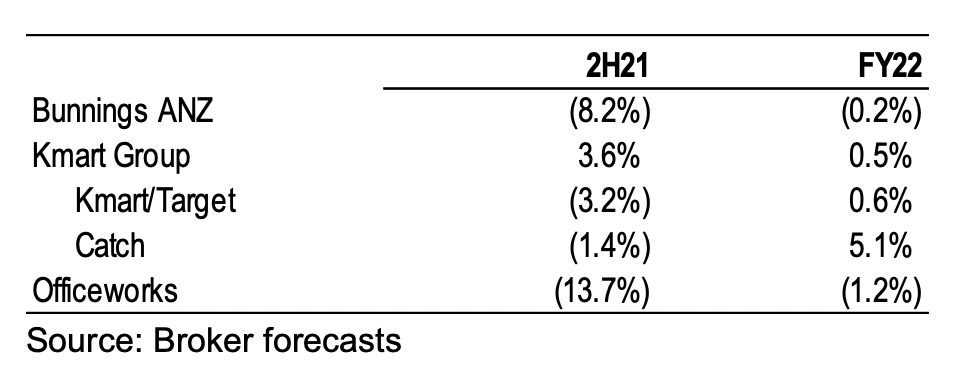

The revised forecasts of sell-side analysts imply more the first scenario, given the reduction in 2H21 sales and slow growth in FY22 implied by their forecasts.

Figure 2: Wesfarmers Sales Growth in 2H21 and FY22 Implied by Average Broker Forecasts

This helps to define the risk/return in Wesfarmers stock on the near-term basis and the ability to assess the market’s expectations for both the timing and quantum of mean reversion of sales once fiscal stimulus and COVID related restrictions on movement cease to impact economic conditions.

The Montgomery Funds own shares in Wesfarmers. This article was prepared 16 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Wesfarmers you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY